PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687821

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687821

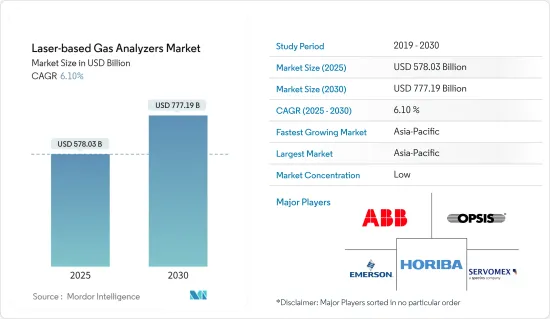

Laser-based Gas Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Laser-based Gas Analyzers Market size is estimated at USD 578.03 billion in 2025, and is expected to reach USD 777.19 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

The global demand for laser-based gas analyzers has been boosted by increased shale gas and tight oil discoveries since these resources are utilized to stop corrosion in the infrastructure of natural gas pipelines. The use of laser-based gas analyzers has also been enforced in several industrial settings by government law and the enforcement of occupational health and safety rules.

Key Highlights

- The growing public consciousness of the dangers of gas leaks and emissions contributed to the increased adoption of laser-based gas analyzers. Manufacturers are integrating laser-based gas analyzers with mobile phones and other wireless devices to offer real-time monitoring, remote control, and data backup.

- Moreover, the growing awareness of workplace toxic and hazardous gas-related dangers is also driving the adoption of laser-based gas analyzers, especially in the oil and gas, chemicals and petrochemicals, and metals and mining industries.

- Further, automotive emission analyzers gained popularity in the market due to government stringencies over the CO2 emissions from vehicles. Automotive manufacturers are making efforts to improve their engine performances, to combat CO2 emissions. Hence, many automotive and automotive testing companies are adopting laser-based gas analyzer systems.

- Increasing competitiveness and reducing exposure to risk is common to all manufacturers in the market. This translates into increased product complexity, constant pressure on costs, and legislated minimization of environmental footprint, which in turn requires better control, more cheaply and with less waste.

- During the COVID-19 pandemic, the growing investments by governments to support scientific progress and infrastructure in several industries, coupled with the focus on R&D and automation, have significantly impacted the studied market.

Laser Based Gas Analyzers Market Trends

Chemical Industry to Witness Growth

- In the chemicals industry, oxygen is one of the many undesired contaminants that can impact the reaction or degrade the final product of the company. For example, olefin co-catalyst systems provide high quality and yield of the final polyolefin product if the olefin feedstock stream is free from oxygen. In such cases, oxygen gas analyzers play a vital role, with low ppm capabilities, to ensure that the products can be maintained at an optimum level.

- Blanketing is one of the most common activities performed when highly flammable products are stored or transported to reduce the risk of explosion. In blanketing, laser gas analyzers are used to monitor the presence of undesired gases below the explosion risk.

- For instance, while storing hydrocarbon liquids in tanks, it is possible that air will leak into the headspace above the liquid level, which may form explosive gas mixtures. Carbon dioxide or nitrogen is injected above the liquid into the headspace to remove its presence.

- Process gas analyzers play a crucial role in ensuring the safe running and efficiency of numerous chemical production steps. Process gas analyzers are critical components, from preventing the development of explosive conditions in reactors to controlling combustion in thermal oxidizers.

- Hydrogen is one of the essential products and intermediates of the chemical industry. For instance, hydrogen is commonly used as feedstock in the industry to produce ammonia. Thus, a significant demand exists for hydrogen analyzers in the industry, which are used to determine the concentration of hydrogen in a gas mixture.

- The strong growth in the chemicals industry in recent times is expected to fuel the demand for gas analyzers significantly. For instance, BASF shows that growth in the global chemical industry was 6.1% in 2021. According to the organization, global chemical production was expected to grow by 3.5% in 2022, which is above the average for the years before the coronavirus pandemic.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the only region to register an oil and gas capacity growth in recent years. About four new refineries were added in the region, which has added about 750,000 barrels per day to global crude oil production. Increased investments in new plants in oil and gas, steel, power, chemical, and petrochemicals and the rising adoption of international safety standards and practices are expected to influence market growth.

- The development of industries in the region is driving the growth of gas analyzers, owing to their use in the oil and gas industry, such as monitoring processes, increased safety, enhanced efficiency, and quality. Hence, the refineries in the region are deploying gas analyzers in the plants.

- The APAC region has the largest older population demographic. As per the Population Reference Bureau, China has about 166 million citizens aged over 65, which is twice the elderly population of Japan, Germany, and Italy combined.

- Furthermore, gas analyzers are also being used to analyze the pollution levels across a city. In countries like China and India, pollution levels are at an all-time high, leading to gas analyzers being deployed to monitor and control pollution levels.

- Researchers are making efforts to reduce greenhouse gas across the world, and for the analysis purposes of these gases, they are using the gas analyzer. For example, scientists from Southeast Asia are investing in measuring Greenhouse Gas (GHG) emissions from goats and cattle by investigating the effects of different feeding regimes and implementing a portable FTIR gas analyzer from Gasmet Technologies. These factors are expected to drive the market for gas analyzers in the region.

Laser Based Gas Analyzers Industry Overview

The growing presence of prominent manufacturers in the Laser-based Gas Analyzers Market is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as ABB Ltd., Opsis AB, Emerson Electric Co., HORIBA Ltd, Servomex Group Limited, Honeywell International Inc., etc., greatly influence the overall market.

- In December 2022, ABB introduced Sensi+, a ground-breaking analyzer for monitoring natural gas quality. False readings are almost eliminated by ABB's laser-based technology, which also offers quick response times for dependable process control. Sensi+ provides exceptional performance and a low total cost of ownership and is designed for remote and dangerous settings.

- In June 2022, Servomex unveiled a new analyzer to deliver the most advanced photometric gas analysis solution. Designed around an easier-to-use digital platform, the new analyzer is a rugged and reliable product ready to handle a wide range of industrial applications, including ethylene production, carbon capture, ethylene dichloride production, and the direct reduction iron process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emission Regulation

- 5.1.2 Demand for Robust and Modular Systems

- 5.2 Market Restraints

- 5.2.1 Complex Mathematical Analysis Process and High Costs

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 In Situ

- 6.1.2 Extractive

- 6.2 By Type

- 6.2.1 Tuneable Diode Laser Spectroscopy (TDLS)

- 6.2.2 Raman Spectroscopy (RA)

- 6.2.3 Cavity Ring Down Spectroscopy (CRDS)

- 6.2.4 Quantum Cascade Laser Spectroscopy (QCLS)

- 6.3 By End-user Industry

- 6.3.1 Power

- 6.3.2 Mining and Metal

- 6.3.3 Healthcare

- 6.3.4 Automotive

- 6.3.5 Pulp and Paper

- 6.3.6 Oil and Gas

- 6.3.7 Chemical

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Opsis AB

- 7.1.3 Emerson Electric Co.

- 7.1.4 HORIBA Ltd

- 7.1.5 Servomex Group Limited

- 7.1.6 KNESTEL Technology & Electronics GmbH

- 7.1.7 Hangzhou Zetian Chunlai Technology Co. Ltd

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 NEO Monitors AS (Nederman Group)

- 7.1.10 Endress + Hauser AG

- 7.1.11 Fuji Electric Co. Ltd

- 7.1.12 Siemens AG

- 7.1.13 Anton Paar GmbH

- 7.1.14 AMETEK Land Instruments International

- 7.1.15 Bruker Corporation

- 7.1.16 Mettler Toledo

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET