PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403979

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403979

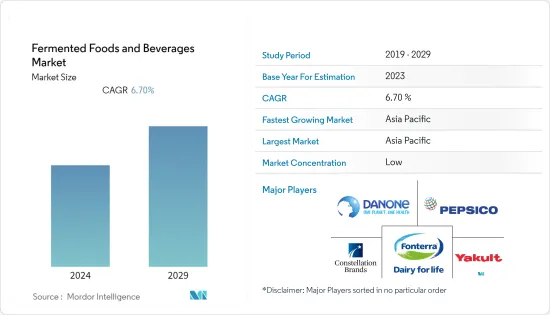

Fermented Foods and Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The fermented foods and beverages market size is expected to grow from USD 1.83 trillion in the current year and is projected to register a CAGR of 6.70% over the next five years.

Key Highlights

- In the process of fermentation, several chemical changes occur in the components of the raw matrix, which thus results in products with improved nutritional properties and health effects. A higher bioactive molecule content and enhanced antioxidant activity were found in fermented milk, cereals, fruit and vegetables, meat, and fish. Due to this, market players have been incorporating fermented fruits and vegetables into their products. The increased health consciousness among consumers has led to a demand for functional beverages. The rising trend of veganism and the inclination of people towards plant-based diets is anticipated to boost market demand for fermented foods.

- The increasing prevalence of health problems among the growing population is expected to drive the demand for fermented foods. Moreover, the rising innovations and launches of newly enhanced products by emerging and key market players will drive the market in the forecasted period. Additionally, an increase in retail and e-commerce sales is also driving the market. Consumers have a variety of products available on e-commerce sites.

- Convenience and the availability of multiple products are also driving the market to grow. For instance, in February 2022, Remedy, a United Kingdom kombucha brand, announced the addition of a new flavor to its lineup. Remedy Kombucha Wild Berry will be available exclusively at Tesco in a multipack (4 x 330 ml) format initially (RRP: GBP 5). Remedy Kombucha Mango Passion will also be introduced by the retail giant.

Fermented Foods and Beverages Market Trends

Rising Awareness About the Health Benefits of Fermented Food and Beverages

- High prevalences of digestive disorders, obesity, diabetes, and many more diseases are the main concerns of consumers these days. Due to this, they have become more conscious of their food habits and preferences. Demand for probiotic foods and drinks among the young population is growing due to their easy availability and health benefits. Dairy-based fermented foods hold the major share in the segment, followed by plant-based foods.

- Additionally, free-from and vegan products are in demand due to allergies and health aspects. In August 2021, Pillars Yogurt LLC launched a new organic coconut probiotic yogurt. The yogurt is made with less sugar, more protein, functional fats, and a blend of pre-and probiotics, which help support gut health.

- Market participants have been launching more such products in response to consumer demand. Furthermore, fermented food products like sauerkraut, kombucha, kefir, and many more are also gaining popularity among consumers owing to their anti-inflammatory, anti-oxidant, anti-diabetic, and anti-fungal properties. Many businesses use fermentation to extend the shelf life of their products and give them a distinct flavor.

- In August 2022, Yeo Valley Organic launched the Kefir drinks range. The kefir is available in three different flavors, i.e., natural, cherry, mango, and passion fruit.

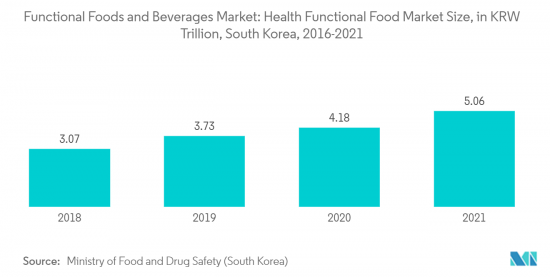

Asia-Pacific Holds a Prominent Market Share

- Increasing awareness among consumers about healthy diet habits and their demand for natural ingredients in food is driving the fermented food and beverage market in Asia-Pacific. New product developments, availability of products, advertising, and promotions are driving the market to grow. The rising awareness of fermented drinks in China and India is expected to boost the market in the region.

- The rising urbanization and the increasing purchasing power of consumers have evolved eating habits, which have fueled the demand for processed foods and beverages and increased the utilization of fermented ingredients for their production.

- In the Asia-Pacific region, the demand for fermented products is growing owing to their nutritional benefits, like providing gut health and mental health. Additionally, products such as tofu and tempeh and other fermented food products are extensively consumed across Southeast Asian countries such as Vietnam, Indonesia, and others. Moreover, the market players have been innovating new products to cater to consumer demand. For instance, in April 2022, China Dairy Giant Yili launched a solid beverage formulated with probiotics and GABA as the key ingredients in China.

Fermented Foods and Beverages Industry Overview

The fermented foods and beverages market witnessed dominance from Nestle S.A., Danone S.A., and Yakult H.S. Other prominent players include Fonterra Co-operative Group (Nurture), PepsiCo Inc. (Kevita), Chobani Inc., and BioGaia, among others. The alcoholic beverage segment in the fermented foods and beverages market is dominated by major players, such as AB InBev, Heineken, Constellation Brands, and many others.

The leading companies focus on launching innovative, low-calorie, and natural ingredient-based products that taste good. Huge investments have been made in R&D to develop products for specific needs. The increasing prevalence of health problems among the growing population is expected to drive the demand for fermented foods. Moreover, the increasing innovations and launches of newly enhanced products by emerging and key market players will drive the market in the forecasted period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Inclination Towards Health-based Food Products

- 4.1.2 Increasing Vegan Food Consumption

- 4.2 Market Restraints

- 4.2.1 The Risk of Contamination of Food is High

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fermented Food

- 5.1.1.1 Yogurt

- 5.1.1.2 Tofu

- 5.1.1.3 Tempeh

- 5.1.1.4 Sauerkraut / Fermented Veggies and Pickles

- 5.1.1.5 Cheese

- 5.1.1.6 Other Fermented Food

- 5.1.2 Fermented Beverages

- 5.1.2.1 Yogurt Drink/Smoothies

- 5.1.2.2 Kombucha

- 5.1.2.3 Kefir

- 5.1.2.4 Other Fermented Beverages

- 5.1.1 Fermented Food

- 5.2 Distribution Channel

- 5.2.1 Supermarket/Hypermarket

- 5.2.2 Convenience Store

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategies Adopted

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Fonterra Co-operative Group Limited

- 6.3.2 Constellation Brands, Inc.

- 6.3.3 Danone S.A.

- 6.3.4 PepsiCo, Inc.

- 6.3.5 Anheuser-Busch InBev SA/NV

- 6.3.6 Yakult Honsha Co. Ltd

- 6.3.7 Nestle S.A.

- 6.3.8 Heineken N.V.

- 6.3.9 The Boston Beer Company

- 6.3.10 BioGaia

- 6.3.11 Lactalis Group

- 6.3.12 Chobani Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS