PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433883

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433883

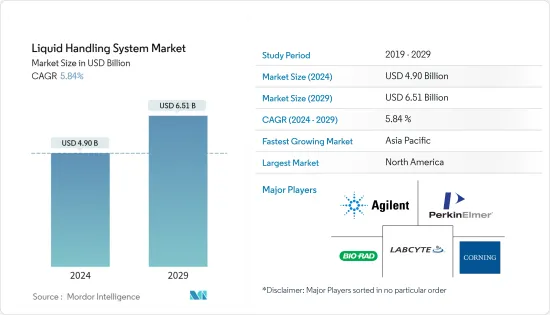

Liquid Handling System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Liquid Handling System Market size is estimated at USD 4.90 billion in 2024, and is expected to reach USD 6.51 billion by 2029, growing at a CAGR of 5.84% during the forecast period (2024-2029).

The major factors for the growth of the liquid handling system market include the rising investment in research and drug development, increasing demand for high-throughput screening, and technological advancements in automated liquid handling systems.

The automated liquid handling systems and high-throughput screening applications are now widely used in drug discovery and most of the major market players are moving towards the automated liquid handling systems. The rising investment in the research and drug discovery is expected to increase the demand for liquid handling systems. Furthermore, in recent years, the interest in high-throughput screening technologies in the United States has increased drastically in academic research. In the United States, a comprehensive database of academic screening centers, hosted by the Society for Biomolecular Sciences, is available. It does not only provide HTS resources to the academic community but also helps in the identification of probes and leads for drug discovery. Thus, owing to all above-mentioned factors, the market is expected to witness high growth over the forecast period.

Liquid Handling Technology Market Trends

Contract Research Organisation in the End User Segment are Expected to Witness Healthy Growth in Future

The contract research organizations are expected to witness healthy growth owing to the rising funding for R&D and increasing outsourcing by pharmaceutical companies for research activities. The contract research organizations are adopting this technology to enhance their lab capabilities. As per the estimations of the Association of Clinical Research Organizations, more than 50% of the CROs perform outsourced clinical study work for the pharmaceutical industry. The primary benefit of liquid handling systems is that it helps to remove both person-to-person and day-to-day variability. The increase in contract research activities will increase the demand for liquid handling systems over the forecast period.

United States is Expected to Dominate the Studied Market

The major factors driving the growth of the market in the United States are increasing research activities and the rising adoption of automation in the research facilities. Furthermore, market players are focusing on the launch of new liquid handling systems. For instance, recently in 2018, one of the market player Labcyte Inc., announced the launch the Echo 650 and 655 Liquid Handlers. The United States provides high funding for research and development activities which is expected to boost the overall growth of the market. Also, most of the research facilities are adopting automation in the lab procedures leading to the healthy demand for liquid handling systems.

Liquid Handling Technology Industry Overview

The market studied is moderately competitive with a presence of various market players. Some of the market players are Agilent Technologies, Hamilton Company, Bio-Rad Laboratories, , Corning Incorporated, Promega Corporation, Eppendorf AG, PerkinElmer, Inc., LABCYTE INC., and Thermo Fisher Scientific, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Investment in Drug Development and Research

- 4.2.2 Increasing Demand for High-Throughput Screening

- 4.2.3 Technological Advancements in Automated Liquid Handling Systems

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Labor in Developing Countries

- 4.3.2 High Cost and Complexity

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Manual Liquid Handling

- 5.1.2 Automated Liquid Handling

- 5.1.3 Semi-Automated Liquid Handling

- 5.2 By Product

- 5.2.1 Automated Workstations

- 5.2.2 Pipettes

- 5.2.3 Dispensers

- 5.2.4 Burettes

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Drug Discovery

- 5.3.2 Cancer and Genomics Research

- 5.3.3 Clinical Diagnostics

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical and Biotechnology Industry

- 5.4.2 Contract Research Organization

- 5.4.3 Academic Institutes

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies

- 6.1.2 Bio-Rad Laboratories

- 6.1.3 Corning Incorporated

- 6.1.4 Eppendorf AG

- 6.1.5 Hamilton Company

- 6.1.6 Labcyte Inc.

- 6.1.7 PerkinElmer, Inc.

- 6.1.8 Promega Corporation

- 6.1.9 Thermo Fisher Scientific, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS