PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444944

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444944

Asia-Pacific Insulin Infusion Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

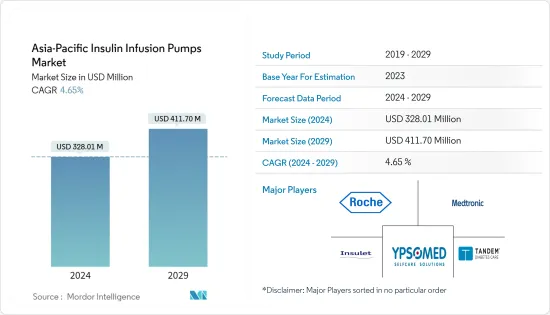

The Asia-Pacific Insulin Infusion Pumps Market size is estimated at USD 328.01 million in 2024, and is expected to reach USD 411.70 million by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

People with Covid-19 had a statistically greater incidence of type 2 diabetes and other kinds of diabetes in the Asia-Pacific region. Individuals with no history of diabetes who recovered from SARS-CoV-2 infections have been reported to develop insulin resistance and reduced insulin secretion. It has been proposed that integrated rather than disease-specific methods are needed for post-Covid syndrome diagnosis and therapy.

The conventional method of daily injections or an insulin pen can be replaced by an insulin infusion pump. Insulin infusion pumps alleviate discomfort, distribute insulin more precisely than injections, and prevent huge fluctuations in blood glucose levels. When utilizing pumps, mealtime planning is not necessary. Patients can use infusion pumps more easily as a result. Continuous subcutaneous insulin infusion is another name for insulin treatment (CSII). It is a reliable and adaptable way to administer insulin. The insulin pump has improved and is now more dependable than it ever was. Numerous technical developments have been made to CSII technology, including the incorporation of continuous glucose monitoring with the pump.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Asia-Pacific Insulin Infusion Pumps Market Trends

Insulin Infusion Pump Devices Dominating the Asia-Pacific Insulin Infusion Pump Market

An insulin pump is a device that delivers insulin continuously or, whenever required, automatically. The pump mimics the human pancreas. The insulin is provided by a tube (catheter), which is attached to a thin cannula, which is inserted into the layer of fat beneath your skin, usually in the area around your stomach, by the pump, which is approximately the size of a smartphone or deck of cards and worn on the exterior of your body. The pump can be carried in a pump case around your waist, strapped to a belt or bra, tucked into a pocket, or worn on an armband. You can have your insulin pump look stylish with specially manufactured attachments. The insulin infusion pump works as an alternative to the traditional system of daily injections or an insulin pen. An autoimmune reaction in which the body's immune system attacks the insulin-producing beta cells in the pancreas is the primary cause of type-1 diabetes. To maintain appropriate glucose levels, patients with type-1 diabetes need daily insulin injections, usually up to four times a day. Chronic glucose levels may lead to complications such as retinopathy and nephropathy.

Insulin pump therapy is a treatment in which insulin is continuously administered using a portable pump. The insulin is delivered into the patient's body through a subcutaneously inserted cannula. Because the insulin dosage can be adjusted accurately depending on day-to-day activities such as exercise and meal choice, it is expected to improve glucose management and help prevent complications.

An insulin pump has been demonstrated in studies to enhance diabetes management and reduce the risk of hypoglycemia. When using an insulin pump, many patients find that they have more freedom in timing their meals and activities. Sharing insulin pump data with the care team between office visits allows patients to get the most out of the time they spend with them during their sessions. Uploading pump data helps the care team track patterns and, if necessary, make changes to your care plan. Insulin pumps use short-acting and rapid-acting insulin but are not long-acting since the pump is programmed to deliver a small amount continuously to keep your blood sugar levels even. Most insurance companies cover insulin pumps.

Australia and China are Expected to Dominate the Asia-Pacific Insulin Infusion Pump Market.

Among the Asia-Pacific countries, Australia and China dominate around 56% of the total Asia-Pacific insulin infusion pump market. This is mainly due to the high prevalence of diabetes in these countries. China records the highest healthcare expenditure in the Asia-Pacific region. According to the National Bureau of Statistics of China, MOH (China), in 2020, China's expenditure on health was Yuan 7,217.5 billion. Expenditure includes government, collective, and private out-of-pocket spending on health care. In 2020, health expenditures in China were equal to about 7.1 percent of the GDP, up from 6.67 percent in the previous year. In China, health insurance is optional, but over the past ten years, a larger percentage of the population has access to basic health insurance.

In 2021, according to Diabetes Australia, "the Australian health system spent USD 2.5 billion per year directly on diabetes". On top of this, diabetes is a leading cause of heart disease, which costs the health system more than USD 2 billion per year; chronic kidney disease, which costs USD 1.7 billion; and stroke, which costs USD 660 million. In Australia, neither Medicare nor the NDSS are expected to pay the entire cost of an insulin pump. Without private health insurance, insulin pumps can cost between USD 5,000 and USD 10,000 or more. Several private health insurance providers subsidize the price of an insulin pump. Insulin pump consumables such as pump sets and lines are an ongoing cost for the patient and are not usually covered by private health insurance, NDSS, or Medicare. Although the pump and its supplies (tubing, insulin cartridges, and infusion sets) remain expensive, insurance coverage has improved considerably.

Therefore, owing to the factors above, the growth of the studied market is anticipated in the Asia-Pacific region.

Asia-Pacific Insulin Infusion Pumps Industry Overview

The Asia-Pacific insulin infusion pumps market is consolidated by very few companies occupying the largest market share globally and especially in the Asia-Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Drivers

- 4.3 Restraints

- 4.4 Technology

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Tethered Insulin Pump

- 5.1.2 Tubeless Insulin Pump

- 5.2 Component

- 5.2.1 Insulin Pump Device

- 5.2.2 Insulin Pump Reservoir

- 5.2.3 Infusion Set

- 5.3 End User

- 5.3.1 Hospital/Clinics

- 5.3.2 Home/Personal

- 5.4 Geography

- 5.4.1 Japan

- 5.4.2 South Korea

- 5.4.3 China

- 5.4.4 India

- 5.4.5 Australia

- 5.4.6 Vietnam

- 5.4.7 Malaysia

- 5.4.8 Indonesia

- 5.4.9 Philippines

- 5.4.10 Thailand

- 5.4.11 Rest of Asia-Pacific

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Medtronic

- 7.1.2 Insulet

- 7.1.3 Roche

- 7.1.4 Animas

- 7.1.5 Tandem

- 7.1.6 Terumo

- 7.1.7 Ypsomed

- 7.1.8 Cellnovo

- 7.2 COMPANY SHARE ANALYSIS

- 7.2.1 Roche

- 7.2.2 Animas

- 7.2.3 Medtronic

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITES AND FUTURE TRENDS