PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851023

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851023

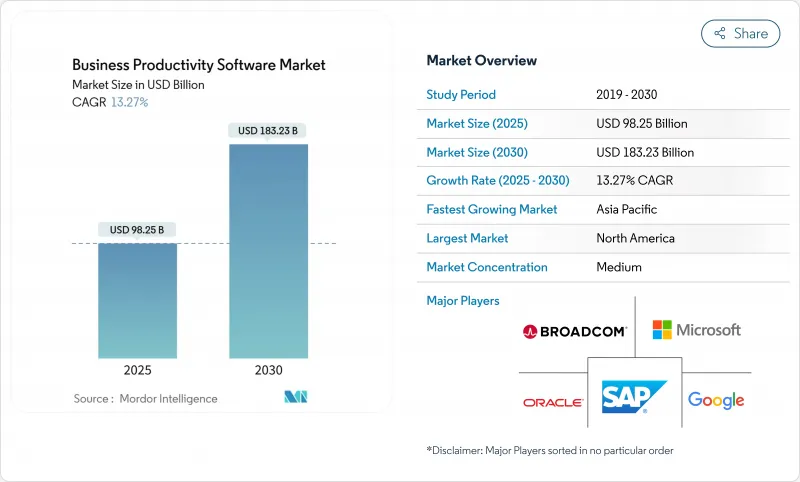

Business Productivity Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The business productivity software market stood at USD 98.25 billion in 2025 and is on track to reach USD 183.23 billion by 2030, reflecting a solid 13.3% CAGR over the forecast period.

Generative AI now sits at the core of modern productivity suites, with Microsoft recording 75% gains in individual task completion speeds after Copilot roll-outs and modelling a 112% three-year ROI for early enterprise adopters. Cloud infrastructure commitments from hyperscalers, fresh hybrid-work mandates, and stricter data-governance laws collectively accelerate platform refresh cycles. On-premise deployments still dominate revenue today because many sectors must keep sensitive workloads in-house, yet the fastest spending momentum clearly tilts toward sovereign-ready cloud regions and consumption-based pricing models. Platform vendors report a sharp rise in requests for built-in compliance automation, regional data-residency controls, and low-code toolkits that let non-technical staff streamline routine work. At the same time, collaboration traffic is exploding: Microsoft Teams has surpassed 300 million daily active users while enterprises increasingly run Teams and Slack side-by-side to satisfy diverse team preferences.

Global Business Productivity Software Market Trends and Insights

Cloud-first SaaS adoption across line-of-business apps

Enterprise buying patterns now prioritise cloud-native services, extending well beyond core IT into finance, HR, and operations teams. Microsoft Azure posted 30% year-on-year revenue growth in 2024, and Google Cloud highlighted a 20-fold jump in Vertex AI usage tied directly to Workspace deployments. Cost advantages remain compelling: organisations that replace bespoke on-premise modules with standardised SaaS suites routinely report double-digit reductions in total ownership costs and noticeably faster release cycles. Increasingly stringent data-governance statutes have not slowed momentum; instead, providers answer sovereignty demands with region-specific instances, automated audit trails, and customer-managed encryption keys. The upshot is a decisive tilt toward cloud subscription revenue even inside industries that once viewed off-prem storage as non-negotiable.

Proliferation of gen-AI copilots embedded in productivity suites

Generative AI has moved from experimental pilots to the day-to-day work fabric. Microsoft's Copilot can draft summaries, generate presentations, and ingest long e-mail threads in seconds, underpinning the 75% task-time reduction noted above. Google counters with Gemini-infused Workspace plans that wrap AI functionality into the base subscription fee, removing a cost barrier for broad roll-outs. Oracle has embedded conversational analytics inside Fusion Data Intelligence so finance users can query ledgers in plain language. As these copilots mature, buyers increasingly evaluate vendors on model transparency, governance tooling, and ease of prompt engineering rather than on core office-suite features.

Cyber-sovereignty laws restricting cross-border data residency

Governments are tightening localisation mandates that obligate foreign providers to store and process information domestically. The EU Data Act's extraterritorial reach could shave 2% off total US digital-services exports once enforcement begins. Similar frameworks in China and India require cloud operators to set up physically separate facilities and subject them to in-country audits. Productivity suites rely heavily on real-time collaboration and global AI model training, so splitting data islands drives both capital costs and operational complexity.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid-work tooling mandates in global compliance standards

- Vertical-specific low-code work platforms for frontline workers

- Rising SaaS sprawl driving consolidation fatigue and licence rationalisation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The business productivity software market size for on-premise installations commanded 68.4% of 2024 revenue, a share rooted in strict data-location policies inside finance, defence, and public administration. Yet cloud subscriptions are progressing at a 15.0% CAGR, the fastest of any deployment model, as hyperscalers add high-performance GPU clusters designed for large language model (LLM) workloads. Organisations increasingly select hybrid architectures, keeping protected datasets in private clusters while exploiting cloud AI for real-time transcription, translation, and document summarisation. Over the forecast window, CIOs expect purely on-premise estates to shrink because replicating cloud-grade silicon and managed ML tooling locally is uneconomical.

Cloud adoption's second-order benefits include faster disaster-recovery times and pooled license reuse during seasonal demand spikes. Vendors now bundle compliance dashboards, tenant-level encryption management, and zero-trust access controls, alleviating earlier objections around sovereignty. As more regulatory frameworks formally accept certified cloud regions, forward-looking procurement policies pivot to "cloud-preferred," relegating bare-metal installs to legacy edge cases.

Large enterprises generated 70.5% of the total 2024 spend thanks to expansive seat counts and multi-suite contract renewals. Nevertheless, the SME cohort demonstrates a 14.7% CAGR that outpaces every other customer tier, gradually eroding incumbents' enterprise-heavy revenue mix. The business productivity software market size for SMEs benefits directly from usage-linked billing, where teams can start with a handful of AI assists per month and expand as ROI becomes visible.

Smaller firms also adopt bleeding-edge AI faster because they carry minimal legacy baggage. A retail start-up can embed conversational search across its product catalogue within weeks, whereas a global retailer must reconcile parallel data lakes first. Vendors attuned to these differences now ship turnkey templates-inventory reconciliations, shift scheduling, expense approvals-that require almost no configuration. This "minimal-admin" ethos appeals to SMEs that often lack dedicated IT support.

The Business Productivity Software Market Report is Segmented by Deployment (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (BFSI, Telecommunications and IT, and More), Solution Type (Content Collaboration and Document Management, Communication and Unified Communications, and More), and Geography.

Geography Analysis

North America generated 36.4% of global revenue in 2024. Deep cloud-infrastructure footprints, a mature SaaS procurement culture, and record hyperscaler capex-Microsoft alone is funnelling USD 80 billion into AI datacentres through 2026-ensure the region remains the primary launchpad for new functionality. Public-sector digital-modernisation grants further widen the lead by subsidising secure collaboration for state and local agencies. Canada and Mexico contribute incremental upside as cross-border supply-chain programmes standardise on shared document-workflow platforms.

Europe maintains steady growth under a vastly different regulatory climate. GDPR and the EU Data Act together push vendors to provide granular data-portability controls and location-based routing. While compliance overhead slows some cloud migrations, it simultaneously catalyses demand for purpose-built governance modules. Continental buyers also show heightened interest in open-source underpinnings and sovereign LLMs housed in local facilities.

Asia-Pacific is the fastest-rising territory, projected at a 14.0% CAGR through 2030 as digital-public-infrastructure initiatives across India, Indonesia, and the Philippines bring millions of new small businesses online. Korean organisations spearhead mobile-first workplace adoption, embedding AI transcription inside messaging clients for on-the-move teams. Japan's advanced robotics sector uses AI-enhanced spreadsheet scripts to blend production data with ERP systems, trimming downtime. China continues to encourage domestic vendors through preferential procurement and strict data-export rules, resulting in a dual-track market where multinationals must partner with local cloud operators to gain traction.

South America registers lower absolute spend today, but has a robust runway. Brazil's government is investing in open banking and e-invoicing standards that mandate secure document exchange, indirectly spurring collaboration-suite deployments. Argentina's currency volatility increases the appetite for SaaS denominated in US dollars because capital equipment buys carry higher hedging risk. Finally, the Middle East and Africa cluster demand around Saudi Arabia and the UAE, where state-sponsored smart-city plans incorporate remote-working hubs, and around South Africa-Nigeria corridors, where mobile broadband growth encourages lightweight, bandwidth-frugal productivity apps.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- SAP SE

- Salesforce Inc.

- IBM Corporation

- Broadcom Inc. (Symantec)

- VMware Inc.

- Amazon Web Services Inc.

- Atlassian Corporation

- ServiceNow Inc.

- Adobe Inc.

- Monday.com Ltd.

- Asana Inc.

- Zoho Corporation

- Citrix Systems Inc.

- Dropbox Inc.

- Smartsheet Inc.

- Slack Technologies LLC

- AppScale Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first SaaS adoption across line-of-business apps

- 4.2.2 Proliferation of Gen-AI copilots embedded in productivity suites

- 4.2.3 Hybrid-work tooling mandates in global compliance standards

- 4.2.4 Vertical-specific low-code work platforms for frontline workers

- 4.2.5 Ecosystem shift to usage-based pricing unlocking SMB upgrade cycles

- 4.3 Market Restraints

- 4.3.1 Cyber-sovereignty laws restricting cross-border data residency

- 4.3.2 Rising SaaS sprawl driving consolidation fatigue and license rationalisation

- 4.3.3 Scarcity of integration talent delaying complex workflow roll-outs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Organisation Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises

- 5.3 By End-User Industry

- 5.3.1 BFSI

- 5.3.2 Telecommunications and IT

- 5.3.3 Manufacturing

- 5.3.4 Media, Entertainment and Publishing

- 5.3.5 Transportation and Logistics

- 5.3.6 Retail and E-commerce

- 5.3.7 Healthcare and Life Sciences

- 5.3.8 Government and Public Sector

- 5.3.9 Others (Education, Utilities)

- 5.4 By Solution Type

- 5.4.1 Content Collaboration and Document Management

- 5.4.2 Communication and Unified Communications

- 5.4.3 Project, Work and Task Management

- 5.4.4 Business Intelligence and Analytics

- 5.4.5 Low-Code / No-Code Automation

- 5.4.6 Digital Asset and Creative Tools

- 5.4.7 Security and Compliance Add-ons

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 Google LLC

- 6.4.3 Oracle Corporation

- 6.4.4 SAP SE

- 6.4.5 Salesforce Inc.

- 6.4.6 IBM Corporation

- 6.4.7 Broadcom Inc. (Symantec)

- 6.4.8 VMware Inc.

- 6.4.9 Amazon Web Services Inc.

- 6.4.10 Atlassian Corporation

- 6.4.11 ServiceNow Inc.

- 6.4.12 Adobe Inc.

- 6.4.13 Monday.com Ltd.

- 6.4.14 Asana Inc.

- 6.4.15 Zoho Corporation

- 6.4.16 Citrix Systems Inc.

- 6.4.17 Dropbox Inc.

- 6.4.18 Smartsheet Inc.

- 6.4.19 Slack Technologies LLC

- 6.4.20 AppScale Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment