PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642020

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642020

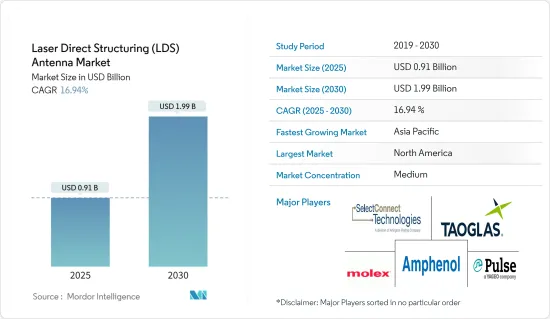

Laser Direct Structuring (LDS) Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Laser Direct Structuring Antenna Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.99 billion by 2030, at a CAGR of 16.94% during the forecast period (2025-2030).

Key Highlights

- With the miniaturization trend gaining prominence across various industries, the LDS market is gaining popularity. LDS technology allows smaller designs with integrated functionalities. Modern electronics have brought several difficulties for manufacturers. However, the introduction of the LDS antenna technology offers an effective way to overcome these challenges by offering a high degree of freedom in terms of metallization shape, thus, allowing improved radiation performance.

- The convergence of digital-based audio, video, and information technology is changing the shape of the consumer electronics industry, creating a whole new world of electronic gadgets that can grab consumers' attention. The consumer-spending trend is a leading economic indicator in the consumer electronics industry, strongly correlated with economic growth.

- Technological advancements are bringing convergence of computer, communication, and consumer electronics, auguring well for the industry, with many new opportunities for product innovations, with miniaturization. The trend towards miniaturization in the consumer electronics industry has driven package component sizes down to the design-rule level of early technologies.

- Specifically, smartphones have observed a robust uptake of this technology, nearly doubling production volumes over the past decade. Apart from this, the rising adoption of smart devices, wearables, and connected medical equipment, innovations in the modern medical sciences across the world has bought a massive advancement into the global healthcare offerings as most consumers are now leveraging the advantages offered by smart medical devices to address critical health needs.

- Furthermore, the electronics segment in the military and defense industry also presents potential opportunities for the LDS antenna market, buoyed by the rising number of unmanned aerial vehicles (UAVs), global positioning system/global navigation satellite system (GPS/GNSS) navigation, and conformal communication antennas, among others.

- According to Teal Group, approximately 95% of the 28,912 UAVs projected to be developed between 2013 and 2027 will be employed for military purposes. UAV operations are becoming well-embedded in the armed forces worldwide, affecting global security. Aiding this trend, players, such as TE Connectivity, are focused on delivering lighter, smaller antennas that can sustain in harsh environments in the aerospace and defense sector.

- However, the market growth is expected to be hindered by the high equipment costs, need for high temperature-resistant materials, long plating process, and complexity in procedure due to thin metallization layers and beads of the laser structuring process.

- COVID-19 adversely affected manufacturing operations in numerous industries where LDS technology has a wide range of antenna uses. The sales, as well as production of smartphone and pad devices, laptop and notebook computers, vehicle tracking systems, gaming consoles, inventory tracking systems, wireless printers, and routers, UAVs, etc., were all affected by restrictions on logistics and the availability of the workforce.

Laser Direct Structuring (LDS) Market Trends

Automotive is expected to register a Significant Growth

- Laser direct structuring of 3D molded connecting devices (3D MIDs) is widely used in automotive applications to reduce weight and boost reliability. The production of next-generation (future) vehicles depends mostly on enhancing vehicles' abilities to connect wirelessly to a wide variety of services. The vision for connected vehicles aims to effectively use wireless communication resources to deliver advanced functionalities for effective traffic management, infotainment, and ensuring the driver's safety.

- To fulfill the requirements for a wide variety of applications in broadcasting and telematics, onboard automobile equipment is integrated into an increasing number of wireless services. Typically, automotive onboard antennas, like integrated rooftop antennas, on-glass antennas, and rod antennas, are mostly used to cover all wireless communication standards.

- LDS is majorly used in steering wheel hubs, as most automobiles generally come equipped with steering-mounted controls. In addition, LDS is widely used in forwarding control switches, positioning sensors, and brake sensors. LDS finds its applications vastly in advanced driver-assistance systems (ADAS) for self-driving cars. Moreover, self-driving cars are anticipated to see rapid adoption in the transportation sector. The European Transport Safety Council (ETSC), a not-for-profit advocacy group in Brussels, projected that automatic braking could minimize traffic death rates by as much as 20%.

- For example, in June 2022, Tesla built its Enhanced Autopilot in China and the United States. In the United States, Enhanced Autopilot costs USD 6,000. Meanwhile, in China, it costs USD 4,779. The features included in Enhanced Autopilot are navigate on autopilot, auto lane change, autopark, summon, and smart summon. Tesla also released Enhanced Autopilot in New Zealand and Australia. In New Zealand, Enhanced Autopilot costs USD 3,615, and in Australia, it costs USD 3,579. Enhanced Autopilot offers the same features in all four countries.

- By 2030, autonomous automobiles will probably rule the market, as per NASDAQ. In addition, several governments worldwide are promoting the use of ADAS features. For instance, the National Highway Traffic Safety Administration (NHTSA) of the United States Department of Transportation (USDT) established the Federal Automated Vehicles Policy (FAVP) in relation to highly automated vehicles (HAVs), which can range from cars with advanced driver-assistance features to autonomous vehicles.

North America is Expected to Hold Major Share

- Nearly all the end-user sectors in the North American region greatly demand LDS Antenna solutions. However, the region's main source of demand for LDS antennas is likely to come from the consumer electronics, networking, and automotive industries.

- The region's strong automobile industry growth helps the market grow and expand. For the enhancement of the comfort and safety of passengers, modern automobiles need to combine a variety of sensors and electronic assistants. However, the requirement to reduce the number of components is growing along with deploying these sensors and components.

- Incorporating LDS technology is anticipated to promote miniaturization and lower the number of components when used with appropriate connection and assembly technology. LDS technology also assists in terms of cost-effectiveness in the manufacturing process and aids in the extension of design alternatives.

- The United States has a significant share of the major consumer electronics markets. According to the Consumer Technology Association (CTA), smartphones generated the most revenue in consumer electronics/technology sales in the United States during the previous five years. The sales value of smartphones sold in the United States increased by 1.7 billion USD in 2022 to USD 75.4 billion compared to USD 74.7 billion in the previous year.

Laser Direct Structuring (LDS) Industry Overview

The market for laser direct structuring (LDS) antenna is hugely competitive. It contains several leading players such as Taoglas Limited, Molex LLC, SelectConnect Technologies, TE Connectivity Ltd, Pulse Electronics Corporation (Yageo Corporation), etc. In terms of market share, few significant players currently dominate the market. These major players with a substantial stake in the market are highly focused on expanding their customer base across foreign countries. These companies leverage various strategic collaborative initiatives to maximize their market share and increase their profitability.

In July 2022, TE Connection, a global provider of sensors, bought Linx Technologies, a supplier of radio frequency (RF) components in the Internet of Things (IoT) markets. The strategic acquisition will further strengthen Te's product portfolio and competitiveness in the IoT. As TE continues to strengthen its investment in the IoT market, the acquisition will help expand TE's supply chain, particularly in antennas and RF connectors for the IoT. It is also an important strategy for TE following the acquisition of Laird Connectivity's antenna business in 2021.

Moreover, in July 2022, Taoglas, a leading enabler of digital transformation through IoT, and Novotech, a leading 4G/5G cellular IoT electronics components distributor and solutions provider, entered into a new Canadian partnership agreement combining the distribution of Taoglas' advanced components, including industry-leading antennas, sales and technical support for cellular IoT connectivity solutions. This new partnership will expand Novotech's portfolio, providing the company's partners and customers access to Taoglas' innovative 4G/5G cellular portfolio for supporting public safety, transportation, e-charging, fixed wireless, and 5G mobile networking solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For Miniaturization In Consumer Electronics Industry

- 5.1.2 Growth of IoT and Devices With Higher Antenna Ranges

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Manufacturing Complexities Associated With Molded Interconnect Devices

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 Healthcare

- 6.1.2 Consumer Electronics

- 6.1.3 Automotive

- 6.1.4 Networking

- 6.1.5 Other End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Taoglas Limited

- 7.1.2 Molex LLC

- 7.1.3 Multiple Dimensions AG

- 7.1.4 SelectConnect Technologies

- 7.1.5 TE Connectivity Ltd

- 7.1.6 Pulse Electronics Corporation (Yageo Corporation)

- 7.1.7 Amphenol Corporation

- 7.1.8 Tongda Group Holdings Limited

- 7.1.9 Shenzhen Sunway Communication Co. Ltd

- 7.1.10 Luxshare Precision Industry Co. Ltd

- 7.1.11 HARTING KGaA

- 7.1.12 Huizhou Speed Wireless Technology Co. Ltd

- 7.1.13 LPKF Laser & Electronics AG

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNIES AND FUTURE TRENDS