PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907254

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907254

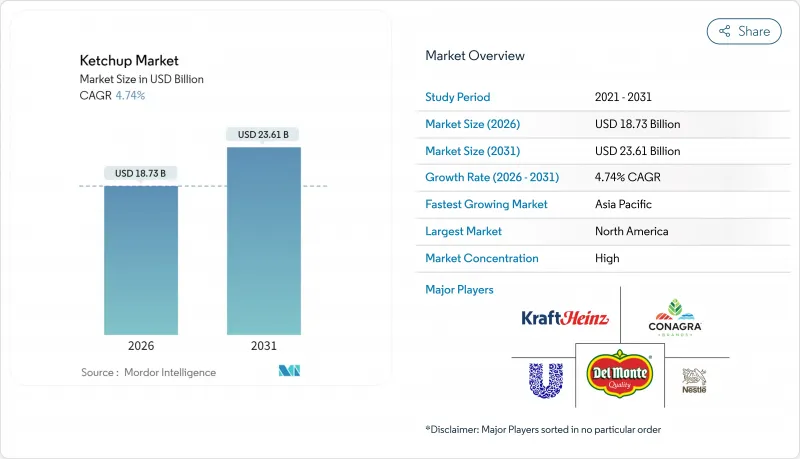

Ketchup - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ketchup market is expected to grow from USD 17.88 billion in 2025 to USD 18.73 billion in 2026 and is forecast to reach USD 23.61 billion by 2031 at 4.74% CAGR over 2026-2031.

Ketchup's growth is fueled by its deep-rooted presence in global dining and its nimbleness in adapting to trends like convenience, health, and premiumization. Its demand is widespread, encompassing traditional fast-food accompaniments, meal-kit enhancements, and gourmet applications that elevate home cooking experiences. This versatility ensures its relevance across diverse consumer preferences, culinary practices, and eating occasions. Brands bolster their resilience through climate-conscious tomato sourcing, pioneering flavor innovations, and eco-friendly packaging, which align with evolving consumer expectations for sustainability, quality, and ethical practices. Additionally, the rise of digital commerce broadens reach, enabling niche producers to explore markets and test consumer preferences without the burden of extensive physical distribution investments. This digital shift not only fosters innovation and competition but also allows smaller players to establish a foothold in the market, contributing to its dynamic growth.

Global Ketchup Market Trends and Insights

Convenience-food demand spike

As lifestyles accelerate, the reliance on ready-to-eat items grows, amplifying ketchup's role as an instant flavor enhancer. Data from the USDA reveal that as dining out becomes more prevalent, condiment usage rises, leading to a surge in single-serve ketchup volumes. These single-serve packs are particularly popular in fast-food chains, cafeterias, and convenience stores, where quick service and portability are key priorities. Shelf-stable, portion-controlled packs are designed for commuters and students who value portability, offering a convenient solution for on-the-go consumption. Thanks to its long shelf life, ketchup finds a place in emergency food kits and institutional meal plans, ensuring a reliable flavoring option in various scenarios. Manufacturers are experimenting with flavors, introducing smoky or spicy notes, to refresh traditional profiles while maintaining their familiar essence. These innovations aim to cater to evolving consumer preferences, keeping the product relevant in a competitive market. Regulatory mandates on transparent labeling empower consumers, allowing them to make informed choices even in the fast-paced world of quick eating, further bolstering demand.

Fast-food expansion in emerging markets

Across Asia-Pacific and Latin America, quick-service restaurant networks are rapidly expanding, leading to an uptick in ketchup usage. Both U.S. chains and local franchises are making ketchup a standard accompaniment, introducing it to new consumer groups and reinforcing its role in modern dining habits. As young urban populations with increasing disposable incomes adopt Western dining styles, ketchup becomes a staple in their daily meals, often complementing popular fast-food items like burgers, fries, and sandwiches. Menu localization introduces spicy or sweetened regional ketchup variants, promoting experimentation within the category and catering to diverse taste preferences. Furthermore, with governments backing foreign foodservice investments to boost employment and economic growth, the demand for ketchup remains robust, supported by the growing footprint of international and domestic foodservice chains.

Health pushback on sugar/salt

Public health campaigns are pushing for a reduction in sweetened sauce consumption, leading parents to examine ketchup labels more closely. Many conventional SKUs fall outside the FDA's "healthy" claim band due to the agency's 2025 criteria, limiting on-pack promotional opportunities and potentially impacting consumer purchasing decisions. This shift is expected to drive manufacturers to explore healthier formulations to meet evolving regulatory and consumer demands. Reformulating ketchup to cut sugar while balancing acidity and viscosity drives up research and development costs, as manufacturers must invest in advanced techniques, ingredient testing, and sensory evaluations to maintain product quality. In Western Europe, retail chains are using traffic-light nutritional stickers, pushing high-sugar ketchups to lower shelf positions, which could reduce their visibility and sales. This trend reflects a broader movement toward promoting healthier food choices at the retail level. While flavor-house suppliers provide monk fruit and stevia solutions as sugar alternatives, their lingering aftertastes hinder widespread acceptance, posing a challenge for mass-market adoption and requiring further innovation in sweetener technology.

Other drivers and restraints analyzed in the detailed report include:

- Innovative packaging and flavor formats

- Cross-border e-commerce reach

- Climate-driven tomato yield volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, regular ketchup offerings command a dominant 70.98% market share, underscoring the consistency of global recipes and habitual consumer purchasing patterns. This quintessential red condiment is synonymous with staples like fries, burgers, and eggs, fueling steady demand and enabling efficient large-scale production. Its universal flavor profile and widespread recognition cultivate a dedicated customer base that views ketchup as an indispensable condiment. Major brands leverage economies of scale, ensuring competitive pricing and extensive availability. The sustained popularity of regular ketchup cements its status as the primary product driving global volume sales. For market leaders, this segment is pivotal, bolstering consistent revenue streams amidst a shifting condiment landscape.

On the other hand, flavored ketchup lines are the market's fastest-growing segment, boasting a CAGR of 5.34%. As adventurous millennials gravitate towards Chipotle, curry, sriracha, and other innovative blends of Western formats with local spices, leading ketchup brands are ramping up research and development investments. Their goal is to tap into these niche micro-segments without undermining their core regular ketchup sales. Often debuting as limited editions, these new flavors allow marketers to gauge consumer interest and swiftly adapt based on feedback, especially from social media polls. Retailers, keen on seasonal promotions, prominently display spicy flavored ketchups during grilling season to attract barbecue lovers. Meanwhile, foodservice operators are experimenting with regional flavors, adjusting quick-service menus to promote trials that could lead to mainstream retail adoption. Between 2026 and 2031, the flavored ketchup market is set to grow by an estimated USD 1.32 billion, bolstered by strategic cross-promotions with snack manufacturers that enhance reach and consumer engagement.

In 2025, conventional ketchup commands a dominant 82.93% market share, thanks to cost-effective production and a long-standing consumer trust in its quality and flavor. This segment resonates especially with price-sensitive consumers in emerging markets, who favor multi-serve plastic bottles for added value. The widespread availability and recognition of conventional ketchup solidify its status as the go-to household condiment. Its established market presence, bolstered by economies of scale, ensures competitive pricing and a consistent supply across various regions. The combination of affordability and trust in this traditional product cements its foundational role in the ketchup industry. Furthermore, manufacturers are continually refining production processes to uphold profit margins while catering to a broad consumer base.

On the other hand, organic ketchup is the market's fastest-growing segment, boasting a CAGR of 6.03%. This surge is largely driven by health-conscious parents prioritizing pesticide-free staples for their families. While its current volume is modest, organic ketchup's share in specialty retail is set to leap to 22.60% by 2031, fueled by robust double-digit sales growth. Achieving organic certification involves stringent audits, allowing vertically integrated growers to fetch premium prices for their produce. E-commerce is pivotal in amplifying organic ketchup's visibility, navigating challenges like limited shelf space and steep fees in conventional hypermarkets. Retailers bolster this segment with promotions like "organic weeks," pairing ketchup with other organic staples such as pasta and dairy to enhance overall sales. Major companies are also introducing dedicated sub-brands, tapping into the organic market while preserving the premium image of their flagship conventional lines, ensuring strategic expansion in this lucrative niche.

The Global Ketchup Market Report is Segmented by Product Type (Regular Ketchup, Flavored), Category (Conventional, Organic), Packaging (PET/Glass Bottle, Pouch and Sachet, Others), Distribution Channel (On Trade, Off Trade), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America captured 36.22% of global revenue, bolstered by its long-standing industry presence. Even as the market matures and volumes moderate, North America continues to stand as a beacon of innovation. Stricter nutrient regulations from the FDA have not only spurred early reformulation in the U.S. but have also set a precedent for adoption in other countries. Facing climate challenges, California is diversifying its supply chains, turning to Mexico and controlled-environment greenhouses to ensure a steady flow of raw materials. Marketing strategies are tapping into patriotic sentiments, using themes like Fourth of July cookouts to rekindle emotional connections with ketchup. E-commerce is making waves, with subscription models allowing families to auto-replenish staples and customize flavor bundles based on data insights.

Asia-Pacific is on a growth trajectory, boasting the fastest CAGR of 7.12% through 2031, driven by urban households increasingly opting for quick-cook meal solutions. In China, tier-2 cities are witnessing a surge in hypermarket expansions, leading to a broader display of ketchup products. Meanwhile, India's organized retail landscape and the surge in online shopping are positioning it as a crucial demand hub. The region's diverse palate is giving rise to soy-blended and chili-fortified ketchup variants, broadening their appeal beyond traditional Western dishes. To navigate global trade fluctuations, domestic processors are turning to retort technology, ensuring they meet both export benchmarks and local cost demands.

Europe, with its rich tomato cultivation and a culture steeped in indulgent dining, stands as a pivotal market for ketchup. Here, consumers are willing to pay a premium for labels that boast regional authenticity, like "Made with Emilia-Romagna tomatoes," underscoring ketchup's ties to local culinary heritage. The European Union's shelf tax is pushing brands to rethink their merchandising strategies; innovations like gravity-feed chilled rails and reusable glass jar deposit schemes are not just trends but tools to cultivate brand loyalty. With heightened regulatory scrutiny on plastic waste, brands are swiftly pivoting to paper-based multipacks, reaping rewards in shelf space for being early adopters.

- The Kraft Heinz Company

- Conagra Brands Inc. (Hunt's)

- Del Monte Foods Holdings Ltd.

- Unilever PLC (Hellmann's)

- Nestle S.A. (Maggi)

- McCormick & Company Inc.

- General Mills Inc. (Simply Nature)

- Wingreens Farms Pvt. Ltd.

- Windmill Organics Ltd. (Biona)

- The Foraging Fox Ltd.

- Kagome Co., Ltd.

- Campbell Soup Company (Prego)

- Hain Celestial Group Inc.

- Tata Consumer Products (Kissan)

- Masan Group (Chin-Su)

- Premier Foods plc (Sherwood's)

- Mutti S.p.A.

- Organicville Foods (Litehouse)

- Mars Inc. (MasterFoods)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience-food demand spike

- 4.2.2 Fast-food expansion in emerging markets

- 4.2.3 Innovative packaging and flavor formats

- 4.2.4 Cross-border e-commerce reach (under-the-radar)

- 4.2.5 Regenerative tomato-sourcing pull-through (under-the-radar)

- 4.2.6 Growing demand for natural and clean-label ingredients

- 4.3 Market Restraints

- 4.3.1 Health pushback on sugar/salt

- 4.3.2 Rising alternative-condiment rivalry

- 4.3.3 Climate-driven tomato yield volatility (under-the-radar)

- 4.3.4 Availability of substitute

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Regular Ketchup

- 5.1.2 Flavored

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Packaging

- 5.3.1 PET/Glass Bottle

- 5.3.2 Pouch and Sachet

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 On Trade

- 5.4.2 Off Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Netherlands

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Sweden

- 5.5.2.11 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 Morocco

- 5.5.5.6 Turkey

- 5.5.5.7 South Africa

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Kraft Heinz Company

- 6.4.2 Conagra Brands Inc. (Hunt's)

- 6.4.3 Del Monte Foods Holdings Ltd.

- 6.4.4 Unilever PLC (Hellmann's)

- 6.4.5 Nestle S.A. (Maggi)

- 6.4.6 McCormick & Company Inc.

- 6.4.7 General Mills Inc. (Simply Nature)

- 6.4.8 Wingreens Farms Pvt. Ltd.

- 6.4.9 Windmill Organics Ltd. (Biona)

- 6.4.10 The Foraging Fox Ltd.

- 6.4.11 Kagome Co., Ltd.

- 6.4.12 Campbell Soup Company (Prego)

- 6.4.13 Hain Celestial Group Inc.

- 6.4.14 Tata Consumer Products (Kissan)

- 6.4.15 Masan Group (Chin-Su)

- 6.4.16 Premier Foods plc (Sherwood's)

- 6.4.17 Mutti S.p.A.

- 6.4.18 Organicville Foods (Litehouse)

- 6.4.19 Mars Inc. (MasterFoods)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK