PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851753

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851753

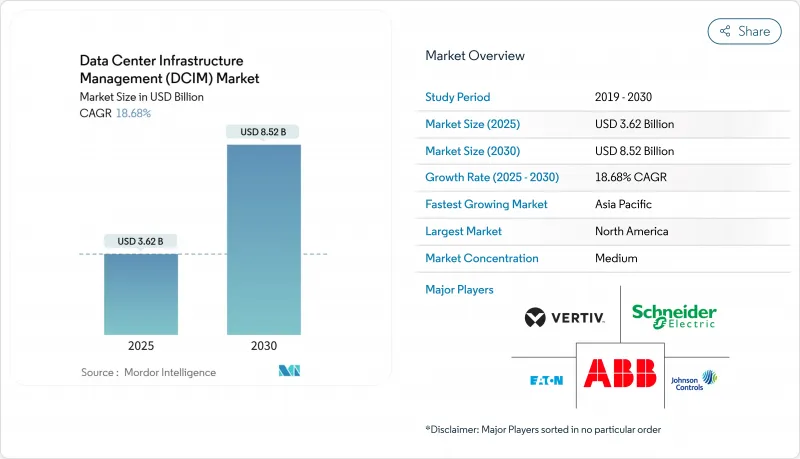

Data Center Infrastructure Management (DCIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Data Center Infrastructure Management market is valued at USD 3.62 billion in 2025 and is forecast to reach USD 8.52 billion by 2030, expanding at an 18.68% CAGR.

Growth is propelled by AI-driven thermal loads, mandatory energy-use disclosure rules in the European Union, and a global wave of hyperscale projects that now top 500 MW per campus. Providers increasingly embed predictive analytics to meet cyber-insurance telemetry requirements and to convert regulatory compliance into measurable energy savings. Services linked to managed DCIM operations are accelerating fastest because data-center operators face persistent shortages of facility engineers. Competitive activity centres on integrated hardware-software portfolios that optimise cooling, power, and asset utilisation at rack level. Investors are tying financing costs to verifiable ESG metrics, turning DCIM-verified efficiency into a differentiator for new builds and retrofits.

Global Data Center Infrastructure Management (DCIM) Market Trends and Insights

Accelerated Pursuit of Net-Zero and Mandatory Energy-Use Disclosure

The EU Energy Efficiency Directive requires all data centers above 500 kW to disclose Power Usage Effectiveness, Carbon Usage Effectiveness, and Water Usage Effectiveness by September 2024, repositioning DCIM from optional optimisation software to mandatory compliance infrastructure. Operators that deployed real-time DCIM report 18% energy savings through dynamic capacity forecasting, demonstrating tangible returns on regulatory spending. Multinationals now standardise identical DCIM stacks in every facility to streamline sustainability reporting and to avoid region-specific audits. Demand is spreading beyond Europe because investors demand harmonised ESG disclosures. The directive also covers centres consuming nearly 3% of EU electricity, so incremental efficiency gains translate into region-wide grid relief.

Hyperscale Build-Outs Exceeding 500 MW Clusters

Campus-scale investments such as Compass Datacenters' USD 10 billion Mississippi project require DCIM platforms that coordinate thousands of racks across modular power and cooling skids. Traditional building-management systems cannot deliver rack-level telemetry or predictive failure alerts at gigawatt scale. Integration with prefabricated power modules, exemplified by Siemens' multi-year supply agreement, tightens the link between DCIM software and electrical infrastructure. Operators prioritise real-time visualisation of airflow and capacity to shave operating expenses as capital intensity rises. The shift to 500 MW-plus footprints thus anchors DCIM at the heart of project feasibility studies.

Persistent OT-IT Integration Complexity and Legacy BMS Overlap

Legacy building-management systems often rely on proprietary protocols that do not interoperate with modern DCIM APIs. Operators then duplicate sensors and dashboards, inflating both capex and opex while still lacking a unified asset inventory. Custom middleware projects add months to deployment schedules and raise lifecycle costs because upgrades must be recoded. In multi-vendor estates, each mechanical contractor may lock functionality inside closed toolchains, hampering holistic energy optimisation.

Other drivers and restraints analyzed in the detailed report include:

- Edge and Micro-Data-Center Proliferation for 5G/IoT

- AI/ML-Driven Thermal Loads Demanding Real-Time CFD-Coupled DCIM

- Data-Sovereignty Worries About Cloud-Hosted DCIM Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services revenue is projected to climb at 23.34% CAGR because 58% of operators report difficulty hiring qualified facility engineers. Asset-management rollouts now shift from project-based implementations to subscription frameworks that bundle continuous optimisation. Managed services also absorb the complexity of tuning liquid-cooling loops that accompany AI clusters. Though Solutions held 66.2% of Data Center Infrastructure Management market share in 2024, the rise of outcome-based contracts points to a service-centric future. Enterprises prefer to cap labour overheads by outsourcing sensor calibration, firmware management, and compliance reporting.

Demand for Network and Connectivity Management functions also increases as edge nodes expand, while Power and Cooling Management stays critical for hyperscale sites. Vendors package integration accelerators that bridge legacy BMS so clients see a single pane of glass. The evolution underscores a strategic pivot from one-off software licences toward recurring revenue backed by expert support.

Mega facilities, defined as campuses above 150 MW, are expected to post a 21.96% CAGR, displacing Massive facilities that dominated earlier cloud waves. Operators centralise AI training clusters because GPU interconnect benefits outweigh latency penalties. Mega campuses unlock economies of scale, allowing liquid cooling loops to be shared across several halls and driving cooling plant efficiency below 1.1 PUE. The Data Center Infrastructure Management market size for this segment will expand rapidly as orchestration complexity multiplies with sensor counts running into millions.

The migration toward mega-scale campuses also seeds innovation in modular power skids and prefabricated hall segments that arrive with factory-tested DCIM integrations. Smaller enterprise facilities retain a role for latency-sensitive workloads, but budget constraints limit adoption of advanced digital-twin modules.

Data Center Infrastructure Management (DCIM) Market Report Segments the Industry Into Data Center Size(Small and Medium, and More), Deployment Type (On -Premise, Colocation), Component(solutions, Services), End-User Industry(IT and Telecom, BFSI and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 42.4% of 2024 revenue thanks to hyperscale builds and early adoption of AI training centres. Operators there deploy liquid cooling and digital twins to push rack densities past 50 kW, amplifying DCIM spending. Federal and state energy-efficiency incentives further reinforce the business case for real-time monitoring.

Asia-Pacific is forecast to grow at 35.23% CAGR through 2030 as China targets a USD 125 billion data-center economy by 2027 and India accelerates under the Digital India initiative. Japan faces the world's highest construction costs, driving interest in automated DCIM to extract maximum capacity from every square metre. Singapore and Australia act as regional hubs, supplying cross-border cloud services that must meet diverse compliance mandates.

Europe maintains steady expansion on the back of the Energy Efficiency Directive. Operators race to meet September 2024 reporting deadlines, integrating DCIM into both brownfield retrofits and new builds. Middle Eastern and South American markets show rising demand as regional cloud providers localise infrastructure to cut latency. Africa remains nascent but is expected to adopt lightweight DCIM as mobile-internet use increases.

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd

- Eaton Corporation plc

- Johnson Controls International plc

- IBM Corporation

- Siemens AG

- CommScope (Nlyte and iTRACS)

- Sunbird Software

- FNT GmbH

- Device42

- Panduit Corp.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd

- Raritan Inc. (Legrand)

- Siemens Smart Infrastructure

- EkkoSense Ltd

- RFcode Inc.

- Modius Inc.

- OpenDCIM (open-source)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated pursuit of net-zero and mandatory energy-use disclosure

- 4.2.2 Hyperscale build-outs exceeding 500 MW clusters

- 4.2.3 Edge and micro-data-center proliferation for 5G/IoT

- 4.2.4 AI/ML-driven thermal loads demanding real-time CFD-coupled DCIM

- 4.2.5 Cyber-insurance policies now requiring DCIM-based risk telemetry

- 4.2.6 ESG-linked financing that scores DCIM-verified efficiency metrics

- 4.3 Market Restraints

- 4.3.1 Persistent OT-IT integration complexity and legacy BMS overlap

- 4.3.2 Data-sovereignty worries about cloud-hosted DCIM platforms

- 4.3.3 Shortage of DCIM-literate facility engineers

- 4.3.4 Rising AI rack densities outpacing sensor network retrofits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

- 4.9 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Asset and Capacity Management

- 5.1.1.2 Power and Cooling Management

- 5.1.1.3 Network and Connectivity Management

- 5.1.2 Services

- 5.1.2.1 Consulting and Integration

- 5.1.2.2 Managed and Support Services

- 5.1.1 Solutions

- 5.2 By Data-Center Size

- 5.2.1 Small

- 5.2.2 Medium

- 5.2.3 Large

- 5.2.4 Massive

- 5.2.5 Mega

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Colocation

- 5.3.2.1 Retail Colo

- 5.3.2.2 Wholesale / Hyperscale Colo

- 5.3.3 Cloud / DCIM-as-a-Service

- 5.4 By End-User Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Healthcare and Life-Sciences

- 5.4.4 Government and Defence

- 5.4.5 Manufacturing and Industrial

- 5.4.6 Retail and E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Singapore

- 5.5.3.5 Australia

- 5.5.3.6 Malaysia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirate

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Vertiv Group Corp.

- 6.4.3 ABB Ltd

- 6.4.4 Eaton Corporation plc

- 6.4.5 Johnson Controls International plc

- 6.4.6 IBM Corporation

- 6.4.7 Siemens AG

- 6.4.8 CommScope (Nlyte and iTRACS)

- 6.4.9 Sunbird Software

- 6.4.10 FNT GmbH

- 6.4.11 Device42

- 6.4.12 Panduit Corp.

- 6.4.13 Cisco Systems Inc.

- 6.4.14 Huawei Technologies Co. Ltd

- 6.4.15 Raritan Inc. (Legrand)

- 6.4.16 Siemens Smart Infrastructure

- 6.4.17 EkkoSense Ltd

- 6.4.18 RFcode Inc.

- 6.4.19 Modius Inc.

- 6.4.20 OpenDCIM (open-source)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment