PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687918

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687918

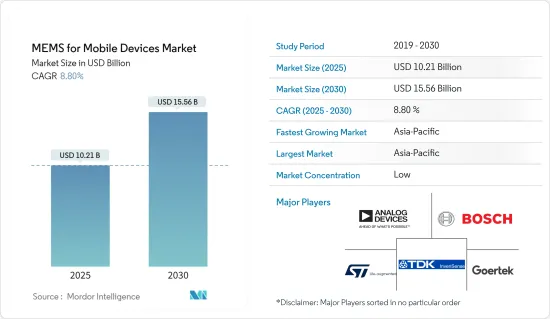

MEMS for Mobile Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The MEMS for Mobile Devices Market size is estimated at USD 10.21 billion in 2025, and is expected to reach USD 15.56 billion by 2030, at a CAGR of 8.8% during the forecast period (2025-2030).

With an increase in demand for accelerometers and gyroscopes in smartphones, the MEMS for mobile devices market is expected to grow significantly during the forecast period. For instance, in 2022, the total number of mobile subscriptions globally is expected to reach around 8.4 billion. It is poised to increase further, according to Ericsson forecasts.

Key Highlights

- The studied market has been marked by a trend toward lower power consumption of MEMS devices. Also, changing consumer needs, like faster charging speeds, shorter charging times, and better charging optimization, drive the need for sensors in smart mobile devices. These devices are made to use less power, which makes them charge much faster.

- Moreover, as smartphones are increasingly being used for image applications, the usage of optical image stabilization (OIS) and electronic image stabilization (EIS) is enabled by MEMS sensors. This broad set of features and innovative functions further augments MEMS sensor growth for smart mobile devices in the forecast period.

- Global trends in the market studied are boosted by the commercialization of 5G. For instance, the transition toward 5G accelerates the demand for advanced mobile devices. According to the Ericsson Mobility Report released in November 2022, 5G mobile subscriptions are anticipated to reach 5 billion by the end of 2028. Further, 5G population coverage is projected to reach 85%, while 5G networks are expected to carry around 70% of mobile traffic. Such events are also expected to drive the demand for RF MEMS, owing to the higher number of bands that 5G demands, triggering the demand for RF filters.

- MEMS companies have minimal access to MEMS fabrication facilities or foundries for prototypes and device manufacture. Also, most organizations expected to benefit from this technology do not currently have the required capabilities and competencies to support MEMS fabrication, directly impacting fabrication standardization. This is expected to hinder the market's growth.

- The effect of COVID-19 on the mobile device market has been moderate. Moreover, the pandemic changed the perception of the current global supply chain in manufacturing, potentially leading to more localized value chains and further regionalization to minimize similar risks in the near future.

MEMS for Mobile Devices Market Trends

Increasing Acceptance of Miniaturization Trend to Drive the Market

- The miniaturization of devices is one of the major factors driving the demand for MEMS in mobile devices. With the size of end devices shrinking, manufacturers continuously look for ways to upgrade their technology to reap benefits. As the number of sensors on a mobile device increases, the need for smaller MEMS is required to fulfill design factors. Mobile devices have sensors like proximity sensors, accelerometers, gyroscopes, fingerprint sensors, ambient light sensors, compasses, hall effect sensors, barometers, and others.

- Furthermore, miniaturization and improvements in their acoustic properties have enabled MEMS microphones to facilitate the sharing of information through smartphone videos. MEMS microphones are also useful for active noise cancellation, like on long-distance flights or when you want to listen to music without being disturbed.

- Vendors worldwide are focusing on reducing the size of MEMS further to enhance the cost benefits it reaps. Furthermore, the manufacturers of MEMS sensors are pushing to reduce the size of MEMS to meet the need for smaller mobile devices. For instance, in order to support the demand for even smaller mobile devices, the SiT15xx MEMS oscillators available in 1.5 x 0.8 x 0.55 mm CSPs (chip-scale packages) reduce footprint by as much as 85% compared to standard 2.0 x 1.2 mm SMD XTAL packages. Unlike XTALs, the SiT15xx family has a unique output that directly drives the chipset's XTAL-IN pin.

- In areas where traditional sensors cannot efficiently operate, developing next-generation micro-accelerometers with ultra-small dimensions and high sensitivity is required. Also, the constant process of making accelerometers smaller has led to smaller packages and, in the end, lower costs.

- Nano Electromechanical Systems (NEMS)-based accelerometers using graphene occupy orders of magnitude smaller die areas than conventional silicon MEMS accelerometers while retaining competitive sensitivities. Such trends in the miniaturization of devices drive the market for MEMS used in mobile devices. The need to add more power and reduce cost and space will remain a key factor for innovators in the market. Market innovators are banking on such trends to add more functionalities to their devices for high-performance-demanding consumers.

Asia Pacific is Expected to Witness Significant Growth

- The Asia-Pacific region has been one of the most significant markets for smartphones, primarily due to the highly developing telecom sector and large customer base. Furthermore, the region is increasingly investing in advanced mobile networks. Countries such as China, India, Japan, Australia, Singapore, and South Korea are increasingly investing in developing their domestic telecom markets, which are also expected to drive the market in the region.

- Also, companies set up their production centers in the area because raw materials are easy to get and there are low costs to set up and pay workers.

- Growing demand for mobile phones and other consumer electronics products from countries such as India, China, the Republic of Korea, and Singapore is encouraging many companies to set up factories in the Asia-Pacific region.

- According to the most recent figures given by the Chinese government, Chinese subscribers are flocking to buy pricey new 5G cellphones. China's 5G phone shipments surpassed 266 million units in 2021, an increase of 63.5 percent over the previous year. Data from the China Academy of Information and Communications Technology (CAICT) shows that 75.9% of all mobile phones shipped were 5G.

- There is a growing need for MEMS sensors because of the ease and speed with which fingerprint technology allows smartphones to be unlocked. Fingerprint authentication is more secure than traditional techniques, which rely on passwords and personal identification numbers. Fingerprint sensing technology is becoming more common in consumer electronics like smartphones and tablets. This is because it is popular and has unique qualities, like being able to recognize each person's ridges, valleys, and small points.

MEMS for Mobile Devices Industry Overview

The MEMS market is riddled with large-scale vendors that are capable of both backward and forward integration and command significant revenue generation capabilities. The level of competition in the market is moderately high, and it is likely to get worse in the years to come.

In October 2022, Bosch Sensortec announced its first IMU device, the BMI323, to include the I3C interface and the I2C and SPI interfaces. The BMI323 is a six-axis accelerometer and gyroscope designed for motion-sensitive applications in consumer goods. The BMI323 has a current consumption of 790 A in high-performance mode, using both the gyroscope and the accelerometer, compared to 925 A on the BMI160, representing a nearly 15% reduction.

In May 2022, Analog Devices, Inc. (ADI) released a three-axis MEMS accelerometer. The ADXL367 accelerometer reduces power consumption twice compared to the previous generation (ADXL362) while improving noise performance by up to 30%. The new accelerometer also has a longer field time, which increases battery life while decreasing maintenance frequency and cost.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Acceptance of Miniaturization Trend

- 5.1.2 Increasing Demand for High-Performance Devices

- 5.2 Market Restraints

- 5.2.1 Highly Complex Manufacturing Process and Demanding Cycle Time

- 5.2.2 Lack of Standardized Fabrication Process

6 MARKET SEGMENTATION

- 6.1 By Type of Sensor

- 6.1.1 Fingerprint Sensor

- 6.1.2 Accelerometer Sensor

- 6.1.3 Gyroscope

- 6.1.4 Pressure Sensor

- 6.1.5 BAW Sensor

- 6.1.6 Microphones

- 6.1.7 Other Types of Sensors

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Bosch Sensortec GmbH

- 7.1.3 STMicroelectronics NV

- 7.1.4 InvenSense Inc. (TDK)

- 7.1.5 Goertek Inc.

- 7.1.6 Knowles Corporation

- 7.1.7 Murata Manufacturing

- 7.1.8 AAC Technologies

- 7.1.9 MEMSIC Inc.

- 7.1.10 BSE Co. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET