PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445867

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445867

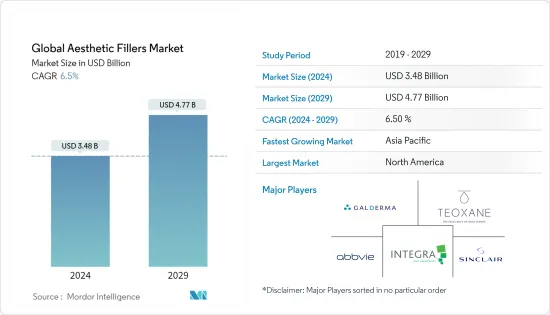

Global Aesthetic Fillers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Aesthetic Fillers Market size is estimated at USD 3.48 billion in 2024, and is expected to reach USD 4.77 billion by 2029, growing at a CAGR of 6.5% during the forecast period (2024-2029).

The COVID-19 outbreak resulted in decreased public mobility and impacted the therapeutic and surgical industry significantly, as the surgical procedures and screening programs are non-immediate and are postponed decreasing the burden on healthcare infrastructure. Thus, the rising COVID-19 cases are expected to have a short-term impact on surgical rates of cosmetic procedures. The short-term effects on the surgical segment are less prominent. However, the adverse impacts of COVID-19 on the global economy may have significant indirect effects on the surgical segment of the market. According to a research article titled 'Plastic Surgery Cost in India' published in October 2021, many people opt for cosmetic or plastic surgery to improve their looks or fix physical deformities. Since plastic surgery is typically considered an aesthetic procedure, it involves high costs. Cosmetic surgeons and plastic surgeons in India may charge anywhere between INR 10,000 to INR 200,000 per sitting. The cost also multiplies based on material costs, surgeon fees, room costs, follow-up appointment costs, etc. The current pandemic may result in an approximately 20% decrease in collected fees, which is expected to show a negative impact on the market studied.

The growth of the aesthetic fillers market can be attributed to the increasing trend of using anti-aging treatments and the demand for a much younger lifestyle. Globally, there has been a rising trend of aesthetic procedures. This is majorly attributed to the increasing focus of people on appearance and advancements done in the procedures, which provides better outcomes. For instance, countries, such as Germany, Italy, and Spain, are witnessing a rise in the number of aesthetic procedures performed. Additionally, there is a significant number of plastic surgeries and different aesthetic procedures are expected to drive the market. For instance, according to Aesthetic Plastic Surgery National Databank Statistics for 2020-2021, overall aesthetic body procedures such as abdominoplasty, buttock augmentation, and liposuction increased by 63% since 2020. However, Breast procedures such as breast augmentation, augmentation/ breast lift, and breast lift/reductions were up 48%.

The increasing trend of using anti-aging treatments and the rising acceptance of tissue fillers with increasing dermal filler surgeries is giving rise to a number of market development activities. For instance, in August 2022, Allergan Aesthetics, an AbbVie company announced the United States Food and Drug Administration (FDA) approval of JUVEDERM VOLUX XC for the improvement of jawline definition in adults over the age of 21 with moderate to a severe loss of jawline definition. Similarly, in January 2022, the US Food and Drug Administration (FDA) announced the approval of RHA Redensity. Produced by Swiss hyaluronic acid product manufacturing company Teoxane, RHA Redensity is a gel implant or dermal filler that is injected in specific areas of facial tissue to reduce the appearance of lines and wrinkles. Due to its rapid growth rate, many new companies are getting attracted to this market. Hospitals working on the introduction and implementation of new surgeries are leading the growth of the market studied. Consequently, the demand for the ever-expanding range of dermal fillers and the number of operations performed has boosted the growth of the market studied. However, the side effects associated with dermal fillers and other factors are hindering the growth of the market studied.

However, side effects associated with dermal fillers and the negative effects of unregistered practitioners are expected to impede the growth of the global market in the forecast period.

Aesthetic Fillers Market Trends

Hyaluronic Acid Segment Holds the Significant Market Share Over the Forecast Period

Hyaluronic acid is a natural substance that is also found in the human body. High concentrations of acid are present in soft connective tissues and the fluid surrounding the eyes. It is also present in some cartilage and skin tissue. The demand for hyaluronic acid in much personal care and cosmetic products has increased as a result of the world's noticeable increase in attention to personal care. The prevalence of osteoarthritis is also anticipated to increase hyaluronic acid demand because it is essential for the treatment of viscosupplementation. Additionally anticipated to positively impact market expansion are investments in research to identify additional advantages of hyaluronic acid and rising disposable income. Hyaluronic acid-based fillers became the most used soft tissue filler augmentation agents over the past few years. They helped revolutionize the aesthetic fillers market with several new products available for use.

The FDA-approved hyaluronic acid fillers include Belotero Balance, Juvederm products (Juvederm XC, VOLBELLA, VOLUMA, and VOLLUR), and Restylane products (Restylane, Restylane Refyne, Restylane Silk, Restylane Lyft, and Restylane Defyne). As per an article titled 'Incidence and treatment of delayed-onset nodules after VYC filler injections to 2139 patients at a single Canadian clinic' published in April 2022, Hyaluronic acid (HA) fillers are widely used in facial rejuvenation and be safe in clinical practice. The incidence of delayed-onset hypersensitivity reactions to earlier nonanimal stabilized HA (NASHA) fillers has been estimated at 0.02%-0.4%. Thus, the high usage of hyaluronic acid is expected to promote segmental growth.

Furthermore, frequent product approvals by the FDA for new hyaluronic acid-based aesthetic fillers are responsible for the intense competition among market players. Numerous organizations are focusing on new product launches for dermal fillers. For instance, in October 2020, IBSA Derma launched its Aliaxin LV - Lips Volume, a non-invasive HA dermal filler used for the treatment to enhance lips. The demand for hyaluronic acid is increasing significantly, as it is an essential material that takes care of the skin. Thus, the market is expected to witness growth in the coming years. Therefore, the above-mentioned factors are expected to drive the market growth of the segment.

North America captured the Largest Market Share and is expected to Retain its Dominance

Geographically, North America dominated the overall aesthetic filler market with the United States accounting for the major contributor to the market. Recently, consumers, around the world are showing increasing interest in their aesthetic appearance.

According to the American Society of Plastic Surgeons (ASPS), the Society board-certified plastic surgeons reported they stopped performing elective surgical procedures for an average of 8.1 weeks in 2020 due to COVID-19, or 15 percent of the year, which mirrors the decline in the total number of procedures performed last year. The increase was attributed to the safe and effective minimally invasive procedure and lesser side effects. A new hyaluronic acid dermal filler for the lips and wrinkles called Restylane Kysse was introduced by several businesses, including Galderma. Additionally, Teoxane Resilient Hyaluronic RHA fillers for wrinkles and folds were introduced by Revance. More patients are drawn to these cutting-edge medications with cutting-edge formulations. The need for less invasive cosmetic procedures has risen over time as a result of the accessibility of these newly formulated dermal filler formulations. The desire for cosmetic operations is also rising in industrialized nations due to their minimal adverse effects. According to the American Society of Plastic Surgeons, more than 3.4 million soft tissue filler treatments were carried out in the United States alone in 2020.

Furthermore, in Feb 2020, RepliCel Life Sciences Inc., a Canadian company developing next-generation technologies in aesthetics and orthopedics, announced that it had ordered the first production run of commercial-grade automated RepliCel dermal injectors and consumables. RCI-02 dermal injector is a motorized injection device designed to deliver a variety of injectable substances, including cells, dermal fillers, drugs, or biologics. Thus, owing to these factors, the aesthetics fillers market is boosting the country and gaining a significant place in the market.

Aesthetic Fillers Industry Overview

The market studied is highly fragmented, with the majority of the manufacturing operations in North American countries. The presence of a significant number of players in the market studied has an impact on the prices of products by firms, such as AbbVie Inc., Vital Esthetique, Galderma Pharma SA, Teoxane, and Sinclair Pharma PLC, among others. The industry is witnessing a series of acquisitions and mergers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Facial Aesthetics

- 4.2.2 Rising Acceptance of Tissue Fillers with Increasing Dermal Filler Surgeries

- 4.2.3 Increased Attention on Facial Aesthetics among Older Population

- 4.3 Market Restraints

- 4.3.1 Side Effects Associated with Dermal Fillers

- 4.3.2 Negative Effects of Unregistered Practitioners

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Absorbable

- 5.1.2 Non-absorbable

- 5.2 By Material Type

- 5.2.1 Polymers and Particles

- 5.2.2 Collagen

- 5.2.3 Hyaluronic Acid

- 5.3 By Application

- 5.3.1 Facial Line Correction

- 5.3.2 Face Lift

- 5.3.3 Lip Treatment

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AbbVie Inc.

- 6.1.2 BioPlus Co. Ltd.

- 6.1.3 Bioxis Pharmaceuticals

- 6.1.4 Galderma Pharma SA

- 6.1.5 Laboratoires Vivacy SAS

- 6.1.6 Merz Pharma

- 6.1.7 SCULPT Dermal Fillers Ltd.

- 6.1.8 Sinclair Pharma

- 6.1.9 Suneva Medical Inc.

- 6.1.10 Teoxane

- 6.1.11 Vital Esthetique

7 MARKET OPPORTUNITIES AND FUTURE TRENDS