PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642125

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642125

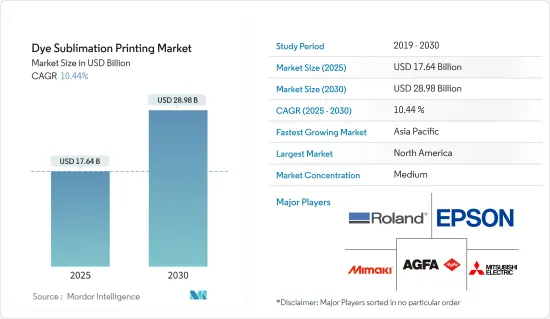

Dye Sublimation Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Dye Sublimation Printing Market size is estimated at USD 17.64 billion in 2025, and is expected to reach USD 28.98 billion by 2030, at a CAGR of 10.44% during the forecast period (2025-2030).

Key Highlights

- Dye sublimation printing, known for its high-quality photographic results, uses heat to transfer colored dye pigments from a carrier film to the PVC printing surface, where they bond chemically. This method is quickly becoming popular in the promotional products market because it can be used on many products, from fabrics to hard materials. Unlike traditional printing, dye sublimation embeds colors permanently into the material, ensuring they do not fade or crack, even after multiple washes, with images remaining intact.

- In recent years, the demand for dye sublimation printers has grown significantly, leading printer vendors to produce high-speed, high-volume systems for industrial use. These printers have better designs, improved printheads, and other components, which increase demand. The latest printheads offer faster print speeds and an automatic circulation system, reducing printhead nozzle clogs, a common cause of downtime.

- The garment industry is increasingly choosing dye sublimation printing solutions. One key reason is its design flexibility, which is better than traditional screen printing. Famous designers like Alexander McQueen and Mary Katrantzou prefer digital printing for smaller prints because it is cost-effective.

- Additionally, the market is seeing more funding for new players and start-ups, supporting its growth. For example, in May 2024, Hannto Technology Co. Ltd raised CNY 300 million (USD 41.5 million) to build a new production facility in China. This facility is expected to produce around 3 million intelligent printing devices. Hannto plans to use the funds for technology research and development (R&D) and product development to expand its range of inkjet, dye sublimation, and laser printers.

- However, dye sublimation printers, known for their excellent quality, are slower than inkjet printers. Additionally, the complex multi-step dye-sublimation process, which ensures high-quality prints, increases costs. This higher expense is a significant obstacle to market growth.

Dye Sublimation Printing Market Trends

Transformation of Home Textile Decor Landscape Aiding the Market Growth

- Dye sublimation printing is excellent for home textiles like curtains, cushions, and other custom accessories. This method works well on flame-resistant fabrics and does not need extra steps after printing, making it ideal for the upholstery and contract furnishing industry.

- Contract furnishing companies worldwide use dye sublimation printing, increasing the demand for these printers. For example, Meshtex Printing Services in the United Kingdom offers various outdoor items, like furniture covers and umbrellas, printed with this technology. Also, as more people want personalized furnishings, the market is expected to grow.

- The rise in urbanization and higher disposable incomes are significant factors driving the demand for home decor. This shift is changing global social norms, with urban culture becoming more dominant. According to the US Census Bureau, retail sales for clothing and accessories stores in the United States reached USD 20.94 billion in February 2023, up from USD 20.15 billion in 2022.

- Various vendors are expanding their product lines with new printers and solutions to meet the growing demand. For instance, Seiko Epson Corporation, a leading dye sublimation printer provider, added the SC-F10000H, a 76-inch industrial-grade textile printer, to its range.

- However, the demand for printed fabrics in home textiles is increasing, and the demand for wall-covering products has declined. This decline is primarily due to the challenges of removing existing wallpaper, which requires specific tools and chemicals. The process is often labor-intensive and time-consuming, deterring many consumers from opting for wallpaper. This shift in consumer preference has led to a steady decrease in the popularity of traditional wall-covering products, impacting the market growth.

Asia-Pacific's Textile Sector Fuels Dye Sublimation Printing Market Growth

- The dye sublimation printing market in Asia-Pacific is increasing, driven by the region's expanding textile industry. Key reasons include the trend toward shorter fashion cycles, the rapid adoption of new technologies, and the growth of the e-commerce sector.

- The National Bureau of Statistics reports that China's clothing fabric production increased from 2.77 billion meters in December 2023 to approximately 4.81 billion meters in January and February 2024. China's growing digital printing sector significantly supports this growth.

- The IBEF highlights India's textile sector, one of the country's oldest industries, and it is expected to reach a value of USD 209 billion by 2029. The region is seeing more digital printing because customers want quicker results. As end-user sectors, especially textiles, demand more innovative results, digital printing's importance is set to rise, ultimately impacting the dye sublimation printing market's growth.

- India's interest in dye sublimation printing grew a decade ago after the IPL's campaign when Epson introduced IPL-themed t-shirts through its Surecolor SC-F6070 and SC-F 7070 printers. With such events becoming more popular, the market for dye sublimation printing is expected to grow further in the coming years.

- The region's companies focus on sustainable practices with advanced, eco-friendly printers. For example, in May 2024, the Colorjet Group launched the Polo Earth, a 3.2-meter eco-solvent printer. This move shows the company's commitment to eco-friendly large-format printing, meeting the rising demand for sustainable solutions.

Dye Sublimation Printing Industry Overview

The dye sublimation printing market is semi-consolidated due to a few significant players. The market is rapidly growing with the textile sector's increasing adoption of dye sublimation printing. The key players in the market are Seiko Epson Corporation, Roland DGA Corporation, Agfa-Gevaert Group, Mimaki Engineering Co. Ltd, Mitsubishi Electric Corporation, HP Development Company LP, and Mutoh Europe NV. The players in the market are focusing on increasing their market share through product launches and acquisitions.

April 2024: Seiko Epson Corporation announced the launch of two new industrial SureColor F-Series dye-sublimation printers to increase production efficiency and productivity for textile print vendors. The new printers will help clients adapt to changing textile trends and meet market demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of Impact of Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growing Apparel Market

- 5.1.2 Increase in Marketing and Advertisement Spending

- 5.2 Market Restraint

- 5.2.1 Capital Expenditure and Consumption Cost

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Garments

- 6.1.2 Technical Textiles

- 6.1.3 Household

- 6.1.4 Visual Communication

- 6.1.5 Rigids

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.3.1 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Seiko Epson Corporation

- 7.1.2 Roland DGA Corporation

- 7.1.3 Agfa-Gevaert Group

- 7.1.4 Mimaki Engineering Co. Ltd

- 7.1.5 Mitsubishi Electric Corporation

- 7.1.6 Colorjet Group

- 7.1.7 Sawgrass Technologies Inc.

- 7.1.8 HP Development Company LP

- 7.1.9 Gandy Digital Ltd

- 7.1.10 Klieverik Heli BV

- 7.1.11 Mutoh Europe NV

- 7.1.12 Dai Nippon Printing Co. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET