PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851032

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851032

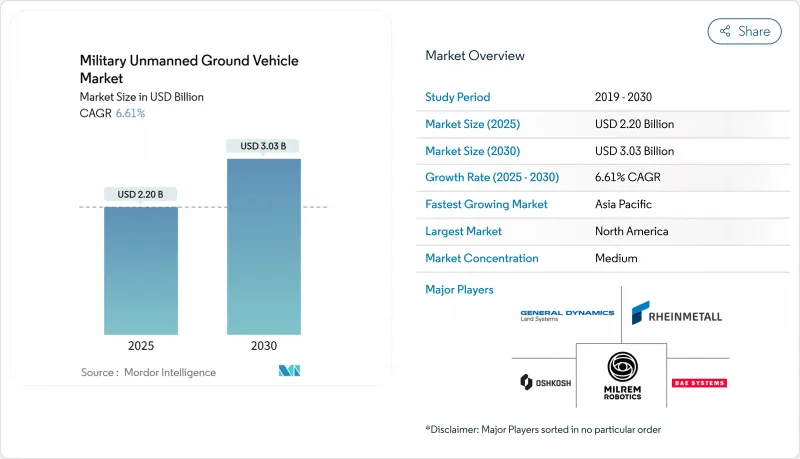

Military Unmanned Ground Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The military unmanned ground vehicle market size is estimated at USD 2.20 billion in 2025, and is expected to reach USD 3.03 billion by 2030, expanding at a 6.61% CAGR.

Expansion is tied to steadily rising defense budgets across NATO and Indo-Pacific nations, the growing imperative to protect soldiers by delegating high-risk tasks to robots, and rapid advances in artificial intelligence that make autonomous navigation feasible in GPS-denied settings.At the same time, the pace of adoption remains disciplined rather than explosive because militaries prioritize proven reliability, cyber-secure command links, and stable logistics over headline-grabbing novelty. Combat missions continue to dominate demand, yet logistics and disaster-response roles are emerging rapidly as armies recognize the strategic value of unmanned sustainment and dual-use deployments. Competitive intensity is moderate because prime contractors leverage existing vehicle families, while specialist robotics firms carve niches through legged or hybrid mobility concepts.

Global Military Unmanned Ground Vehicle Market Trends and Insights

Expanding defence budgets among NATO and Indo-Pacific nations

Allied spending increases have sent clear demand signals to industry. Japan set aside JPY 103.2 billion (USD 714 million) for unmanned asset defence capabilities in FY 2025, while the US allocated USD 10.1 billion for uncrewed systems in the same fiscal cycle. Europe boosted military outlays by 17% in 2024, funneling part of the European Defence Fund into autonomous ground platforms. These multi-year budget uplifts underpin long-term production planning, allowing the military unmanned ground vehicles market to scale without disruptive boom-and-bust cycles.

Soldier-safety focus driving autonomous combat and logistics platforms

Modern doctrine places unmanned systems on the front line of contact. Ukraine's field use of Milrem Robotics THeMIS for casualty evacuation validated the concept of removing troops from danger zones. The US Army's Autonomous Transport Vehicle System seeks a 50% uplift in sustainment throughput by offloading routine resupply to robots. This safety imperative fuels procurement across weight classes, particularly for logistics and explosive-ordnance roles.

Cyber/jamming vulnerability of C2 links

Near-peer adversaries field powerful electronic-warfare suites that can jam or spoof control channels, exposing unmanned vehicles to hijack or mission failure. The US Air Force now mandates Zero Trust principles for any system managing autonomous platforms, adding encryption and continuous authentication layers that raise cost and design complexity. Vendors must therefore invest heavily in redundant communications and onboard autonomy to mitigate link interruptions.

Other drivers and restraints analyzed in the detailed report include:

- AI-enabled sensor-fusion and autonomous navigation breakthroughs

- Manned-unmanned teaming doctrine in multi-domain operations

- High acquisition and life-cycle cost vs manned vehicles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Combat platforms represented 54.65% of the military unmanned ground vehicles market in 2024, reflecting the imperative to project lethality while shielding soldiers. The US Army's Robotic Combat Vehicle prototypes from General Dynamics and Textron are scheduled for formation-level trials by 2028. Logistics UGVs recorded the fastest 7.87% CAGR outlook as commanders target automated resupply to reduce convoy exposure.

Persistent intelligence, surveillance, and reconnaissance missions exploit UGV endurance and low acoustic signatures, whereas explosive-ordnance disposal remains a mature procurement line under the Common Robotic System series. Engineering and route-clearance vehicles remove mines and obstacles, and training or decoy units support force preparation. The widening mission set underpins the continuous expansion of the military unmanned ground vehicles market.

Tele-operated units held 65.12% of 2024 revenue because the DoD Directive 3000.09 still requires human judgment for lethal decisions. Even so, semi-autonomous navigation that asks operators only for critical approvals is proliferating. Fully autonomous vehicles are projected to rise at a 10.24% CAGR, the fastest within the military unmanned ground vehicles market, as sensor-fusion breakthroughs reduce the need for uninterrupted data links.

Hybrid control modes allow crews to toggle between manual and autonomous behavior when jamming or terrain dictates. The US Army xTechOverwatch competition incentivizes small firms to deliver AI modules that natively support such flexible concepts of operation.

The Military Unmanned Ground Vehicle Market Report is Segmented by Application (Combat, Explosive Disposal (EOD), Logistics and Resupply, and More), Mobility (Wheeled, Tracked, and More), Mode of Operation (Tele-Operated and Autonomous), Weight Class (Micro, Small, and More) and Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.14% share of the military unmanned ground vehicles market in 2024, underpinned by USD 10.1 billion in DoD funding for uncrewed systems and by multi-service experimentation that spans micro to heavy classes. Canada's Arctic logistics trials add niche requirements for extreme-cold platforms.

Asia-Pacific is projected to register the highest 7.32% CAGR, driven by Japan's JPY 103.2 billion (~USD 0.72 billion) unmanned assets line item and India's INDUS-X initiative, emphasizing joint AI research for autonomous systems. China accelerates development under Military-Civil Fusion, while South Korea's multipurpose ground robots and Australia's optionally crewed vehicles aim to secure supply chains amid Indo-Pacific tensions.

Europe amplified spending by 17% to USD 693 billion in 2024, and the European Defence Fund channels grants into autonomous platforms to strengthen NATO deterrence. Germany's order for 41 advanced EOD UGVs from AeroVironment illustrated immediate operational demand. The Middle East pursues indigenous programs through UAE-based EDGE and Saudi Vision 2030, while Africa explores border-security robots, together contributing a modest but stable opportunity pool.

- General Dynamics Land Systems (General Dynamics Corporation)

- Rheinmetall AG

- KNDS N.V.

- Oshkosh Defense, LLC

- L3Harris Technologies, Inc.

- ASELSAN A.S.

- QinetiQ Group

- Milrem Robotics (Milrem AS)

- Robo-Team Ltd.

- Teledyne Technologies Incorporated

- Israel Aerospace Industries Ltd.

- BAE Systems plc

- Textron Systems Corporation (Textron, Inc.)

- HDT Global

- Elbit Systems Ltd.

- Kongsberg Defence & Aerospace (Kongsberg Gruppen ASA)

- Hanwha Aerospace (Hanwha Corporation)

- Singapore Technologies Engineering Ltd.

- FNSS Savunma Sistemleri A.S.

- Hyundai Rotem Company

- Iveco Defence Vehicles (Iveco Group N.V.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding defense budgets among NATO and Indo-Pacific nations

- 4.2.2 Soldier-safety focus driving autonomous combat/logistics platforms

- 4.2.3 AI-enabled sensor-fusion and autonomous navigation breakthroughs

- 4.2.4 Manned-unmanned teaming doctrine in multi-domain operations

- 4.2.5 EW-resilient ground relay nodes demand

- 4.2.6 Climate-disaster engineering missions creating dual-use demand

- 4.3 Market Restraints

- 4.3.1 Cyber/jamming vulnerability of C2 links

- 4.3.2 High acquisition and life-cycle cost vs manned vehicles

- 4.3.3 Arms-control ambiguity over lethal autonomy

- 4.3.4 Lack of cross-allied interoperability standards

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Combat

- 5.1.2 Intelligence, Surveillance, and Reconnaissance (ISR)

- 5.1.3 Explosive Ordnance Disposal (EOD)

- 5.1.4 Logistics and Resupply

- 5.1.5 Engineering and Route Clearance

- 5.1.6 Training and Decoy

- 5.2 By Mobility Platform

- 5.2.1 Wheeled

- 5.2.2 Tracked

- 5.2.3 Legged

- 5.2.4 Hybrid

- 5.3 By Mode of Operation

- 5.3.1 Tele-operated

- 5.3.2 Autonomous

- 5.3.2.1 Semi-Autonomous

- 5.3.2.2 Fully Autonomous

- 5.4 By Weight Class

- 5.4.1 Micro (Less than 25 kg)

- 5.4.2 Small (25 to 200 kg)

- 5.4.3 Medium (200 to 1,000 kg)

- 5.4.4 Heavy (More than 1,000 kg)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 Israel

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 General Dynamics Land Systems (General Dynamics Corporation)

- 6.4.2 Rheinmetall AG

- 6.4.3 KNDS N.V.

- 6.4.4 Oshkosh Defense, LLC

- 6.4.5 L3Harris Technologies, Inc.

- 6.4.6 ASELSAN A.S.

- 6.4.7 QinetiQ Group

- 6.4.8 Milrem Robotics (Milrem AS)

- 6.4.9 Robo-Team Ltd.

- 6.4.10 Teledyne Technologies Incorporated

- 6.4.11 Israel Aerospace Industries Ltd.

- 6.4.12 BAE Systems plc

- 6.4.13 Textron Systems Corporation (Textron, Inc.)

- 6.4.14 HDT Global

- 6.4.15 Elbit Systems Ltd.

- 6.4.16 Kongsberg Defence & Aerospace (Kongsberg Gruppen ASA)

- 6.4.17 Hanwha Aerospace (Hanwha Corporation)

- 6.4.18 Singapore Technologies Engineering Ltd.

- 6.4.19 FNSS Savunma Sistemleri A.S.

- 6.4.20 Hyundai Rotem Company

- 6.4.21 Iveco Defence Vehicles (Iveco Group N.V.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment