PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850304

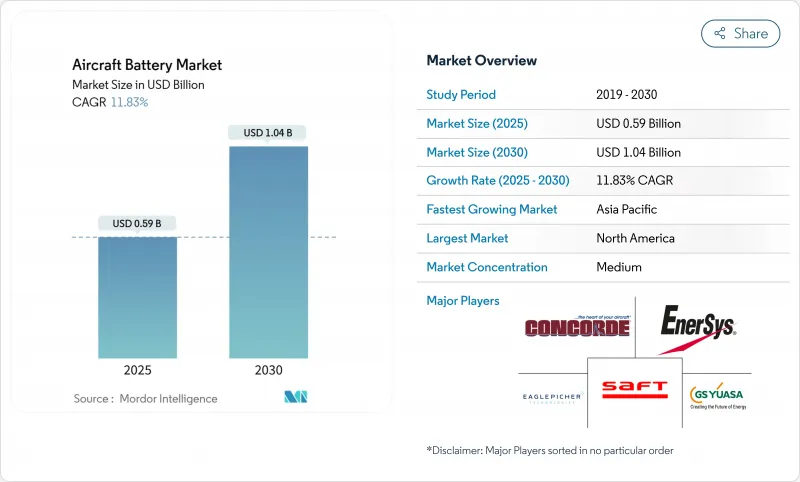

Aircraft Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft battery market size is estimated at USD 0.59 billion in 2025, and is expected to reach USD 1.04 billion by 2030, reflecting a CAGR of 11.83%.

Growth rests on airlines and manufacturers moving quickly toward electrified propulsion, regulatory incentives that shorten certification cycles, and sizable venture funding for advanced air-mobility programs. Lithium-based chemistries dominate product strategies, while solid-state and high-rate cells progress from laboratory scale to pilot production. North America retains leadership, yet Asia-Pacific records the strongest growth as China, Japan, and South Korea accelerate low-altitude-economy initiatives. Across platforms, eVTOL and hybrid-electric programs are reshaping supplier relationships, drawing automotive battery leaders into an aviation segment that rewards high energy density and strict safety compliance.

Global Aircraft Battery Market Trends and Insights

Adoption of More-Electric Aircraft in North American Narrow-Body Programs

North American airframers are redesigning single-aisle jets around electrical subsystems that replace pneumatic architecture, tripling peak loads during take-off and climb. Demonstrators such as RTX's 1 MW motor aim to cut fuel burn by 30%, aligning with the Clean Aviation initiative that co-funds high-performance battery research. Airlines see lower maintenance costs and carbon compliance value, motivating early retrofits. Battery makers that can validate rapid-charge, high-cycle packs under Federal Aviation Administration (FAA) guidance stand to secure long-term supply contracts.

OEM Shift to Li-ion Batteries for High-Load Avionics in Asia

Chinese, Japanese, and Korean OEMs are phasing out nickel-cadmium units in favor of lithium-ion packs, which study results show reduce supply-chain complexity by 72% and carbon emissions by 75%. Domestic suppliers such as CATL and Gotion High-Tech already reach 500 Wh/kg and 300 Wh/kg, respectively, giving regional manufacturers secure access to advanced chemistries. Competitive pressure intensified when SoftBank reported 350 Wh/kg in all-solid-state prototypes, spurring a regional technology race. The shift will ripple across flight-control computers, radar, and galley systems, cutting weight and freeing space for additional payload.

Thermal-Runaway Incidents Slowing Wide-Body Adoption

In 2024, the FAA logged 69 lithium-battery smoke or fire events aboard passenger aircraft, reinforcing airline caution on large-format packs. EASA followed by commissioning Fraunhofer's LOKI-PED tests to quantify cabin and cockpit fire risk, with results due in 2025. Regulators prepare new handling protocols, while research shows that unprotected pouch cells can shatter at crash speeds, making robust housing mandatory. Wide-body programs, therefore, keep legacy battery systems longer, limiting volume growth even as single-aisle and regional platforms electrify.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Certification Pipeline for eVTOL Air Taxis in Europe

- Military UAV Modernization Driving High-Rate Cells in Middle East

- Scarce Aerospace-Grade Li-S Production Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion held 52.88% of the aircraft battery market share in 2024, owing to mature supply chains and well-understood performance envelopes. Designers favor its high gravimetric energy for starter-generator duties and growing hybrid-electric thrust demands. Recent capacity enhancements, including silicon-rich anodes, push cycle life past 2,000 deep discharges, lowering total-cost-of-ownership metrics that sway airline procurement. Conversely, nickel-cadmium and lead-acid remain serviceable in hostile environments such as polar routes or rotary-wing missions where low-temperature resilience trumps weight efficiency.

Momentum is shifting toward lithium-sulfur, forecast to compound at 24.49% annually through 2030 as collaborations resolve shuttle-effect durability hurdles. Early flight tests show 20% range gains on light drones, validating performance claims. Sodium-ion solutions under US Navy funding indicate a future niche for thermally stable chemistries in carrier operations.These developments widen the competitive field, encouraging smaller innovators to license cell architectures optimized for aviation's stringent safety codes.

Back-up and emergency systems occupied 38.29% of the aircraft battery market size in 2024 because every certified aircraft must power vital radios and fly-by-wire controls during generator loss. Yet the propulsion segment for eVTOL aircraft is outpacing all categories with 30.04% CAGR, to urban-mobility trials across Dubai, Los Angeles, and Singapore. Moore's law-style cost curves in power electronics amplify the economic case, allowing operators to forecast per-seat-mile costs below regional turboprops for missions under 200 km.

Auxiliary power units (APUs) and avionics packs benefit from lighter lithium-ion formats that cut scheduled maintenance and decrease fuel burn. Advanced battery systems integrated with thermal-management hardware, such as BAE Systems' 200 kWh pack for a hybrid narrow-body demonstrator, signal a shift toward modular, swappable units. This architectural evolution enables airlines to upgrade chemistries without major airframe modifications, keeping residual values high.

The Aircraft Battery Market Report is Segmented by Battery Type (Lead Acid, and More), Application (Propulsion, and More), Aircraft Technology (Traditional, and More), Aircraft Type (Fixed-Wing, Rotary Wing, and More), Power Density (Less Than 100Wh/Kg, and More), End-User (Original Equipment Manufacturer (OEM) and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 30.58% revenue in 2024 as federal policies such as the Inflation Reduction Act channeled funding into domestic cell production and electric-aircraft demonstration programs. The FAA's Innovate28 roadmap provides step-by-step integration milestones, allowing airlines to plan fleet renewals around certified electric or hybrid models. Yet material reliance on imported lithium and rare-earths exposes a supply-chain risk that could constrain longer-term expansion.

Asia-Pacific posts the fastest 10.14% CAGR during 2025-2030, propelled by China's low-altitude economy blueprint and manufacturing scale, which produces roughly 85% of global lithium-ion output. Japanese all-solid-state breakthroughs and Korean cathode expertise reinforce regional self-sufficiency, allowing local OEMs to lock in competitive pricing. India's aviation upswing and drone-delivery trials add incremental volume, broadening the customer base for regional battery suppliers.

Europe maintains a stronghold built on Airbus, Leonardo, and a dense tier-one supplier network. The EU Battery Regulation mandates recycled-content thresholds and carbon footprint declarations, steering product design toward circular-economy principles. Funding lines from Clean Aviation accelerate hybrid-regional demonstrators, while national energy strategies underwrite gigafactory construction from Scandinavia to Spain. These converging initiatives secure Europe's relevance in premium-priced sustainable aviation segments.

- Saft Groupe SAS

- EnerSys

- EaglePicher Technologies, LLC

- GS Yuasa International Ltd.

- HBL Engineering Limited

- True Blue Power (Mid-Continent Instrument Co., Inc)

- Teledyne Technologies Incorporated

- Sichuan Changhong Battery Co., Ltd.

- Meggitt PLC

- Cella Energy Ltd.

- Kokam Co. Ltd.

- Epsilor-Electric Fuel Ltd.

- Securaplane Technologies Inc.

- Tesla Industries, Inc.

- Concorde Battery Corporation

- InoBat

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Adoption of More-Electric Aircraft (MEA) architecture in North American narrow-body programs

- 4.1.2 OEM shift to Li-ion batteries for high-load avionics in Asia

- 4.1.3 Rapid certification pipeline for eVTOL air-taxis in Europe

- 4.1.4 Military UAV modernization driving high-rate cells in Middle East

- 4.1.5 Government policy support and clean aviation funding

- 4.1.6 Solid-state battery technology breakthroughs

- 4.2 Market Restraints

- 4.2.1 Thermal-runaway incidents slowing wide-body adoption

- 4.2.2 Scarce aerospace-grade Li-S production capacity

- 4.2.3 Nickel and Cobalt price volatility compressing OEM margins

- 4.2.4 Supply chain vulnerabilities and geopolitical tensions

- 4.3 Value Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Nickel-Cadmium (NiCd)

- 5.1.3 Lithium-ion (Li-ion)

- 5.1.4 Lithium-sulfur (Li-S)

- 5.2 By Application

- 5.2.1 Propulsion

- 5.2.2 Auxiliary Power Unit (APU)

- 5.2.3 Emergency/Backup

- 5.2.4 Avionics and Flight-Control Actuation

- 5.2.5 Adavanced Battery System

- 5.3 By Aircraft Technology

- 5.3.1 Traditional

- 5.3.2 More-Electric

- 5.3.3 Hybrid-Electric

- 5.3.4 Fully Electric

- 5.4 By Aircraft Type

- 5.4.1 Fixed-Wing

- 5.4.1.1 Commercial Aviation

- 5.4.1.1.1 Narrow-body Aircraft

- 5.4.1.1.2 Wide-Body Aircraft

- 5.4.1.1.3 Regional Jets

- 5.4.1.2 Business and General Aviation

- 5.4.1.2.1 Business Jets

- 5.4.1.2.2 Light Aircraft

- 5.4.1.3 Military Aviation

- 5.4.1.3.1 Fighter Aircraft

- 5.4.1.3.2 Transport Aircraft

- 5.4.1.3.3 Special Mission Aircraft

- 5.4.2 Rotary Wing

- 5.4.2.1 Commercial Helicopters

- 5.4.2.2 Military Helicopters

- 5.4.3 Unmanned Aerial Vehicles

- 5.4.4 Advanced Air Mobility

- 5.4.1 Fixed-Wing

- 5.5 By Power Density

- 5.5.1 Less than 100 Wh/kg

- 5.5.2 Between 100-300 Wh/kg

- 5.5.3 More than 300 Wh/kg

- 5.6 By End-User

- 5.6.1 Original Equipment Manufacturer (OEM)

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Saft Groupe SAS

- 6.3.2 EnerSys

- 6.3.3 EaglePicher Technologies, LLC

- 6.3.4 GS Yuasa International Ltd.

- 6.3.5 HBL Engineering Limited

- 6.3.6 True Blue Power (Mid-Continent Instrument Co., Inc)

- 6.3.7 Teledyne Technologies Incorporated

- 6.3.8 Sichuan Changhong Battery Co., Ltd.

- 6.3.9 Meggitt PLC

- 6.3.10 Cella Energy Ltd.

- 6.3.11 Kokam Co. Ltd.

- 6.3.12 Epsilor-Electric Fuel Ltd.

- 6.3.13 Securaplane Technologies Inc.

- 6.3.14 Tesla Industries, Inc.

- 6.3.15 Concorde Battery Corporation

- 6.3.16 InoBat

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment