PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687813

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687813

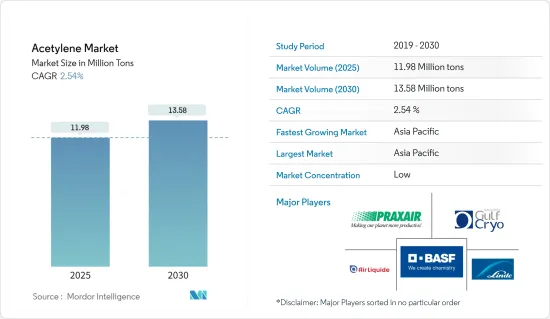

Acetylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Acetylene Market size is estimated at 11.98 million tons in 2025, and is expected to reach 13.58 million tons by 2030, at a CAGR of 2.54% during the forecast period (2025-2030).

The acetylene market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, growing demand from the metalworking industry and increasing demand from the chemical sector are the major factors driving the demand for the market studied.

- However, stringent environmental regulations due to the harmful effects of acetylene and alternatives of acetylene in welding and cutting applications are expected to hinder the market's growth.

- Nevertheless, the application of acetylene gas for various scientific research is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Acetylene Market Trends

Metalworking Segment is Expected to Dominate the Market

- Acetylene, a highly flammable gas, is pivotal in various metalworking processes. Its distinct properties render it an optimal fuel gas for numerous industrial applications.

- Primarily, acetylene is utilized in oxyacetylene cutting, heat treating, and welding. Additionally, the chemical processing industry employs bulk acetylene as a raw material to synthesize organic compounds like acetaldehyde, acetic acid, and acetic anhydride.

- Acetylene's triple-bond structure grants it the highest flame temperature among gases. When combusted with oxygen, acetylene reaches a flame temperature of 3090°C (5594°F), releasing an energy of 54.8 kJ/liter. This elevated flame temperature is what makes acetylene indispensable for metalworking tasks such as cutting, welding, soldering, and brazing.

- These metalworking applications find utility across diverse end-user industries, including automotive, aerospace, metal fabrication, pharmaceuticals, and glass.

- As per the data from the World Steel Association (worldsteel), global crude steel production was 135.7 million tonnes (Mt) in December 2023, down 6.3% from November. By July 2024, production rebounded to 152.8 million tonnes (Mt), though this was a 4.7% dip from July 2023. These figures highlight the industry's challenges, but with emerging economies ramping up infrastructure projects, a steel demand recovery is anticipated.

- As reported by the Ambattur Industrial Estate Manufacturers Association (AIEMA), India's machine tools industry was estimated to grew by 14-15% in 2023 compared to the previous year. Looking ahead, AIEMA forecasts a growth rate of 12-17% for the machine tools sector over the next three years. Such growth is set to amplify the demand for metalworking applications, subsequently propelling the market's expansion.

- Additionally, enhanced steel production capacities in countries like China and the United States have bolstered global steel output, further driving the demand for metalworking applications and supporting the market's growth.

- As per the World Steel Association, Japan's steel production in July 2024 stood at 7.1 Mt, marking a 3.8% decline from the same month in 2023. Year-to-date figures show a production of 49.8 Mt, reflecting a 2.8% year-on-year drop.

- The United States, ranked as the fourth-largest producer of crude steel globally, reported a production of 6.9 Mt in July 2024, witnessing a modest increase of 2.1%. However, the year-to-date production figures were at 46.9 Mt, indicating a decline of 1.8%, as per the World Steel Association.

- As highlighted in the United States Manufacturing Technology Orders report by AMT-the Association For Manufacturing Technology-December 2023 saw a surge in new machine tool orders. Manufacturers invested USD 491.03 million in metal-cutting and metal-forming/fabricating machinery, reflecting a 21.7% rise from November 2023 and an 11.9% increase from December 2022. In February 2024, orders for manufacturing technology (machine tools) reached USD 343.3 million, marking a 2.1% uptick from January 2024. Furthermore, in February 2024, manufacturing technology (machine tools) orders reached USD 343.3 million, indicating an increase of 2.1% compared to January 2024.

- Germany's steel production in July 2024 was estimated at 3.1 Mt, showcasing a 4.8% increase. Year-to-date, Germany's production reached 22.5 Mt, marking a notable 4.5% rise, according to World Steel Association data.

- Brazil led with the most significant growth, producing 3.1 Mt in July 2024, an impressive 11.6% increase. Year-to-date, Brazil's production stood at 19.4 Mt, up by 3.3%, as reported by the World Steel Association.

- Given the rising applications of acetylene in metalworking, the market for acetylene is set to witness growth over the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is poised to lead the acetylene market, emerging as the region with the fastest growth during the forecast period. This surge is primarily fueled by rising demands in diverse applications, including metalworking and as a chemical raw material, particularly in nations like China, India, South Korea, Japan, and several Southeast Asian countries.

- Acetylene plays a pivotal role in producing essential chemicals, including vinyl chloride monomer, acrylonitrile, vinyl acetate, vinyl ether, acetaldehyde, 1,2-dichloroethane, 1,4-butynediol, acrylate esters, polyacetylene, and polydiacetylene. Given that Asia-Pacific boasts the largest market for the chemical industry, there's vast potential for the acetylene market to flourish.

- China, a global chemical processing hub, dominates worldwide chemical production. As global demand for various chemicals rises, this sector's need for intermediates, such as acetic acid, is projected to see a significant uptick during the forecast period.

- China stands out not only as the largest player in the chemical arena but also as one of its fastest-growing markets. Data from VCI (Association of the Chemical Industry e.V.) highlights China's significant role, with the nation accounting for 12.8% of global petrochemical exports in 2023.

- China, the world's leading iron and steel producer, is also pivoting towards eco-friendly steel production methods. While serving both domestic and international markets, China's steel output saw a 9.0% decline in July 2024, totaling 82.9 million tonnes (Mt). Year-to-date figures indicate a production of 613.7 Mt, marking a 2.2% drop from 2023, as per the World Steel Association.

- Data from Invest India highlights that exports of chemicals and chemical products (excluding pharmaceuticals and fertilizers) accounted for 10.5% of total exports in 2022-23, down from 11.7% in 2021-22. As of December 2023, this segment contributed 10% to total exports for the 2023-24 fiscal year.

- According to BigMint, India's steel production is projected to grow by nearly 6% year-on-year, reaching 152 million tons by the close of FY2024/2025 (ending March 2025). The bulk of this projected output is anticipated to stem from steel mills utilizing blast furnaces.

- Furthermore, data from the Observatory of Economic Complexity (OEC) highlights a significant rise in South Korea's organic chemical exports. From May 2023 to May 2024, exports jumped by USD 76.6 million, a 4.42% increase from USD 1.73 billion to USD 1.81 billion. This growth underscores the sector's rising prominence and sets the stage for increased market demand.

- Additionally, the Department of Statistics Malaysia (DOSM) reports that Malaysia's chemical and chemical product exports grew by 0.8% year-on-year to MYR 6.31 billion (~USD 1.34 billion) in May 2024. This growth comes as signs indicate a bottoming out of the nation's overall trade weakness. Overall chemicals exports surged by 7.3% year-on-year to MYR 128.2 billion (~USD 27.22 billion) in May 2024, while imports rose by 13.8% to MYR 118.1 billion (~USD 25.08 billion). Such robust growth in the chemical sector is set to bolster demand in the acetylene market.

- Given the burgeoning industries in the region, the acetylene market is poised for significant growth in the coming years.

Acetylene Industry Overview

The acetylene market is fragmented in nature. The major players (not in any particular order) include BASF SE, Praxair Technology Inc., Gulf Cryo, Linde PLC, and Air Liquide, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Metalworking Industry

- 4.1.2 Increasing Demand from the Chemical Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Due to the Harmful Effects of Acetylene

- 4.2.2 Alternatives of Acetylene in Welding And Cutting Applications

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Metal Working

- 5.1.2 Chemical Raw Materials

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Qatar

- 5.2.5.3 United Arab Emirates

- 5.2.5.4 Nigeria

- 5.2.5.5 Egypt

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products And Chemicals Inc.

- 6.4.3 Asia Technical Gas Co Pte Ltd.

- 6.4.4 Axcel Gases

- 6.4.5 BASF SE

- 6.4.6 Butler Gas Products

- 6.4.7 Denka Company Limited

- 6.4.8 Gruppo SIAD

- 6.4.9 Gulf Cryo

- 6.4.10 Jinhong Gas Co. Ltd.

- 6.4.11 Koatsu Gas Kogyo Co. Ltd.

- 6.4.12 Linde PLC

- 6.4.13 Nippon Sanso Holdings Corporation

- 6.4.14 NOL Group

- 6.4.15 Pune Air Products

- 6.4.16 TOHO ACETYLENE Co.

- 6.4.17 Transform Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Application of Acetylene Gas for Various Scientific Research

- 7.2 Other Opportunities