PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850969

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850969

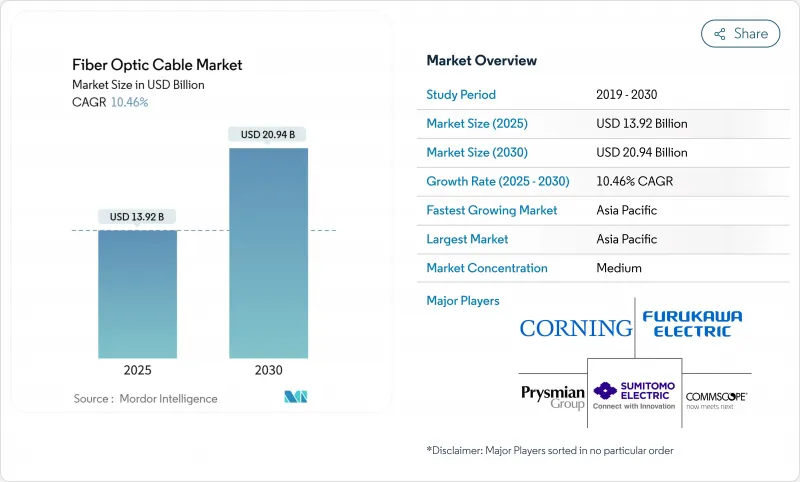

Fiber Optic Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Fiber Optic Cable Market size is estimated at USD 13.92 billion in 2025, and is expected to reach USD 20.94 billion by 2030, at a CAGR of 10.46% during the forecast period (2025-2030).

Growth accelerates as artificial-intelligence workloads demand ultra-low latency, 5G densification pushes fiber-deep architectures, and hyperscale data-center operators reserve unprecedented cable capacity to bypass legacy carriers. Government-funded digital-inclusion programs mandate future-proof infrastructure, while geopolitical tensions prompt tech giants to diversify submarine routes, therefore widening the addressable fiber optic cable market even in mature economies. On the supply side, vertical integration, regional manufacturing mandates, and investments in multi-core and hollow-core technologies reshape competitive dynamics, positioning fiber as the definitive backbone for both terrestrial and subsea connectivity. Intensifying sustainability goals further reinforce the shift from copper to low-carbon glass, signalling a durable expansion trajectory for the fiber optic cable market.

Global Fiber Optic Cable Market Trends and Insights

Increasing Penetration of High-Speed Internet and Global Data-Traffic Surge

Bandwidth demand is rising so quickly that operators now treat fiber as the only infrastructure with adequate headroom for 8K video, cloud gaming, and real-time collaboration. Global IP traffic is expanding at 22% per year, with streaming and cloud services absorbing 82% of the load, a scenario that underscores why the fiber optic cable market continues to accelerate. Researchers in Japan have demonstrated 402 Tb/s transmission across standard fiber using 1,505 wavelengths, proving that today's cable investments will sustain decades of incremental upgrades without wholesale replacement. Such breakthroughs give carriers confidence to allocate capital toward dense fiber corridors rather than incremental copper fixes. Consequently, the fiber optic cable market registers faster order cycles, longer contract horizons, and broader geographic rollout plans as both developed and emerging regions converge on gigabit-class access targets.

Accelerated 5G Roll-Outs and Fiber-Deep FTTx Deployments

Every 5G small-cell demands dedicated fiber backhaul, multiplying cable counts by three to five times relative to legacy 4G sites. AT&T's expansion to 23.8 million fiber locations, with an ambition of 60 million by 2030, illustrates how radio-access densification fuels the fiber optic cable market. Edge-cloud architectures amplify this pull by requiring low-latency links between towers and micro-data centers, thus extending fiber deeper into suburban grids. Operators report 15-25% higher 5G revenue per user when symmetrical fiber underpins the service, a financial lift that catalyzes multi-year procurement of high-density ribbon and armored cables. Competitive intensity escalates as carriers race to light new corridors, confirming fiber's role as the indispensable substrate for ultra-low-latency mobile services.

High Civil-Works Cost and Right-of-Way Complexities

Construction labor shortages and regulatory bottlenecks elevate underground installation expenses to USD 24 per foot in major cities, squeezing capital budgets and tempering rollout speeds. Right-of-way approvals can stretch 6-18 months, delaying service launches and raising interim financing costs. Skilled-technician gaps are estimated at 31,500 annually inflate wages, while environmental surveys add USD 50,000-200,000 to project totals. These frictions compel operators to prioritize high-density corridors over universal builds, thereby slowing addressable growth in cost-sensitive pockets of the fiber optic cable market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Hyperscale Data-Center Interconnect Demand

- Government-Backed Rural Broadband and Digital-Inclusion Programs

- Price Volatility in Raw Materials and Helium Supply Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Armored products represented 38.0% of the fiber optic cable market in 2024, evidencing operator preference for mechanically robust designs whenever cables traverse harsh terrain or public rights-of-way. Ribbon formats, however, are on course to outpace all others with an 11.4% CAGR, owing to mass-fusion splicing that trims field time by as much as 80%. Ribbon's gel-free variants also cut cleanup, enhancing velocity in hyperscale data-center builds. The fiber optic cable market size for ribbon architectures is projected to more than double by 2030 as labor savings outweigh higher per-meter costs.

Suppliers continue refining armored constructions with corrugated steel and water-blocking tapes, targeting submarine lead-ins and urban conduits vulnerable to excavation damage. Conversely, non-armored and breakout cables stay popular inside secured campuses where flexibility and tight bend radii matter more than crush resistance. Because installation labor can account for over half the project bill, network planners lean toward high-count ribbon or micro-duct solutions that slash splice events, further reinforcing ribbon's fast-rising share within the fiber optic cable market.

Single-mode strands held 63.2% of the fiber optic cable market share during 2024, remaining indispensable for metropolitan, long-haul, and submarine links that span hundreds of kilometers. Yet multi-mode is poised for a 13.2% CAGR through 2030, a resurgence propelled by data-center top-of-rack connections where 100-150 m reach and cost-efficient VCSEL transceivers prevail. Hollow-core prototypes promise latency reductions of 30%, attracting algorithmic trading platforms and scientific sites requiring femtosecond-level synchronization.

As cloud operators flatten their campus topologies, OM5-grade fiber coupled with 400G-SR8 transceivers delivers 800 Gbps rack-to-rack, aligning cost and performance targets. Meanwhile, single-mode innovation pivots toward ultra-low-loss and multi-core formats capable of crossing ocean basins without repeaters, expanding the premium subsea slice of the fiber optic cable market size. The modal mix, therefore, hinges on distance-bandwidth economics: single-mode continues its reign in backbone routes, while multi-mode secures a volume foothold inside hyperscale halls where reach envelopes remain modest.

The Fiber Optic Cable Market Report is Segmented by Cable Type (Armored Cable, Non-Armored Cable, Ribbon Cable, and Other), Fiber Mode (Single-Mode Fiber, Multi-Mode Fiber, and Plastic Optical Fiber), Installation Type (Aerial/Overhead, Underground/Buried, and More), End-User Industry (Telecommunication, Power Utilities and Smart Grid, Defense and Aerospace, Industrial Automation and Control, and More), and Geography.

Geography Analysis

Asia Pacific dominates with a 58.7% revenue chunk and the highest 12.6% CAGR through 2030, a reflection of state-backed megaprojects under China's Belt and Road umbrella and India's new rules favouring domestic landing stations. Japanese laboratories continue to set optical-throughput records, an R&D edge that cements regional leadership. South Korea and Japan's dense 5G grids escalate fiber counts per square kilometre, while Southeast Asian consortia enlarge submarine clusters that turn Singapore into a de facto regional hub. Political frictions in the South China Sea, however, raise cable-cut risks, prompting redundant routing strategies that sustain elevated capex in the fiber optic cable market.

North America, the second-largest territory, pivots from greenfield to modernization cycles. The USD 42.45 billion BEAD program keeps rural builds active, whereas mergers such as AT&T's sale of consumer fiber assets to Lumen reshape the competitive canvas. Domestic-content mandates foster capacity expansions in North Carolina and South Carolina, aligning supply with escalating AI-driven bandwidth demand. Europe reinforces subsea resilience following Baltic incidents, investing in multi-landing architectures that safeguard digital sovereignty; projects such as IOEMA illustrate the continent's resolve to diversify pathways.

The Middle East, Africa, and South America emerge as next-wave hotspots. Gulf carriers leverage geographic crossroads to host multi-continent cables, while the 2Africa ring brings 45,000 km of new capacity that slashes latency and wholesale prices across Africa. Mediterranean ventures like Medusa extend reach into North Africa, whereas Brazil leads Latin American fiber rollouts tied to cloud-region launches. Financing, regulatory clarity, and skilled-labor availability remain challenges, but higher mobile-data adoption rates anchor a compelling long-term narrative for the fiber optic cable market.

- Prysmian Group

- Corning Inc.

- Sumitomo Electric Industries Ltd.

- Furukawa Electric Co., Ltd.

- CommScope Holding Company Inc.

- Fujikura Ltd.

- Nexans S.A.

- LS Cable and System Ltd.

- OFS Fitel LLC

- Sterlite Technologies Ltd.

- Hengtong Optic-Electric Co. Ltd.

- Yangtze Optical Fiber and Cable (JOFC)

- ZTT Group

- Proterial Ltd.

- Finolex Cables Ltd.

- Belden Inc.

- General Cable Corp.

- Hexatronic Group AB

- HMN Tech Co., Ltd.

- Taihan Fiberoptics Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing penetration of high-speed internet and global data-traffic surge

- 4.2.2 Accelerated 5G roll-outs and fiber-deep FTTx deployments

- 4.2.3 Expanding hyperscale data-center interconnect demand

- 4.2.4 Government-backed rural broadband and digital-inclusion programs

- 4.2.5 Sub-sea route diversification for geopolitical resiliency

- 4.2.6 Sustainability push replacing copper with low-carbon glass fiber

- 4.3 Market Restraints

- 4.3.1 High civil-works cost and right-of-way complexities

- 4.3.2 Price volatility in raw materials and helium supply constraints

- 4.3.3 Delays in environmental permitting for submarine routes

- 4.3.4 Plateauing telco CAPEX in saturated metro markets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Multi-core and hollow-core fiber roadmap

- 4.6.2 Integrated photonics and silicon-photonics transceiver integration

- 4.7 Pricing Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment Analysis

- 4.10 COVID-19 Impact and Recovery Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cable Type

- 5.1.1 Armored Cable

- 5.1.2 Non-Armored Cable

- 5.1.3 Ribbon Cable

- 5.1.4 Others

- 5.2 By Fiber Mode

- 5.2.1 Single-Mode Fiber

- 5.2.2 Multi-Mode Fiber

- 5.2.3 Plastic Optical Fiber

- 5.3 By Installation Type

- 5.3.1 Aerial/Overhead

- 5.3.2 Underground/Buried

- 5.3.3 Submarine/Under-water

- 5.3.4 Indoor/Drop Cables

- 5.4 By End-user Industry

- 5.4.1 Telecommunications

- 5.4.2 Data Centers and Cloud Providers

- 5.4.3 Power Utilities and Smart Grid

- 5.4.4 Defense and Aerospace

- 5.4.5 Industrial Automation and Control

- 5.4.6 Healthcare and Medical

- 5.4.7 Oil and Gas and Offshore

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Prysmian Group

- 6.4.2 Corning Inc.

- 6.4.3 Sumitomo Electric Industries Ltd.

- 6.4.4 Furukawa Electric Co., Ltd.

- 6.4.5 CommScope Holding Company Inc.

- 6.4.6 Fujikura Ltd.

- 6.4.7 Nexans S.A.

- 6.4.8 LS Cable and System Ltd.

- 6.4.9 OFS Fitel LLC

- 6.4.10 Sterlite Technologies Ltd.

- 6.4.11 Hengtong Optic-Electric Co. Ltd.

- 6.4.12 Yangtze Optical Fiber and Cable (JOFC)

- 6.4.13 ZTT Group

- 6.4.14 Proterial Ltd.

- 6.4.15 Finolex Cables Ltd.

- 6.4.16 Belden Inc.

- 6.4.17 General Cable Corp.

- 6.4.18 Hexatronic Group AB

- 6.4.19 HMN Tech Co., Ltd.

- 6.4.20 Taihan Fiberoptics Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment