PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438378

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438378

Chocolate Milk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

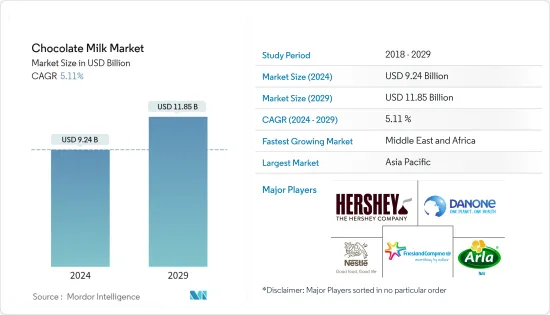

The Chocolate Milk Market size is estimated at USD 9.24 billion in 2024, and is expected to reach USD 11.85 billion by 2029, growing at a CAGR of 5.11% during the forecast period (2024-2029).

The increasing consumer disposable income, rising demand for flavored dairy products, and easy access to retail outlets are a few drivers aiding the market growth. Various attractive packing options and innovative and functional products with added essential nutrients launched by different players worldwide are major factors supporting the market's growth. Additionally, chocolate milk has been a quick meal option for many in urban areas as the working population with less time to cook worldwide is increasing.

Furthermore, the chocolate flavor is one of the most loved flavors globally, also boosting product sales. According to BCZ (Belgian Dairy Industry Confederation), in 2021, on average, roughly 3.4 liters of chocolate milk were consumed per capita, an increase from 3.21 liters in 2018 in Belgium.

Moreover, the rise of the non-dairy chocolate milk industry is being driven by rising vegan trends and consumer desire for plant-based milk products, which provide an authentic dairy feel. Lactose-intolerant people can enjoy non-dairy chocolate milk products, which are also frequently thought to have fewer calories. An increase in the vegan population coupled with its taste drives the sales of nondairy chocolate milk products like vegan milk. Chocolate milk made from a non-dairy basis is reduced in sugar and fortified with protein, vitamins, and minerals. It is a delectable and wholesome substitute for cow's milk. It is low in saturated fat and cholesterol and abundant in protein and vitamin C.

Furthermore, The growth of supermarkets/hypermarkets across most of the Tire 1 and Tire 2 cities worldwide is also aiding the Chocolate Milk Market to penetrate deeper, thus increasing the market size.

Chocolate Milk Market Trends

Increasing Demand for "Better-For-You", "Organic", and "Free-From" Products

Post-pandemic people became more health conscious. They are avoiding products containing chemicals and artificial ingredients. This rise in health consciousness among consumers and the resulting increase in awareness about the disadvantages of consuming artificial ingredients is fueling the sales of organic chocolate milk and sugar-free chocolate milk in the global market. For instance, according to USDA, the total sales of organic fluid milk products in the United States increased by 2.0%from 2021 and stood at USD 2,385 million in 2022. This increased demand and sales support the growth of the organic chocolate milk market in the forecast period.

Along with this, a shift in the food consumption pattern of consumers and increasing demand for chocolate drinks is supporting the growth of organic chocolate drinks across the globe. The trend of these organic chocolate milk is creating lucrative opportunities for the chocolate milk manufacturers to tap the potential markets and opening the doors for new entrants to enter the market with new and innovative organic, flavored chocolates drinks and enhance the revenue of the companies by gaining an advantage over the others. For instance, in March 2021, Maple Hill, one of America's original 100% grass-fed organic dairy brands launched the nation's first Reduced Sugar Grass-Fed Organic Chocolate Milk. Moreover, the product has 25 percent less sugar than leading chocolate milk brands and has 8 grams of protein. It is made with 100% grass-fed organic milk, which is produced using regenerative agriculture along with Fair Trade Cocoa.

Furthermore, the rising demand for vegan and sugar-free chocolate milk is also supporting the chocolate milk market growth. The increase in veganism and people's interest in consuming vegan products with natural ingredients is pushing the leading players in the market to launch vegan-based chocolate milk products. For instance, in October 2021, a2 Milk Co. and Hershey Co. partnered and launched natural chocolate milk containing A2 protein rather than the combination of A1 and A2 proteins contained in most dairy products. Therefore, the demand for better for you and vegan-based chocolate milk is driving the growth of the market during the forecast period.

Asia-Pacific Leading The Global Chocolate Milk Market

Asia Pacific is the leading region for the chocolate milk market. The consumer demand for convenient, natural, nutritious, and healthy on-the-go snack options is the primary attribute for the sales of chocolate milk across Asia-Pacific. The changing lifestyle of consumers, their inclination toward a healthy lifestyle, and the growing desire for chocolate flavor and high nutritional content for children aid in the growth of the region's industry. Hence, chocolate milk, the healthier and more nutritional option, is witnessing increasing demand.

Along with this, dairy-based beverages are naturally high in calcium content, and thus, they are perceived as a nutritional beverage option. Also, the health benefits of probiotic drinks, especially their ability to improve digestion and the immune system, attract consumers across all age groups mainly in China and India. A shift in the food consumption pattern of consumers and increasing demand for chocolate drinks are supporting the growth of organic chocolate drinks across Asia-Pacific.

Moreover, India is the largest milk producer, so it is attracting chocolate milk businesses to set up manufacturing facilities and launch different products to expand their businesses. For instance, in 2021, Parle Agro a well-known player in the Indian beverage industry launched a new flavored milk product under SMOODH brand that is available in chocolate milk and toffee caramel flavors. Through this launch, the company expanded its business into the dairy sector. Therefore, the increased health benefits coupled with new product launches from the major players in the region's market are increasing the demand for chocolate milk products in the region.

Chocolate Milk Industry Overview

The chocolate Milk Market is fragmented, comprising regional/local players and international competitors. Players like Arla Foods, Danone, and Nestle SA dominate the market. The leading players in the chocolate milk market enjoy a dominant presence globally. Other key players, such as the Hershey Company, Saputo Inc., and Muller, are promoting products on social media platforms and online distribution channels to increase online marketing sales and branding to attract more customers. Thus, they collaborate with the entertainment and sports industries to inculcate healthy milk-drinking habits, especially among children. Similarly, major players, such as Mars, extensively focus on providing consumers with innovative and exotic flavors while including functional benefits in each product. Moreover, these companies adopted innovation and expansion as key strategies to increase their geographical presence and customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dairy Based Chocolate Milk

- 5.1.2 Non-Dairy Based Chocolate Milk

- 5.2 Distribution Channel

- 5.2.1 Supermarket/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle S.A.

- 6.3.2 Arla Foods amba

- 6.3.3 Dairy Farmers of America Inc.

- 6.3.4 Saputo Inc.

- 6.3.5 Royal FrieslandCampina N.V.

- 6.3.6 Maryland & Virginia Milk Producers Cooperative Association, Inc.

- 6.3.7 Inner Mongolia Yili Industrial Group Co. Ltd

- 6.3.8 Danone S.A.

- 6.3.9 The Hershey Company

- 6.3.10 The Coca-Cola Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS