PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641843

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641843

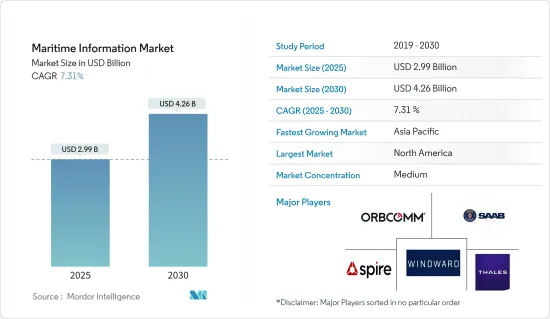

Maritime Information - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Maritime Information Market size is estimated at USD 2.99 billion in 2025, and is expected to reach USD 4.26 billion by 2030, at a CAGR of 7.31% during the forecast period (2025-2030).

The maritime information market plays a pivotal role in global maritime operations, enabling efficient management of marine logistics and vessel tracking. It integrates diverse technologies like Automatic Identification Systems (AIS), Synthetic Aperture Radar (SAR), and satellite imaging to provide real-time data, enhancing safety and operational efficiency. The market serves a wide range of stakeholders, including government agencies, commercial shipping companies, and port operators, underlining its essential role in the maritime industry.

The adoption of maritime information systems is primarily driven by the increasing need for safety and compliance on vessels. These systems are crucial for monitoring routes, identifying risks, and ensuring adherence to international maritime regulations. As the shipping industry grows, companies are using advanced data analytics to optimize routes, reduce fuel consumption, and improve operational efficiency. Increased investments in port logistics and marine traffic analytics further support the market's expansion.

The Growing Importance of On-board Safety and Compliance

Key Highlights

- Enhancing On-board Safety: Maritime information systems have revolutionized safety management on ships by offering real-time data on vessel conditions. This allows crew members to quickly identify potential safety hazards. AIS and Vessel Identification and Tracking technologies help monitor ship movements, particularly in congested waters, thereby reducing accidents and the likelihood of collisions.

- Ensuring Compliance with International Standards: Compliance with regulations, especially those set by the International Maritime Organization (IMO), has gained significance. Maritime information systems aid in meeting these standards by providing accurate data on operational practices, reducing the risk of non-compliance penalties, and ensuring vessels are seaworthy.

- Cost Savings through Data Optimization: These technologies enable shipowners to plan optimal routes, reducing fuel consumption and operational costs. The benefits of compliance extend to cost management, making these systems attractive to stakeholders.

- Stricter Regulations Fueling Demand: Global regulatory bodies increasingly emphasize compliance with international maritime safety standards, pushing for broader adoption of these technologies across the shipping industry.

Cybersecurity Concerns Threaten Maritime Operations

Key Highlights

- Rising Cybersecurity Threats: As maritime operations become more digital, they face increasing risks from cyber attacks. Ship management software and maritime data analytics platforms are vulnerable to hacking, exposing global trade to significant disruptions. A breach could affect shipping routes, delay deliveries, or even lead to accidents.

- Complicated Global Shipping Networks: The complexity of global maritime networks, involving multiple stakeholders such as port authorities, ship operators, and data providers, creates numerous entry points for cybercriminals. Misuse of vessel tracking systems or breaches in satellite communication networks could have far-reaching consequences.

- Growing Focus on Cybersecurity Frameworks: Governments and industry leaders are prioritizing cybersecurity investments to protect maritime data. Improved communication systems and cyber defense mechanisms are being developed to secure sensitive trade information and maintain the continuity of maritime operations.

- Investment in Cybersecurity Solutions: The maritime industry's reliance on digital systems necessitates robust cybersecurity measures. Companies and governments are increasingly focusing on secure communication networks and cyber defense mechanisms to mitigate risks.

Maritime Information Market Trends

Automated Identification Systems to Dominate the Market

- Key Role of AIS in Maritime Operations: Automated Identification Systems (AIS) are critical to global maritime safety and operational efficiency. AIS technology provides real-time vessel tracking and communication, enabling better decision-making for maritime authorities and operators. As global shipping grows more complex, accurate vessel tracking and data analytics become essential.

- Demand for Regulatory Compliance Driving AIS Adoption: Many governments have mandated AIS use for certain vessel types, boosting the demand for AIS technologies. The rise in global trade and the need for efficient vessel management systems further support this trend. Regulatory bodies like the IMO are instrumental in pushing these advancements.

- Technological Advancements in AIS Systems: The evolution of AIS includes its integration with broader maritime information systems that support predictive analytics, fleet management, and cybersecurity. These integrations allow shipping companies to optimize operations, cut costs, and predict maintenance needs, enhancing the market outlook for AIS technologies.

- Steady Growth of AIS Technology: The AIS market is projected to expand as public and private investments in maritime infrastructure increase. The digitalization of global shipping further supports the growth of AIS, which remains central to improving safety and efficiency in marine transport.

Asia Pacific to Witness the Significant Growth

- Strategic Importance of Asia-Pacific in Global Trade: The Asia-Pacific region is set to dominate the maritime information market, driven by its role in global trade and expanding port infrastructure. Countries such as China, Japan, and South Korea are investing heavily in maritime technologies, including AIS and advanced port logistics systems. These investments are crucial for managing the region's vast shipping traffic and driving market growth.

- Investments in Maritime Infrastructure: China leads the region in investing in port technologies and vessel tracking systems to enhance its extensive maritime trade routes. Southeast Asian nations are upgrading their maritime infrastructure, focusing on efficiency, sustainability, and compliance with international standards. This infrastructure development fuels further market growth in the region.

- Advanced Port Traffic Systems: Asia-Pacific ports, being among the busiest globally, rely on sophisticated maritime information systems to handle the increasing volume of trade. Marine traffic analytics and data-driven tools help ports manage logistics more effectively, reducing bottlenecks and improving operational efficiency.

- Environmental and Cybersecurity Concerns: Governments in the region are increasingly prioritizing environmental sustainability, focusing on green technologies to reduce emissions. Cybersecurity concerns are also driving the adoption of secure maritime information systems, reinforcing the region's dominance in the global market.

Maritime Information Industry Overview

Semi Consolidated Market: The maritime information market is Semi consolidated, with both specialized companies and large defense conglomerates playing pivotal roles. Although no single company dominates the market, leading firms shape the industry's future through innovations in maritime data analytics and communication systems.

Focus on Advanced Analytics and Connectivity: Companies such as Windward Limited, SAAB Group, Thales Group, ORBCOMM Inc., and Spire Global are key players in the market. These companies excel in satellite communication, data analytics, and defense technologies, providing comprehensive solutions for the maritime sector. Their advanced platforms offer real-time monitoring of shipping activities, helping improve operational efficiency and security.

Trends Driving Growth: The demand for real-time tracking, enhanced safety protocols, and data-driven decision-making is reshaping the market. Satellite-based maritime solutions and AI-powered platforms are becoming essential for stakeholders aiming to enhance transparency and reduce risks in global shipping.

Strategic Investment for Future Success: To thrive in this market, companies must continue developing secure communication systems while integrating big data and AI. As the maritime industry evolves, the ability to offer robust cybersecurity and real-time data solutions will be key to staying competitive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Importance of On-board Safety and Compliance

- 5.2 Market Challenges

- 5.2.1 Cybersecurity Concerns Threaten Maritime Operations

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Automatic Identification Systems

- 6.1.2 Synthetic Aperture Radar

- 6.1.3 Vessel Identification and Tracking

- 6.1.4 Satellite Imaging

- 6.1.5 Other Applications

- 6.2 By End-user

- 6.2.1 Government

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Windward Limited

- 7.1.2 SAAB group

- 7.1.3 Thales Group

- 7.1.4 ORBCOMM Inc.

- 7.1.5 Spire Global

- 7.1.6 Iridium Communications Inc.

- 7.1.7 Inmarsat Global Limited

- 7.1.8 Northrop Grumman Corporation

- 7.1.9 BAE Systems

- 7.1.10 L3 Harris Technologies, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET