PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444396

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444396

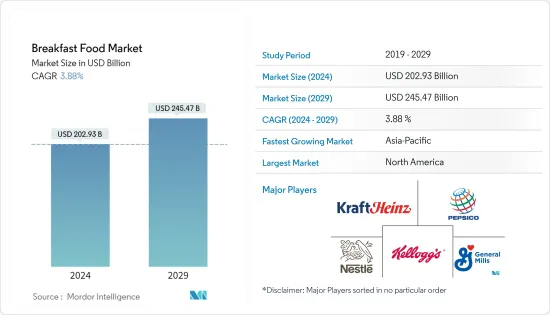

Breakfast Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Breakfast Food Market size is estimated at USD 202.93 billion in 2024, and is expected to reach USD 245.47 billion by 2029, growing at a CAGR of 3.88% during the forecast period (2024-2029).

Customers are actively favoring more nutritious, quick breakfast diets due to rising global health awareness. The market is expected to be driven by a rise in the number of fitness enthusiasts who seek nutritious foods, such as cereals and snack bars, daily. Due to recent health issues like obesity, diabetes, cholesterol, and high blood pressure, consumers are more inclined toward fitness activities. They require instant energy for workouts and, therefore, use snack bars as an alternative for breakfast in the morning. Market players are also providing high-energy snack bars. For instance, in September 2021, Mondelez India, a manufacturer of Cadbury chocolates and Oreo cookies, entered the 'nutritious, guilt-free' snacking segment by launching snack bars through an extension of the 'Cadbury Fuse' brand. The new range of snack bars titled "Cadbury Fuse Fit" has been placed in the mid-premium segment, primarily targeting urban consumers.

Consumers worldwide consider instant breakfast cereals to be convenient and satisfying. Breakfast cereals' flavor variants and their health-promoting properties are driving the overall market. Market players like Kellogg's, Nestle, and Marico are launching new products with additional nutrients, health benefits, and a variety of flavors, attracting young consumers as well. Due to the trend of plant-based food, consumer preference has changed, and market players are also working toward consumer needs. For instance, in October 2021, Nestle launched two new products in their plant-based series, i.e., plant-based alternatives to eggs and shrimps. The products were launched under Garden Gourmet Veggies and Garden Gourmet Vrimp in Europe.

Breakfast Food Market Trends

Rising Demand for Ready-to-eat Food

Due to busy lifestyles in developed and developing countries, a tendency to skip morning meals has emerged, mainly led by the millennial generation. Customers' increasing understanding of the concept and the importance of having breakfast at the start of the day have boosted the ready-to-eat food industry. Ready-to-eat foods are the nearest alternatives to traditional breakfast meals. The widespread consumer acceptance of such breakfast foods is expanding the ready-to-eat food category.

Consumers are more inclined toward food that provides nutrition, health, and safe food apart from the taste. Market players are manufacturing products that are easy to carry and ready to eat within a few minutes of cooking. For instance, in July 2021, J.M. Smucker Co.'s Uncrustables brand launched uncured pepperoni roll-ups and pepperoni bites for lunch times. Bread bites are made with marinara sauce, natural uncured pepperoni, and mozzarella cheese, while roll-ups are made with natural uncured pepperoni and 100% real provolone and Neufchatel cheeses with seasoning. It takes less than 60 seconds to prepare.

North America Holds Largest Share in the Market

The demand for breakfast foods in the global market is dominated by North America, followed by Europe. Market expansion in the region is driven by excess production capacity, purchase behavior, and consumption patterns. North American people are becoming health conscious, and they demand their food to be easy to cook and quicker to make. Due to the rising working population and college-going students in the region, ready meals and snack bars have become the trend.

Manufacturers are also focused on the health and wellness trend in North America, with an emphasis on youths and the working class. For instance, in October 2022, Campbell Soup Company launched four new soups with four different flavors such as Spicy Steak and potato, Spicy Chicken Noodle, Spicy Sirloin Burger, and Spicy Chicken and Gumbo. Consumers' changing lifestyles, including incorporating smaller meals, are leading to an increase in breakfast food consumption, which is likely to drive the demand for snack bars, cereals, and other breakfast foods in the region.

Breakfast Food Industry Overview

The breakfast food market is highly competitive, with the presence of many regional and domestic players. It is entirely focused on business to consumers. Some of the major players in the market include The Kellogg Company, General Mills Inc., Nestle SA, and The Kraft Heinz Company. Omnichannel strategies are expected to yield the highest return on investment. However, mergers, expansions, acquisitions, partnerships, and new product developments are highlighted as strategic approaches key players use to increase their brand exposure among consumers. Major companies like Nestle and Kellogg Company have substantially invested in digital advertising to promote consumer awareness among kids and adults about the benefits of consuming foods like oats and muesli to improve their health and fitness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Cereals

- 5.1.2 Beverages

- 5.1.3 Snack Bars

- 5.1.4 Ready Meals

- 5.2 Distribution Channel

- 5.2.1 Hypermarkets/Supermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Specialist Stores

- 5.2.4 Online Retailers

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 General Mills Inc.

- 6.3.3 The Kellogg Company

- 6.3.4 PepsiCo Inc.

- 6.3.5 The Kraft Heinz Company

- 6.3.6 Del Monte Food Inc.

- 6.3.7 Unilever

- 6.3.8 ITC Limited

- 6.3.9 Pladis Foods Limited (McVitie's)

- 6.3.10 Dr. Oetker

- 6.3.11 Conagra Brands

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 ABOUT US