PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536981

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536981

North America Electric Vehicle Power Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

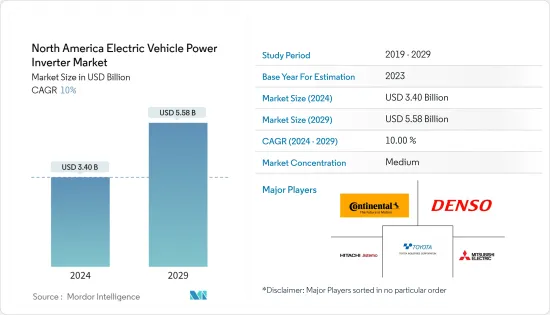

The North America Electric Vehicle Power Inverter Market size is estimated at USD 3.40 billion in 2024, and is expected to reach USD 5.58 billion by 2029, growing at a CAGR of 10% during the forecast period (2024-2029).

A power inverter is one of the key components in electric vehicles, ideally converting battery DC power into AC power for an electric motor. Considering the growing concern among automakers to optimize energy consumption in cars, inverter manufacturers have improved their inverter capabilities to handle energy, and vice versa, from both sources (i.e., battery and motor).

An increase in demand for electric vehicles, proactive government initiatives for the development of electric vehicles, and a surge in demand for low-emission and fuel-efficient vehicles are expected to fuel the growth of the electric vehicle power inverter market in North America.

Moreover, with growing stringent emission standards worldwide, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric cars. In addition, governments have initiated incentives, such as a cut down in vehicle tax, bonus payments, and premiums, for buyers of electric vehicles in respective countries to support the growth of electric vehicle sales.

The Federal Government has set a goal to make half of all new vehicles sold in the United States in 2030 zero-emissions vehicles and build a convenient and equitable network of 500,000 chargers to help make electric vehicles accessible to all Americans for both local and long-distance trips.

Vehicle inverter manufacturers are consistently working to improve their products in terms of efficiency and size. Combining an inverter with a motor or converter has significantly gained attention among automakers.

North America Electric Vehicle (EV) Power Inverter Market Trends

Passenger Car holds Highest Share in the Market

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most widely used means of transportation in many developed countries.

The market for electric vehicles (EVs) has increased in recent years, resulting in high sales of passenger cars.

For instance, according to Marklines, in February 2024, electric vehicle automaker Gaint Tesla's sales in the United States increased from 54,045 units compared to February 2023, with a market share of 4.3%.

Moreover, other factors, such as government policies to boost the sale of electric vehicles, will drive the market growth of electric vehicle power inverters. Several countries across the region are also implementing zero-emission vehicle (ZEV) programs and have passed laws to transit entire fleets of vehicles for public transport to be electric in the future.

Moreover, automakers are building new production plants and making considerable investments in R&D activities to advance electric vehicle production and its parts to cater to the increasing demand. Most major companies plan to roll out dozens of new electric vehicle models over the next decade and are working on launching various new models with the latest features.

The key development is that various automakers announced they would transition toward a compatible modular architecture for their upcoming EV range, which will be released by 2025. The Ioniq 5 is the first car in the collection and has a unique feature of charging faster than most electric vehicles. This is possible due to its 800v battery that can cope with 200kW ultra-fast charging technology. With this technology, the Ioniq 5 can be charged from 10% to 80% in under 18 minutes, adding approximately 200 miles of range.

The above factors will drive the growth of the market.

The United States Holds the Majority Share

In 2023, the United States was considered the third-largest for electric vehicles in North America and worldwide, according to the International Energy Agency.

The annual sales of electric vehicles crossed 1 million until the third quarter of 2023, which was 58% higher than in 2022.

Moreover, the Government of the United States is focusing on policies to promote sales of electric vehicles and become a worldwide leader in the EV industry by introducing initiatives for electric vehicles, coupled with several programs and incentives to increase demand for electric cars.

President Biden's Bipartisan Infrastructure Law invests USD 7.5 billion in EV charging, USD 10 billion in clean transportation, and over USD 7 billion in EV battery components, critical minerals, and materials. Moreover, the growing expense of oil imports and increased pollution levels make governments expedite the transition to e-mobility.

The Biden administration is proposing rules to ensure that two-thirds of new cars and a quarter of new heavy trucks sold in the United States by 2032 are all-electric by applying policies such as new tailpipe emissions that would accelerate the country's clean energy transition.

The speed has sparked interest in solutions that can reduce inverter development time. Manufacturers invest in the R&D of electric vehicles and related infrastructure. For instance, in April 2022, during a Mobex webinar, Renesas Electronics detailed how it offers system-level functional safety support to allow its customers to shorten development time while producing inverter products.

All the above factors create opportunities for electric power inverters, which are expected to boost the electric vehicle power inverter market in the United States.

North America Electric Vehicle (EV) Power Inverter Industry Overview

The North American electric vehicle power inverter market is consolidated and led by globally and regionally established players. The companies adopt new product launches, collaborations, and mergers to sustain their market positions. For instance

In October 2023, GKN Automotive announced its expansion of the US operations with a new aftermarket warehouse in Dallas-Fort Worth. According to DeLand, an inverter team in the United States is extremely important to address the needs of the North American market.

Some of the major players in the market include Continental AG, Robert Bosch, Denso Corp., Toyota Industries Corporation, Hitachi Automotive Systems Ltd, and Mitsubishi Electric Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption of Electric Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost Initiated to Power Invertors

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Propulsion Type

- 5.1.1 Hybrid Electric Vehicle

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Battery Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Vitesco Technologies

- 6.2.2 Robert Bosch GmbH

- 6.2.3 DENSO Corporation

- 6.2.4 Toyota Industries Corporation

- 6.2.5 Hitachi Astemo Ltd

- 6.2.6 Aptiv PLC

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.8 Marelli Corporation

- 6.2.9 Valeo Group

- 6.2.10 Continental AG

- 6.2.11 Eaton Corporation PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS