PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404503

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404503

Naval Ship Propeller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

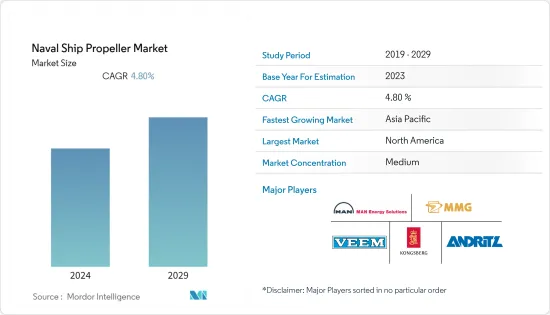

The naval ship propeller market is estimated at USD 4.89 billion in 2024 and is expected to reach USD 6.18 billion by 2029, registering a CAGR of 4.8% during the forecast period (2024-2029).

An increasing demand for electric propulsion technology in the shipbuilding industry is anticipated to drive the naval ship propeller market. This propulsion in electric propulsion technology method eliminates the need for clutches and gearing devices. This technology provides several advantages over the traditional system. Because of the flexible arrangement of mechanical components, it provides high redundancy, enhanced mobility, and increased payload, as well as fewer emissions and fuel consumption.

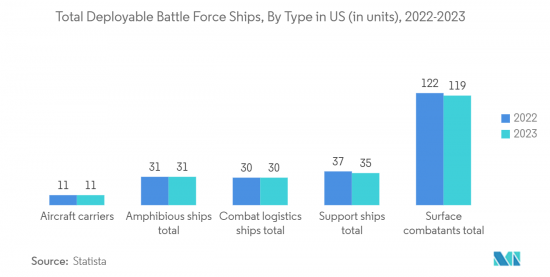

Procurements of naval ships are increasing every year due to various maritime issues that the military is facing. It may drive the market for naval ship propellers in the years to come. Growing maritime trade and security concerns also bolster the market. Additionally, rising naval modernization programs worldwide create opportunities for propeller manufacturers.

However, the market faces challenges such as fluctuating raw material prices, which impact production costs. The market is majorly dependent on defense budgets and geopolitical tensions.

Naval Ship Propeller Market Trends

The Fixed Pitch Propellers Segment Holds Highest Shares in the Market

The fixed-pitch propellers segment holds the highest market share in the market. Fixed pitch propellers are robust and reliable, as the system does not incorporate any mechanical and hydraulic subsystems as in the controlled pitch propellers. Moreover, the manufacturing, installation, and operational costs are lower than the other types of propellers. Thus, they are now widely used in naval ships. The fixed-pitch propellers are well suited for smaller vessels and applications where accessibility is crucial. Furthermore, their consistent performance in various environmental conditions and operational requirements further strengthens their position in the market. For instance, in April 2021, Rolls-Royce reached an agreement with Fincantieri Marinette Marine to design and manufacture up to 40 fixed-pitch propellers for the US Navy's Constellation-class (FFG-62) guided missile frigate program.

Asia-Pacific Region Will Showcase Remarkable Growth During the Forecast Period

Asia-Pacific is expected to register the highest CAGR during the forecast period. Procurements of naval ships in the region are driven by the high military expenditure by the emerging economies in the Asia-Pacific region, such as India and China. Additionally, the disputes in the Arabian Sea, Indian Ocean, and the South China Sea are propelling the navies to further strengthen their sea-based capabilities.

The region's growing shipbuilding industry and geopolitical tensions may further boost the demand for naval vessels, driving the adoption of advanced propulsion systems, including propellers. All these factors are helping the procurement of naval ships, thereby supporting the growth of the naval ship propeller market. For instance, in August 2022, BAE Systems Australia granted a USD 1.76 million contract to VEEM Ltd to construct two prototype propeller blades and a propeller hub for Australia's Hunter class frigates under the supervision of OEM Kongsberg Maritime. It is the final test of VEEM's capacity to manufacture to the Hunter's strict criteria. It represents a critical milestone for VEEM Ltd as it strives to become a defence-qualified warship propeller maker for the Hunter program.

Naval Ship Propeller Industry Overview

The naval ship propeller market is moderately consolidated in nature, with a presence of few players holding significant shares in the market. Kongsberg Gruppen AS, VEEM Ltd, MAN Energy Solutions SE, Mecklenburger Metallguss GmbH, and ANDRITZ AG are some of the prominent players in the market. Acquisitions of local players and companies in the supply chain help the players further strengthen their presence in the market. As the contracts to be gained are for naval ships, many norms and regulatory requirements should be met. Moreover, for new players, the investment costs are expected to be high, as the size and complexity of the propellers for naval ships are far higher compared to those for smaller boats. Investments in R&D, in terms of materials and designs, may help the players in the years to come.

For instance, in March 2023, Kongsberg Maritime and Hyundai Heavy Industries partnered to supply controllable pitch propellers for the Philippine Navy's future offshore patrol vessels. Under the terms of the agreement, Kongsberg will supply a propellor set for each of Hyundai's six new vessels. Each propellor set comes with two Kamewa 86 A/5 D-B waterjet propulsions, as well as operational panels, shat lines, hydraulic power units, and other accessories. Similarly, in January 2021, Naval Group, a defense contractor, created a fully 3D-printed propeller for a French Navy ship. The propeller, which contains a 2.5 m span and five individual 200 kg blades, is reputedly the largest of its kind to be 3D printed and the first to be created using Naval Group's method.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Propeller Type

- 5.1.1 Fixed-Pitch Propeller

- 5.1.2 Controllable-Pitch Propeller

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Russia

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Australia

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Mexico

- 5.2.4.2 Brazil

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Turkey

- 5.2.5.4 Egypt

- 5.2.5.5 South Africa

- 5.2.5.6 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Kongsberg Gruppen ASA

- 6.2.2 MAN Energy Solutions SE

- 6.2.3 VEEM Ltd

- 6.2.4 ANDRITZ AG

- 6.2.5 Mecklenburger Metallguss GmbH

- 6.2.6 Bruntons Propellers Ltd

- 6.2.7 SCHOTTEL GmbH

- 6.2.8 Michigan Wheel

- 6.2.9 AB Volvo

- 6.2.10 Caterpillar Inc.

- 6.2.11 Wartsila Corporation

- 6.2.12 HD Hyundai Heavy Industries Co., Ltd.

- 6.2.13 ABB Ltd

- 6.2.14 Kawasaki Heavy Industries, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS