PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851616

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851616

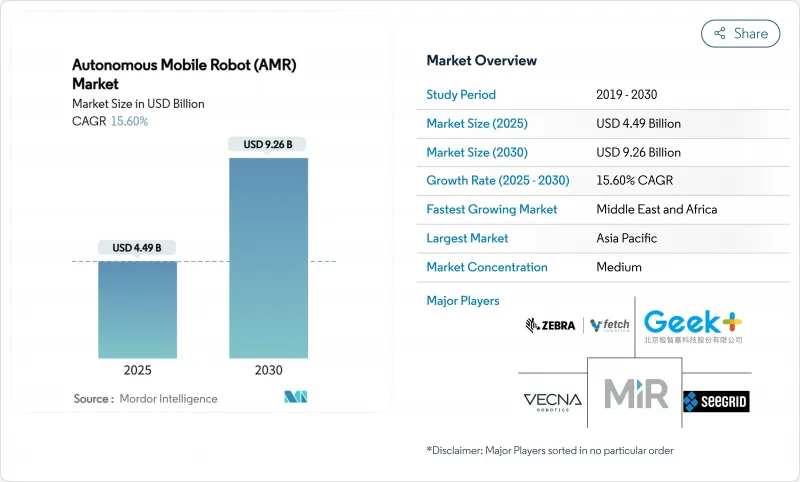

Autonomous Mobile Robot (AMR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The autonomous mobile robot market is valued at USD 4.49 billion in 2025 and is forecast to reach USD 9.26 billion by 2030, expanding at a 15.6% CAGR.

Fast adoption of artificial intelligence, 5G-Advanced connectivity and lower-cost lithium-ion batteries together accelerate commercial feasibility across fulfilment, manufacturing and healthcare environments. Operators deploy robots to offset persistent labour shortages, to gain 24/7 throughput without building fixed conveyor infrastructure and to improve workplace safety. Asia-Pacific leads adoption thanks to Chinese suppliers that blend software-centric design and aggressive pricing, while Middle East mega-projects generate fresh demand for heavy-duty systems. Competitive intensity rises as vendors race to embed fleet-level orchestration software and to secure channel partnerships that shorten time-to-value. Regulatory incentives, such as EU "Factory of the Future" grants, further stimulate uptake by subsidizing capital outlays for small and mid-sized enterprises.

Global Autonomous Mobile Robot (AMR) Market Trends and Insights

Rapid e-commerce fulfilment demand

Online retail now hinges on same-day delivery expectations. Amazon surpassed 1 million deployed robots by July 2025 and cut travel time per pick by 10% through DeepFleet fleet intelligence, proving that mobile automation can quadruple throughput using the same headcount. Locus Robotics crossed 3 billion picks after integrating its LocusOne software, which doubled to tripled productivity while reducing injuries by 80%. Retailers are therefore adopting compact autonomous mobile robot market solutions that flex with seasonal volumes and require minimal facility changes. Vision-only navigation, showcased in the Geek+-Intel design, trims installation cost and time because no fixed markers are needed.

Scarcity of warehouse labour in OECD markets

OECD operators report persistent vacancies for night and peak-season shifts. The European Agency for Safety and Health at Work highlights automation as essential for offsetting shrinking working-age populations. Skechers logged 80% energy savings after replacing conveyors with robots, validating the return on investment where skilled labour is scarce. Employers now redesign rolls around robot supervision and maintenance, making warehouse jobs less physically demanding and more attractive.

Fragmented interoperability standards

ISO 3691-4 and ANSI/RIA R15.08 detail safety, yet they omit fleet communication protocols, forcing buyers into single-vendor ecosystems and inflating integration cost. Middleware suppliers attempt to bridge gaps, but proprietary data formats slow deployment and reduce bargaining power.

Other drivers and restraints analyzed in the detailed report include:

- Falling Li-ion battery cost below USD 70/kWh

- AI-enabled swarm orchestration platforms

- Cyber-physical security vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unmanned ground vehicles controlled 46.0% revenue in 2024. Humanoids, although young, are forecast to expand at 19.22% CAGR because they navigate human-designed spaces without layout changes. Amazon is piloting humanoid couriers that load parcels from Rivian electric vans, hinting at outdoor extension of the autonomous mobile robot market. Unmanned aerial and marine robots remain niche but critical for inspection in energy assets. The autonomous mobile robot market size for humanoids is likely to rise quickly once manipulation reliability reaches warehouse performance benchmarks.

Traditional fleets rely on specialized form factors that optimize one task but lack versatility. Humanoids promise fleet simplification because one platform can switch roles, from shelving to sorting. Investment has therefore shifted from pure mobility hardware to artificial intelligence vision and grasping capability that matches human dexterity. This transition will lower life-cycle cost and unlock new service models such as robot-as-a-service subscriptions.

LiDAR SLAM held 41.5% share in 2024 because of millimetre-level repeatability in congested aisles. Vision-based systems, expanding at 21.22% CAGR, eliminate expensive sensors and reflective targets, which reduces capital outlay for mid-market operators. Geek+ demonstrated LiDAR-equivalent accuracy through Intel RealSense depth cameras and onboard AI. The autonomous mobile robot market size for vision navigation will further increase as edge processors handle real-time image segmentation at lower power budgets.

Hybrid sensor fusion combines cameras, LiDAR and inertial sensors so fleets can switch modes when dust, glare or bandwidth constraints appear. This adaptive approach supports mixed indoor-outdoor operations that warehouses at ports now demand. Standards that certify performance across modalities will accelerate multi-sensor adoption, ensuring safety as robots cross public walkways.

Autonomous Mobile Robot (AMR) Market Report Segmented by Type (Unmanned Ground Vehicles, Humanoids and More), Navigation Technology (LiDAR SLAM, Vision-Based, Magnetic/Inductive/QR Guided and More), End-User Industry (Warehouse & Logistics, Manufacturing, Automotive and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37.8% of 2024 revenue. Chinese firms such as Geek+ export over one-third of production, leveraging cost advantages and government support programs that expedite piloting. Many Japanese and Korean factories now source robots from Chinese brands to cut payback periods. North America remains the second-largest autonomous mobile robot market owing to Amazon's multi-site expansion and a deep ecosystem of software startups that tailor orchestration layers for third-party logistics providers.

Europe benefits from structured subsidies. The EU "Factory of the Future" initiative reimburses up to 20% of automation hardware capital expenditure, which accelerates adoption among mid-sized manufacturers. The autonomous mobile robot market share for Europe will rise as grants kick in post-2025. The Middle East and Africa is the fastest-growing region at a 19.0% CAGR, driven by Saudi Arabia's Vision 2030 and NEOM's USD 774.6 million commitment to construction robotics. High logistics spend and greenfield warehouses allow operators to design around robots from day one.

South America remains early stage. Duty exemptions on imported automation in Brazil and Mexico encourage pilots, yet currency volatility slows wide rollout. Africa's uptake concentrates in South Africa and Morocco where automotive assembly plants demand just-in-time delivery to lineside.

- Zebra Technologies Corporation (Fetch Robotics)

- Teradyne Inc. - Mobile Industrial Robots (MiR)

- Geek+ Technology Co., Ltd.

- Vecna Robotics, Inc.

- Seegrid Corporation

- Aethon, Inc. (ST Engineering)

- Omron Corporation

- Clearpath Robotics Inc. (OTTO Motors)

- HIK Robot Co., Ltd.

- SoftBank Robotics Group Corp.

- SMP Robotics Systems Corp.

- Locus Robotics Corp.

- Amazon.com, Inc. (Kiva/System Robotics)

- Agilox Services GmbH

- Balyo SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce fulfilment demand

- 4.2.2 Scarcity of warehouse labor in OECD markets

- 4.2.3 Falling Li-ion battery $/kWh below USD 70

- 4.2.4 Post-2025 EU "Factory of the Future" grants

- 4.2.5 5G-Advanced private network roll-outs

- 4.2.6 AI-enabled "swarm orchestration" platforms

- 4.3 Market Restraints

- 4.3.1 Fragmented interoperability standards

- 4.3.2 Cyber-physical security vulnerabilities

- 4.3.3 High up-front capex for heavy-payload AMRs

- 4.3.4 Union push-back on robot density limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Unmanned Ground Vehicles (UGV)

- 5.1.2 Humanoids

- 5.1.3 Unmanned Aerial Vehicles (UAV)

- 5.1.4 Unmanned Marine Vehicles (UMV)

- 5.2 By Navigation Technology

- 5.2.1 LiDAR SLAM

- 5.2.2 Vision-based (2D/3D camera)

- 5.2.3 Magnetic / Inductive / QR Guided

- 5.2.4 Hybrid & Multi-Sensor Fusion

- 5.3 By Payload Capacity

- 5.3.1 Up to 100 kg

- 5.3.2 100 - 500 kg

- 5.3.3 500 - 1,000 kg

- 5.3.4 Above 1,000 kg

- 5.4 By End-user Industry

- 5.4.1 Warehouse and Logistics

- 5.4.2 Manufacturing

- 5.4.3 Automotive

- 5.4.4 Food and Beverage

- 5.4.5 Healthcare

- 5.4.6 Retail and E-commerce

- 5.4.7 Defense and Security

- 5.4.8 Mining and Minerals

- 5.4.9 Energy and Power

- 5.4.10 Oil and Gas

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Zebra Technologies Corporation (Fetch Robotics)

- 6.4.2 Teradyne Inc. - Mobile Industrial Robots (MiR)

- 6.4.3 Geek+ Technology Co., Ltd.

- 6.4.4 Vecna Robotics, Inc.

- 6.4.5 Seegrid Corporation

- 6.4.6 Aethon, Inc. (ST Engineering)

- 6.4.7 Omron Corporation

- 6.4.8 Clearpath Robotics Inc. (OTTO Motors)

- 6.4.9 HIK Robot Co., Ltd.

- 6.4.10 SoftBank Robotics Group Corp.

- 6.4.11 SMP Robotics Systems Corp.

- 6.4.12 Locus Robotics Corp.

- 6.4.13 Amazon.com, Inc. (Kiva/System Robotics)

- 6.4.14 Agilox Services GmbH

- 6.4.15 Balyo SA

- 6.5 Vendor Positioning Analysis

- 6.6 Investment Analysis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment