PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851618

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851618

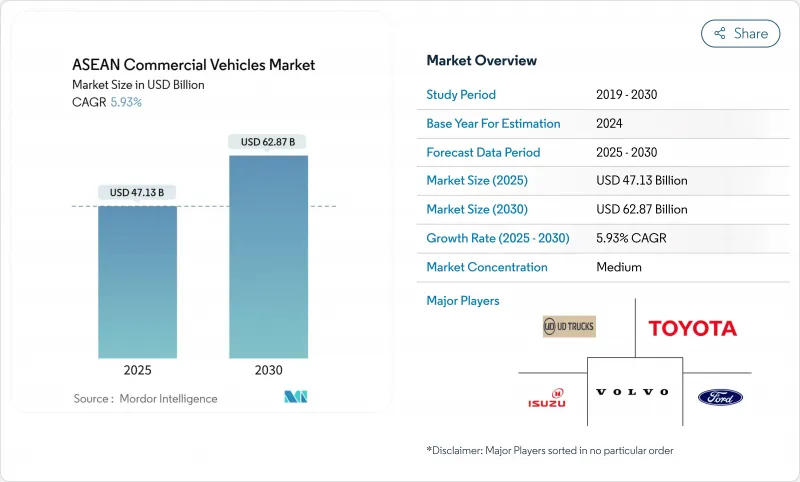

ASEAN Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ASEAN commercial vehicles market is valued at USD 47.13 billion in 2025 and is forecast to reach USD 62.87 billion by 2030, reflecting a 5.93% CAGR.

Surging infrastructure spending, the rapid digitalization of cross-border trade, and accelerating fleet electrification position the region as a pivotal production and consumption hub. Regional customs harmonization trims border-crossing times, while e-commerce platforms reconfigure last-mile distribution patterns and lift demand for agile light-duty models. Simultaneously, member states tighten emissions rules in line with Euro VI, prompting accelerated powertrain upgrades. Chinese OEMs deepen localization, leveraging cost advantages and tariff-free intra-ASEAN trade to erode the dominance of long-entrenched Japanese brands.

ASEAN Commercial Vehicles Market Trends and Insights

E-commerce Boom and Last-Mile Logistics

Explosive online retail growth has redrawn shipment profiles, pushing fleet operators to favour compact vans, pickups, and two-wheeler cargo carriers that can slip through congested urban cores. Courier networks doubled service points across Thailand during 2024, underscoring operators' urgency to narrow fulfilment windows. Purpose-built electric light trucks featuring modular cargo bays are gaining traction, especially where access restrictions penalise diesel vehicles. Partnerships between ride-hailing platforms and local assemblers have yielded sub-USD 1,000 battery-swappable motorbikes that cut idle time and extend asset life. Demand also tilts toward temperature-controlled micro-delivery units as social-commerce platforms heighten fresh-food throughput. Collectively, these shifts amplify procurement of light commercial platforms and open opportunities for telematics suppliers that can optimise multi-drop routing.

Infrastructure Mega-Projects Pipeline

Across Thailand, Indonesia, Malaysia, and Vietnam, more than USD 43 trillion in road and bridge spending is earmarked through 2035, equal to 63% of Asia-Pacific transport allocations. Highway upgrades and quarry expansions lift immediate orders for tipper trucks, concrete mixers, and heavy-duty mining haulers. Port-centric logistics corridors spawning around Laem Chabang and Klang also boost container tractors. While project approvals create a steady baseline, delays tied to land acquisition or fiscal constraints introduce quarterly demand swings that compel OEMs to pursue modular body programmes and flexible shift patterns. Suppliers of drivetrain durability solutions and on-site maintenance services benefit as fleet owners prioritise uptime over outright acquisition cost.

Stricter Euro VI-Equivalent Standards

Thailand enforced Euro 5 diesel specifications in January 2024 and signalled Euro VI compliance no later than 2030, moves mirrored by Cambodia and the Philippines. While environmental gains are clear, the upgrades inflate engine and exhaust-after-treatment costs by 15-20%, squeezing margins for low-volume assemblers. Disparities in diesel sulphur content across member states complicate calibration work, lengthening homologation cycles. OEMs with selective catalytic reduction portfolios stand to gain volume, but smaller players risk exit as capital-expenditure demands outstrip balance-sheet capacity.

Other drivers and restraints analyzed in the detailed report include:

- Intra-ASEAN Trade Growth

- Localization by Chinese EV-CV OEMs

- Cold-Chain Demand Surge

- EV-CV Charging & TCO Barrier

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light commercial vehicles held 56.25% of ASEAN commercial vehicles market share in 2024, buoyed by parcel-delivery momentum and municipal restrictions on heavy diesels. Segment revenue is projected to compound at 6.78% annually through 2030, outpacing the broader ASEAN commercial vehicles market. Chinese challengers introduce battery-electric pickups that undercut traditional offerings by 20%, while Japanese incumbents counter with mild-hybrid upgrades. Urban consolidation centres proliferate around Bangkok and Ho Chi Minh City, catalysing demand for panel vans equipped with factory-fitted shelving and telematics bundles.

The medium-duty cohort serves construction logistics and waste-management niches, relying on improved torque curves and automated transmissions to navigate congestion. Heavy-duty tractors remain vital for intra-ASEAN freight corridors, yet their growth moderates as rail pipelines gain traction on mainland routes. Consequently, chassis makers exploring lightweight composites and aerodynamics enhancements secure competitive advantage in fuel-efficiency-obsessed fleets seeking quick returns on capital.

Internal-combustion engines represent 94.26% of the ASEAN commercial vehicles market size in 2024, but their share erodes as policy incentives tilt fleet economics. Battery-electric models, starting from a low base, are expected to post a 10.23% CAGR to 2030, doubling their contribution within the ASEAN commercial vehicles market. Thailand's EV3.5 scheme grants excise waivers that reduce OEM landed costs, accelerating model-line additions. Indonesia's aspirational target of 600,000 electric vehicles by 2030 stimulates vendor finance packages tied to nickel-rich domestic battery supply.

Plug-in hybrids occupy a bridging role where duty concessions favour low-carbon yet range-extending solutions. Fuel-cell prototypes surface mainly in cross-border haulage pilots between Malaysia and Singapore, leveraging short hydrogen corridors co-developed with port authorities. For ICE holdouts, Euro VI hardware and synthetic-diesel compatibility become selling points as customers weigh future resale value against near-term capital outlay.

The ASEAN Commercial Vehicles Market Report is Segmented by Vehicle Type (Light Commercial Vehicles, Medium-Duty Commercial Vehicles, and More), Propulsion (Internal Combustion Engine, Battery Electric Vehicle, and More), Application (Logistics and E-Commerce Delivery, and More), Body Configuration (Rigid Truck and Van, and More) and by Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Isuzu Motors

- AB Volvo

- Toyota Motor Corporation

- Ford Motor Company

- UD Trucks

- Iveco Group

- Tata Motors

- BYD Auto

- Chery Commercial Vehicles

- Foton Motor

- Dongfeng Trucks

- MAN Truck & Bus

- Daimler Truck (Mitsubishi Fuso & Mercedes-Benz Trucks)

- Hyundai Motor Company

- Ashok Leyland

- Suzuki Motor

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce Boom and Last-Mile Logistics

- 4.2.2 Infrastructure Mega-Projects Pipeline

- 4.2.3 Intra-ASEAN Trade Growth

- 4.2.4 Localization by Chinese EV-CV OEMs

- 4.2.5 Cold-Chain Demand Surge

- 4.2.6 Carbon-Credit and Green-Fleet Mandates

- 4.3 Market Restraints

- 4.3.1 Stricter Euro VI-Equivalent Standards

- 4.3.2 EV-CV Charging and TCO Barrier

- 4.3.3 Fragmented Advanced-Powertrain After-Sales

- 4.3.4 SME Credit Tightening for Fleet Renewal

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Light Commercial Vehicles

- 5.1.2 Medium-Duty Commercial Vehicles

- 5.1.3 Heavy-Duty Commercial Vehicles

- 5.2 By Propulsion

- 5.2.1 Internal Combustion Engine

- 5.2.2 Battery Electric Vehicle

- 5.2.3 Plug-in Hybrid Electric Vehicle

- 5.2.4 Fuel Cell Electric Vehicle

- 5.3 By Application / End-Use

- 5.3.1 Logistics and E-commerce Delivery

- 5.3.2 Construction and Mining

- 5.3.3 Agriculture and Forestry

- 5.3.4 Public Transportation (Bus & Coach)

- 5.3.5 Utilities and Municipal Services

- 5.4 By Body Configuration (NEW)

- 5.4.1 Rigid Truck and Van

- 5.4.2 Tractor-Trailer

- 5.4.3 Bus and Coach

- 5.4.4 Tipper and Dump

- 5.4.5 Refrigerated

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Thailand

- 5.5.3 Vietnam

- 5.5.4 Malaysia

- 5.5.5 Philippines

- 5.5.6 Singapore

- 5.5.7 Rest of the ASEAN Countries

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Isuzu Motors

- 6.4.2 AB Volvo

- 6.4.3 Toyota Motor Corporation

- 6.4.4 Ford Motor Company

- 6.4.5 UD Trucks

- 6.4.6 Iveco Group

- 6.4.7 Tata Motors

- 6.4.8 BYD Auto

- 6.4.9 Chery Commercial Vehicles

- 6.4.10 Foton Motor

- 6.4.11 Dongfeng Trucks

- 6.4.12 MAN Truck & Bus

- 6.4.13 Daimler Truck (Mitsubishi Fuso & Mercedes-Benz Trucks)

- 6.4.14 Hyundai Motor Company

- 6.4.15 Ashok Leyland

- 6.4.16 Suzuki Motor

7 Market Opportunities & Future Outlook