PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685725

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685725

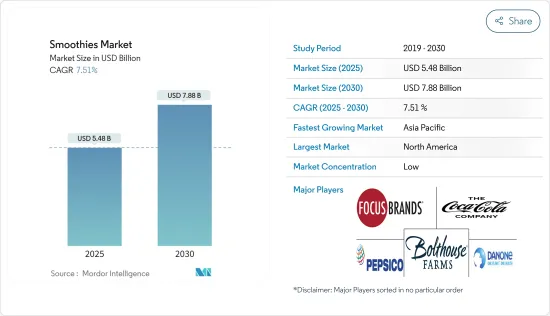

Smoothies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Smoothies Market size is estimated at USD 5.48 billion in 2025, and is expected to reach USD 7.88 billion by 2030, at a CAGR of 7.51% during the forecast period (2025-2030).

Key Highlights

- The smoothies market is expected to witness substantial growth over the forecast period due to changing food habits, varying lifestyle patterns among the general population, and consumer trends shifting toward a healthy way of living. Over the past few years, the global smoothies market has witnessed a surge in market trends, with health boosters, such as superfoods, acai, chia seeds, and protein, that transform traditional smoothie products into functional supplements. These ingredients boost the immune system of consumers and provide a wide range of health benefits. The availability of ample raw materials across various regions has also been providing lucrative opportunities for manufacturers to produce smoothies at competitive costs and attract more customers while doing so. As per data published by the Directorate of Economics and Statistics (India), the production volume of fruits in the year 2022-2023 was 108.34 million metric tons. The fruits being cultivated across the region included bananas, mangos, papayas, and a variety of apples, among others.

- Moreover, the smoothies market has been growing over the past few years owing to consumer preferences shifting due to various factors, among which health consciousness has been one of the prominent reasons. Hence, several companies are pivoting their business model and are producing packaged iterations of their popular products, while franchises have been concentrating on meal delivery partners and drive-through services. Moreover, companies offering more nutritious products are thriving due to increased awareness regarding the consumption of healthy foods. Thus, the smoothies market is expected to grow owing to the change in consumer food habits, rising health consciousness, and an increase in the number of companies offering more nutritious products.

Smoothies Market Trends

Increasing Consumption of Fruit-based Smoothies Driving the Market

- Smoothies, which include large servings of fruits, are recommended as a healthy diet. Moreover, rising health consciousness among consumers, changing lifestyle and food habits, and health benefits are driving the fruit-based smoothie market's growth. Currently, the consumption habits of the majority of the population include skipping meals and using other snack foods as substitutes. The intake of carbohydrates, primarily when smoothies are made without sugar, is low. Thus, most gym trainers recommend smoothies to people planning to lose weight. Therefore, smoothies have emerged as perfect meal replacement products. Furthermore, they are healthier than other snack products and offer good taste, convenience, and portability.

- According to a survey conducted by the International Food Information Council in 2022, the word "fresh" was selected by nearly 37% of respondents in the United States as the best description of healthy food. This definition emerged as the most popular among participants. The second most commonly chosen definition, selected by almost 32% of respondents, was "low in sugar" as a characteristic of healthy food. Furthermore, 28% of customers considered foods containing fruits to be indicative of healthy choices. These factors are also anticipated to drive the market for fruit smoothies in the near future. Additionally, with the ongoing organic trend, many juice manufacturers have started launching smoothie products that are organic and feature clean, easy-to-read labels. Increased health consciousness, obesity control, and rising customer awareness about the composition of a product are the major factors behind the rise of natural and organic fruit smoothies in the market.

North America Accounts for the Major Market Share

- Among regional segments, North America accounts for a major market share, followed by Asia-Pacific. In North America, the United States accounted for the majority share in terms of consumption of healthy ingredients, owing to consumers' busy lifestyles and deteriorating health conditions. Moreover, rising health consciousness and busy lifestyles drive the adoption of convenience food. The consumption of fresh vegetables is increasing at a rapid pace, owing to the growing awareness of their health benefits. Consequently, several smoothie brands are launching products with vegetables, such as kale, spinach, pumpkins, beets, carrots, and cabbages.

- For instance, in September 2021, Clean Energy, a clean-label, plant-based sports nutrition company, announced the launch of its on-the-go smoothie packets containing only organic fruits and vegetables as its first product. These were made available in their debut flavor combinations of banana, strawberry, blueberry, spinach, and flaxseed, with Clean Energy claiming to provide the nutrition of a homemade smoothie. Consumers in North America are using fruit-blend smoothies, which include other ingredients, such as whey powder, herbal supplements, and nutritional supplements, to fulfill their optimum nutritional requirements. Post-workout fruit powders, meal-replacement fruit powders, nutrient-rich fruit powders, and low-carb powders are being launched in the market in response to the demand for healthy smoothies.

Smoothies Industry Overview

The global smoothie market is highly fragmented, owing to large regional and domestic players operating in different countries. Companies are increasingly focusing on mergers, expansions, acquisitions, partnerships, and new product development as strategic approaches to boost their brand presence among consumers. Some top companies offering smoothies in the market include Danone SA, PepsiCo Inc., The Coca-Cola Company, Bolthouse Farms Inc., and Focus Brands LLC.

Additionally, there have been many emerging companies that are offering their products in the market studied. These players have been actively using various strategies and designing various ad campaigns to position their products and drive demand for the same in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Functional Beverages

- 4.2 Market Restraints

- 4.2.1 Availability of Alternative Health Drinks Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Fruit-based

- 5.1.2 Dairy-based

- 5.1.3 Other Product Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Smoothie Bars

- 5.2.3 Convenience Stores

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Danone SA

- 6.3.2 Focus Brands LLC

- 6.3.3 Bolthouse Farms Inc.

- 6.3.4 Barfresh Food Group Inc.

- 6.3.5 The Coca-Cola Company

- 6.3.6 The Hain Celestial Group Inc.

- 6.3.7 PepsiCo Inc.

- 6.3.8 The Kraft Heinz Company

- 6.3.9 MTY Franchising Inc.

- 6.3.10 Smoothie King Franchises Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS