PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433800

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433800

Rubella Diagnostic Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

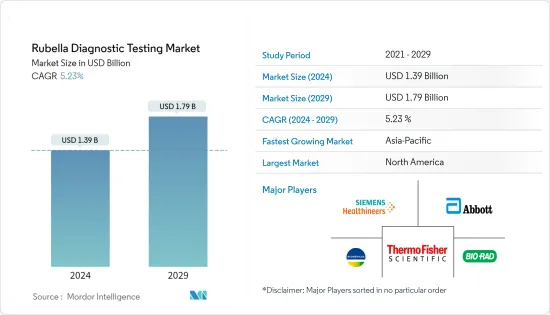

The Rubella Diagnostic Testing Market size is estimated at USD 1.39 billion in 2024, and is expected to reach USD 1.79 billion by 2029, growing at a CAGR of 5.23% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the global rubella diagnostic testing market. For instance, an article published in the International Journal of Molecular Epidemiology and Genetics in June 2021 reported that increasing COVID-19 cases kept aside the other diagnostic tests, and thus the rubella diagnostic market witnessed significant challenges during the initial phase of the pandemic. However, in the current scenario, with the decreasing number of COVID-19 cases and the resumption of diagnostic services, the market is expected to witness significant growth over the forecast period.

The factors that are driving the growth of the studied market are government initiatives to curb the rubella virus, increasing incidences of rubella, and the introduction of advanced point-of-care diagnostic technologies. The increasing government initiatives are creating awareness among individuals about the need for rapid rubella diagnostics, thereby driving the market. For instance, in July 2022, the Pradhan Mantri Surakshit Matritva Abhiyan will be launched by the Ministry of Health & Family Welfare (MoHFW), Government of India, with the aim of improving the quality and coverage of antenatal care (ANC), including diagnostics and counseling services, as part of the Reproductive Maternal Neonatal Child and Adolescent Health (RMNCH+A) strategy. It aims to provide assured, comprehensive, and free-of-cost quality antenatal care to all pregnant women on the 9th of every month in their 2nd-3rd trimesters of pregnancy at designated government health facilities. The program covers proper diagnostic testing, including those for rubella, and thus provides better diagnostic services, and such initiatives are driving the growth of the studied market.

The increasing incidence of rubella is also fueling the need for better diagnostics, thereby driving the growth of the studied market. For instance, in March 2022, the World Health Organization (WHO) reported that rubella is a leading vaccine-preventable cause of birth defects. Similarly, an article published in the Rubella Journal of Virology in April 2022 reported that rubella is an acute illness caused by the rubella virus and characterized by fever and rash, with approximately 100,000 congenital rubella syndrome cases occurring per year and being reported globally.

The increasing cases of rubella are increasing the demand for rubella diagnostics and thus driving the growth of the studied market. For instance, an article published by the Multidisciplinary Digital Publishing Institute in October 2022 reported that among the 8082 laboratory-tested specimens from measles and rubella-suspected cases collected at the Department of Virology in Senegal in the year 2021, the serological evidence of rubella infection was 465/6714 (6.9%). Thus, high cases of rubella are increasing the demand for rubella diagnostics and thus fueling the growth of the studied market.

Also, the introduction of point-of-care diagnostics for rubella diagnosis is driving the growth of the studied market. For instance, in an article published in the book Advanced Materials in March 2022, it was reported that recent research efforts have been made to implement fluorescent biosensors into the exploding field of point-of-care testing (POCT), which uses cost-effective strategies for rapid and affordable diagnostic testing for various diseases, including rubella. Thus, the introduction of point-of-care diagnostics is driving the growth of the studied market.

Thus, due to government initiatives to curb the rubella virus, increasing incidences of rubella, and the introduction of advanced point-of-care diagnostic technologies, the market is expected to witness significant growth over the forecast period. However, a lack of awareness among developing regions may slow growth over the course of the study.

Rubella Diagnostic Testing Market Trends

Enzyme Immunoassay Segment is Expected to Witness a Significant Growth Over the Forecast Period.

Enzyme immunoassay (EIA) reagents and devices are used to detect the presence or concentration of an antigen with its application to epidemiological disease detection. It includes different types of enzymes such as alkaline phosphatases and glucose oxidase. The rubella virus can persist in the bloodstream for years before being killed by antibodies produced by the immune system. The most often used method when using commercial enzyme immunoassay (EIA) kits is IgM testing. Since a significant increase in antibody levels was found in all matched specimens tested from patients with acute rubella infection, the enzyme immunoassay (EIA) is also useful for identifying acute infections. The rising prevalence of infectious diseases such as rubella is the major reason attributable to the growth of the enzyme immunoassay (EIA) segment.

The feasibility and accuracy of the test are also driving the growth of this segment. For instance, an article titled, published by mSphere, in July 2021, reported that measles and rubella are two of the most globally important vaccine-preventable diseases (VPD), and measuring antibodies to measles and rubella viruses in samples collected from serosurveys can play an important role in estimating population immunity and guiding immunization activities and enzyme immunoassay is the most convenient method and easy approach for detecting the rubella virus.

Similarly, another article published by JOMO Kenyatta University of Agriculture and Technology in June 2021, reported that the use of oral fluid specimens is the best alternative for measles/rubella diagnosis since it is simple to collect, non-invasive, and more acceptable than serum. This alternative method can be applied in a varied clinical setup and is more applicable to disease surveillance programs. The merit of oral fluids as a specimen for diagnosis of rubella virus by antibody detection.

Thus, due to the efficacy of ELISA techniques the segment is expected to witness significant growth over the forecast period.

North America is Expected to Witness a Significant Growth Over the Forecast Period.

The North American region is expected to witness significant growth over the forecast period owing to the presence of key market players, significant government strategies, and also due to technological advancements involving the proper and timely diagnosis of this disease.

Moreover, significant government strategies are leading to a decline in rubella cases in the country. For instance, in January 2022, the Government of Canada reported that in Canada, no new cases of measles or rubella were reported in week 52 of the year 2021, and currently, there are no active cases of measles or rubella in Canada. Thus, the government's initiatives to eradicate rubella by providing proper diagnostics are fueling the growth of the market.

Similarly, in January 2021, the Center for Disease Control and Prevention (CDC) reported that rubella is no longer endemic in the United States. CDC also reported that a key strategy for achieving rubella elimination in the North American region is the implementation of a high-quality surveillance system. The government in the region has implemented routine immunization for children, which combined with proper diagnostic campaigns in countries with high case and death rates are key public health strategies to reduce global measles deaths.

Furthermore, the introduction of new technologies is also propelling the growth of the studied market in the region. For instance, an article published in the Journal of Virology Methods in May 2022 reported that due to the COVID-19 pandemic, vaccination services all over the world for rubella have been disrupted, which is leading to an increased immunity gap, and surveillance of RV genotypes is a critical component of monitoring progress toward rubella elimination and eradication goals. This RuV multiplex assay will enable sensitive and accurate test results to be obtained promptly. Such studies and the introduction of more such diagnostics are propelling the growth of this market in the region.

As a result of the presence of key market players, significant government strategies, and technological advances involving the proper and timely diagnosis of this disease, The region is expected to witness significant growth over the forecast period.

Rubella Diagnostic Testing Industry Overview

The rubella diagnostic testing market is fragmented and competitive in nature due to the presence of many companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold market shares and are well-known, such as Abbott Laboratories Inc., Beckman Coulter Inc., Bio Rad Laboratories Inc., Biokit SA, BioMerieux SA, F. Hoffmann-La Roche Ltd., Ortho Clinical Diagnostics, Siemens Healthcare GmbH, Thermo Fisher Scientific Inc., and ZEUS Scientific Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Initiatives to Curb Rubella Virus

- 4.2.2 Increasing Incidences of Rubella

- 4.2.3 Introduction of Advance Point-of-care Diagnostic Technologies

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness among Developing Regions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Testing Technique

- 5.1.1 Latex Agglutination

- 5.1.2 Enzyme Immunoassay (EIA)

- 5.1.3 Radioimmunoassay (RIA)

- 5.1.4 Fluorescent Immunoassay (FIA)

- 5.1.5 Other Testing Techniques

- 5.2 By Application

- 5.2.1 Hospitals

- 5.2.2 Laboratories

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories Inc.

- 6.1.2 Beckman Coulter Inc.

- 6.1.3 Bio Rad Laboratories Inc.

- 6.1.4 Biokit SA

- 6.1.5 BioMerieux SA

- 6.1.6 F. Hoffmann-La Roche Ltd

- 6.1.7 Ortho Clinical Diagnostics

- 6.1.8 Siemens Healthcare GmbH

- 6.1.9 Thermo Fisher Scientific Inc.

- 6.1.10 ZEUS Scientific Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS