PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437906

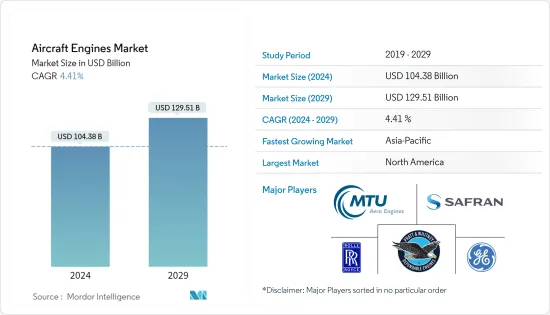

Aircraft Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Aircraft Engines Market size is estimated at USD 104.38 billion in 2024, and is expected to reach USD 129.51 billion by 2029, growing at a CAGR of 4.41% during the forecast period (2024-2029).

The market of aircraft engines was highly affected by the COVID-19 pandemic due to a downturn in the aviation industry, which resulted in reduced deliveries of aircraft engines in 2020 and 2021. However, the large-scale backlog of aircraft OEMs in the commercial, military, and general aviation sectors is expected to drive the market during the forecast period.

The planned fleet modernization and expansion plans of airlines, aircraft operators, armed forces, and charter operators are expected to propel the growth of the aircraft engines market during the forecast period.

The market's growth is also driven by the demand for new generation engines with low emissions and lower weight, which will enhance aircraft fuel efficiency. Due to this trend, companies are investing in research and development of new engine models utilizing the latest technologies, like additive manufacturing and composite technologies.

However, growing concerns over the failure of aircraft engines during operation and delays in deliveries are some of the factors hampering the market's growth.

Aircraft Engine Market Trends

Demand for Commercial Aircraft Engines Expected to Improve During the Forecast Period

The commercial aircraft segment currently dominates the market and is expected to continue its dominance during the forecast period, owing to a large number of commercial aircraft deliveries across the world, which are generating demand for aircraft engines. By the end of 2021, Airbus reported a backlog of 7,082 jets, and Boeing's backlog was 5,136 aircraft. The backlog of the aircraft OEMs is expected to support the commercial engines segment to grow at a healthy rate during the forecast period. The demand for narrow-body aircraft is expected to recover faster than for wide-body aircraft as domestic demand is expected to return to pre-pandemic levels earlier than the international passenger demand. Also, the return of the Boeing 737 MAX into service in 2021 has been boosting the demand for narrow-body aircraft. Technological advancements in newer generation passenger aircraft make it possible for them to fly longer distances. Players are emphasizing increasing the fuel efficiency of passenger aircraft while increasing their range, as airlines are looking to procure such aircraft for their fleets. Airbus entered into a partnership with CFM International in February 2022 to develop a hydrogen-fuelled aircraft engine with the aim of introducing zero-emission aircraft by 2035. Such plans are anticipated to propel the growth of the market.

Asia-Pacific Region Expected to Witness the Highest Growth During the Forecast Period

The Asia-Pacific region is expected to witness the highest growth during the forecast period due to the strong demand for domestic air travel in developing economies. The pandemic led to a decline in passenger traffic in 2020, but domestic passenger traffic in countries like China, India, South Korea, and Australia has been gradually recovering from the second half of 2020. Due to the faster growth of domestic passenger traffic, low-cost airlines in the region are strengthening their aircraft fleet with new generation aircraft to support their route expansion plans. For instance, in November 2021, Akasa Air, a new airline in India, selected CFM LEAP-1B engines for its new Boeing 737 MAX aircraft currently on order. The airline placed an order for 72 Boeing 737 MAX aircraft, including 737-8 and the high-capacity 737-8-200 models. Such robust aircraft orders as part of fleet modernization plans of the airlines in the region are expected to accelerate the demand for aircraft engines over the coming years. Furthermore, due to geopolitical tensions in the region, countries are increasing their investments to strengthen their aerial capabilities with the procurement of advanced aircraft and replace their aging aircraft. The Indian Air Force is planning to acquire 450 fighter aircraft for deployment on the northern and western frontiers of the country by 2035 as part of its plan to bridge the gap between the existing number of squadrons and the required number of squadrons. Such fleet modernization plans will likely generate demand for advanced lightweight and fuel-efficient engines over the coming years.

Aircraft Engine Industry Overview

The aircraft engine market is highly consolidated, with a few players dominating the market in the commercial and military aircraft segments. Some of the prominent aircraft engine market players are General Electric Company (through GE Aviation), Raytheon Technologies Corporation (through Pratt & Whitney), Rolls-Royce Holding PLC, Safran SA, and MTU Aero Engines AG. The aforementioned players, along with their joint ventures such as CFM International (GE Aviation and Safran), International Aero Engines (Pratt & Whitney, Japanese Aero Engine Corporation, and MTU Aero Engines), and Engine Alliance (General Electric and Pratt & Whitney), provide engines for major commercial and military aircraft programs. Despite the decrease in commercial aircraft engine deliveries in 2020 and 2021 consecutively, the remaining performance obligation (RPO) of aircraft engine manufacturers is witnessing an increase due to the increasing aircraft backlog of aircraft OEMs. Also, engine manufacturers are partnering with aircraft manufacturers to develop sustainable aircraft engine solutions that have low weight and reduced engine emissions. In addition to this, due to increasing demand for local manufacturing, regional players are partnering with international players. For instance, as of March 2022, India's Defence Research and Development Organisation (DRDO) was in talks with Safran for joint development of a 125KN engine for the indigenous fifth-generation Advanced Medium Combat Aircraft (AMCA) (currently under development with the first flight planned for 2024). Such developments are anticipated to help the companies increase their geographical presence over the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2027

- 3.2 Market Share by Engine Type, 2021

- 3.3 Market Share by Aircraft Type, 2021

- 3.4 Market Share by Geography, 2021

- 3.5 Structure of the Market and Key Participants

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD billion, 2018 - 2027)

- 5.1 Engine Type

- 5.1.1 Turbofan

- 5.1.2 Turboprop

- 5.1.3 Turboshaft

- 5.1.4 Piston

- 5.2 Aircraft Type

- 5.2.1 Commercial Aviation

- 5.2.1.1 Narrow-body Aircraft

- 5.2.1.2 Wide-body Aircraft

- 5.2.1.3 Regional Aircraft

- 5.2.2 Military Aviation

- 5.2.2.1 Combat Aircraft

- 5.2.2.2 Non-combat Aircraft

- 5.2.3 General Aviation

- 5.2.3.1 Business Jet

- 5.2.3.2 Helicopter

- 5.2.3.3 Turboprop Aircraft

- 5.2.3.4 Piston Engine Aircraft

- 5.2.1 Commercial Aviation

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.1.1 Engine Type

- 5.3.1.1.2 Aircraft Type

- 5.3.1.2 Canada

- 5.3.1.2.1 Engine Type

- 5.3.1.2.2 Aircraft Type

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.1.1 Engine Type

- 5.3.2.1.2 Aircraft Type

- 5.3.2.2 Germany

- 5.3.2.2.1 Engine Type

- 5.3.2.2.2 Aircraft Type

- 5.3.2.3 France

- 5.3.2.3.1 Engine Type

- 5.3.2.3.2 Aircraft Type

- 5.3.2.4 Rest of Europe

- 5.3.2.4.1 Engine Type

- 5.3.2.4.2 Aircraft Type

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.1.1 Engine Type

- 5.3.3.1.2 Aircraft Type

- 5.3.3.2 India

- 5.3.3.2.1 Engine Type

- 5.3.3.2.2 Aircraft Type

- 5.3.3.3 Japan

- 5.3.3.3.1 Engine Type

- 5.3.3.3.2 Aircraft Type

- 5.3.3.4 South Korea

- 5.3.3.4.1 Engine Type

- 5.3.3.4.2 Aircraft Type

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.3.5.1 Engine Type

- 5.3.3.5.2 Aircraft Type

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.1.1 Engine Type

- 5.3.4.1.2 Aircraft Type

- 5.3.4.2 Rest of Latin America

- 5.3.4.2.1 Engine Type

- 5.3.4.2.2 Aircraft Type

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.1.1 Engine Type

- 5.3.5.1.2 Aircraft Type

- 5.3.5.2 Saudi Arabia

- 5.3.5.2.1 Engine Type

- 5.3.5.2.2 Aircraft Type

- 5.3.5.3 Qatar

- 5.3.5.3.1 Engine Type

- 5.3.5.3.2 Aircraft Type

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.5.4.1 Engine Type

- 5.3.5.4.2 Aircraft Type

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Electric Company

- 6.2.2 Safran SA

- 6.2.3 Rolls-Royce Holding PLC

- 6.2.4 Raytheon Technologies Corporation

- 6.2.5 Honeywell International Inc.

- 6.2.6 Rostec

- 6.2.7 MTU Aero Engines AG

- 6.2.8 IHI Corp.

- 6.2.9 Textron Inc.

- 6.2.10 Williams International Co. LLC

- 6.2.11 Mitsubishi Heavy Industries Aero Engines Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS