PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687816

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687816

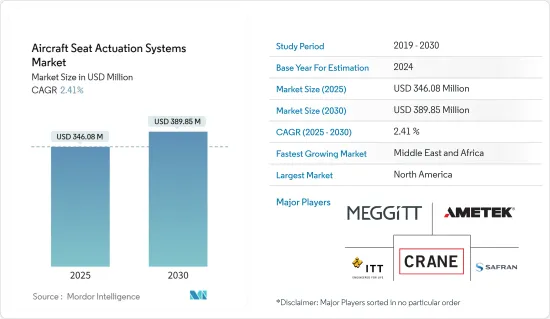

Aircraft Seat Actuation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aircraft Seat Actuation Systems Market size is estimated at USD 346.08 million in 2025, and is expected to reach USD 389.85 million by 2030, at a CAGR of 2.41% during the forecast period (2025-2030).

The outbreak of the COVID-19 pandemic in 2020 severely impacted the entire aviation industry. It has resulted in several aircraft operators filing for bankruptcy, which affected the demand for aircraft in the short term and aircraft seat actuation systems. However, the market gradually recovered in 2021 due to the increasing aircraft deliveries compared to the previous year. A similar trend has been reflected in the military and general aviation sectors.

With the increasing vaccination in various countries, the air passenger traffic is gradually increasing as the regulations for air travel are alleviating. This gradual recovery in passenger traffic supports the airlines and aircraft operators to invest in the procurement of new aircraft for fleet modernization and destination expansion. This is majorly driving the growth of the market during the forecast period.

Growing investment for cabin modernization by airlines and aircraft operators to enhance passenger experience onboard aircraft and innovation in seat designs by the seat manufacturers for offering a higher level of passenger comfort is anticipated to propel the demand for the aircraft seat actuation systems market in the coming years.

The investments into technologies like additive manufacturing for manufacturing thin down panels and other seat components to reduce the overall weight and cost of manufacturing components are anticipated to promote the development of lightweight seat actuators and motors.

Aircraft Seat Actuation Systems Market Trends

The Fixed-wing Aircraft Segment Accounted for Major Revenue Share in 2021

The fixed-wing aircraft segment currently dominates the market. It is anticipated to continue its dominance over the market due to its higher deliveries and seat requirements than the rotary-wing aircraft. New aircraft deliveries improved in 2021 compared to 2020 due to gradual growth in passenger traffic and airline operations. In 2021, Airbus delivered 611 commercial aircraft (566 deliveries in 2020), Boeing delivered 340 commercial aircraft (157 deliveries in 2020), and ATR delivered 31 aircraft (10 deliveries in 2020). The gradual recovery in demand for commercial aviation and business and private aviation is further propelling the procurement of new aircraft.

Similarly, as the supply chain issues subsided, the fixed-wing aircraft deliveries in the military sector have witnessed growth. For instance, Lockheed Martin delivered 142 F-35 fighter aircraft (compared to 123 deliveries in 2020), and Dassault Aviation exported 25 Rafale fighter jets (compared to 13 deliveries in 2020). The growth in aircraft deliveries is anticipated to propel the market's growth during the forecast period. Also, in collaboration with aircraft operators, the aircraft seat manufacturers are working on enhancing their designs to attract new customers. Such innovation in cabin interiors and seating modules is expected to propel the segment's growth in the coming years.

The Middle-East and Africa Region Expected to Witness Highest Growth During the Forecast Period

The demand for the aircraft seat actuation systems market is anticipated to be highest in the Middle-East and African region due to demand for wide-body aircraft from major airlines and large-size aircraft demand from private and charter companies. For instance, Etihad and Emirates had an order book of more than 270 aircraft (as of January 2022), including Boeing 777X, Airbus A350 family, A380, and Boeing 787 family of aircraft. Similarly, with the growing demand for air travel in the Middle-East region, the airlines and aircraft operators in the region are investing in expanding their aircraft fleet to introduce new aircraft routes in the region.

Similarly, the growth in terrorism in this region has resulted in these countries spending a significant amount on military aircraft procurement. The Qatar Emiri Air Force (QEAF) received its first batch of the new generation F-15 combat aircraft in August 2021, produced by the United States and Boeing, in partnership with the Gulf state. The aircraft was delivered under an order signed by the country in 2017 to procure 36 F-15QA fighter aircraft with an option for an additional 36 aircraft. Similar aircraft orders from Air Forces of Egypt, Jordan, Morocco, Algeria, and Israel are anticipated to accelerate the growth of the seat actuation systems market during the forecast period.

Aircraft Seat Actuation Systems Industry Overview

The market of aircraft seat actuation systems is a highly consolidated market with very few players accounting for the majority share in the market despite the presence of the many component providers in the market. Some prominent players in the aircraft seat actuation systems market are Safran SA, Meggit PLC, Crane Co., AMETEK Inc., and ITT Inc. The demand is expected to remain robust and free from market fluctuations due to the economic downturn and COVID-19 pandemic from the military applications side. Thus manufacturers should focus on this segment to stabilize and secure their revenue sources. The Asia-Pacific and the Middle-East and Africa regions, which are currently experiencing demand in the aviation industry, presently lack adequate infrastructure and inventory of products to supply quickly. Therefore, the companies are expanding their presence in underdeveloped regions locally, as it would provide them the first-mover advantage and will also benefit from offset clauses that are being set forth by many governments globally as part of contract obligations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2027

- 3.2 Market Share by Mechanism, 2021

- 3.3 Market Share by Aircraft Type, 2021

- 3.4 Market Share by Geography, 2021

- 3.5 Structure of the Market and Key Participants

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD million, 2018 - 2027)

- 5.1 Mechanism

- 5.1.1 Linear

- 5.1.2 Rotary

- 5.2 Aircraft Type

- 5.2.1 Fixed-wing Aircraft

- 5.2.2 Helicopters

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lee Air Inc.

- 6.2.2 Safran SA

- 6.2.3 Astronics Corporation

- 6.2.4 Crane Co.

- 6.2.5 ITT Inc.

- 6.2.6 CEF Industries LLC

- 6.2.7 ElectroCraft Inc.

- 6.2.8 NOOK Industries Inc.

- 6.2.9 Rollon SpA

- 6.2.10 Buhler Motor GmbH

- 6.2.11 AMETEK Inc.

- 6.2.12 Kyntronics

- 6.2.13 Meggitt PLC

- 6.2.14 OTM Servo Mechanisms Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS