PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851821

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851821

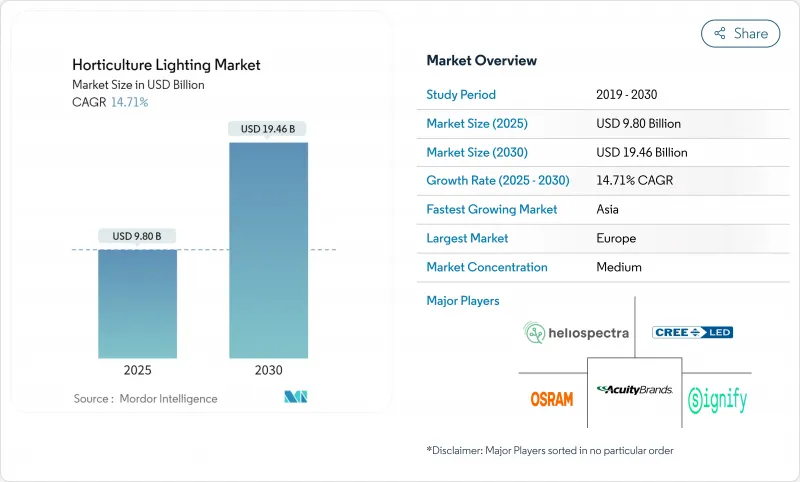

Horticulture Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The horticulture lighting market stood at USD 9.80 billion in 2025 and is forecast to reach USD 19.46 billion by 2030, advancing at a 14.71% CAGR.

This rapid expansion is powered by the migration from high-pressure sodium systems to precision-tuned LEDs that cut energy use by up to 60% while improving metabolite production. Legal cannabis cultivation, urban food-security programs and mandatory European energy directives are reshaping capital spending across controlled-environment agriculture. Hardware vendors now embed AI controls that fine-tune spectra hour-by-hour, giving growers a decisive edge on yield and quality. Meanwhile, regional subsidy programs and the sunset of mercury-containing lamps remove many lingering barriers to adoption.

Global Horticulture Lighting Market Trends and Insights

Precision-tuned LED Spectra Elevating Cannabis Economics

Research trials show that white light with dual red peaks at 640 nm and 660 nm increases bud weight and light-use efficiency versus single-peak systems. Far-red supplementation shortens the daily lighting cycle from 12 hours to 10 hours while preserving cannabinoid content, trimming a further 5.5% in power use. Commercial growers therefore view spectral recipes as proprietary IP, and willingly pay 30-40% price premiums for cannabis-optimized fixtures. Premium pricing shields suppliers from commodity margin pressure and attracts new venture capital to the horticulture lighting market. Ongoing legalization across U.S. states and Germany's adult-use bill will lock in multi-year demand visibility.

Urban Food-Security Programs Accelerate Vertical-Farm Growth

Asian megacities champion vertical farming to offset land scarcity and import dependence. Dubai's GigaFarm project targets 3 million kg annual output using stacked hydroponic towers lit exclusively by LEDs. The UAE alone aims to commission 500 vertical farms by 2026. Taiwan's Everlight and Fucai leverage geographic proximity to supply tailored luminaires, cutting lead times and logistics costs for regional growers. Because lighting represents 25-45% of vertical-farm opex, every incremental efficiency gain feeds directly into profit margins. As a result, the horticulture lighting market finds its highest unit growth in compact, city-centric farms rather than traditional greenhouses.

Material Cost Inflation Squeezes Fixture Margins

Aluminium heat sinks account for up to 30% of bill-of-materials in high-power grow lights. Spot prices rose 28% year-on-year, while rare-earth phosphors jumped in tandem, eroding gross margins for fixture makers. US-China tariffs of 104% on lighting components further inflated landed costs for North American importers. Vendors now dual-source from Vietnam and India, yet shipment rates doubled to more than USD 200,000 per container, limiting savings. Smaller firms defer capital investment, slowing innovation cadence and reducing competitive intensity in the horticulture lighting industry.

Other drivers and restraints analyzed in the detailed report include:

- EU Fit-for-55 Directive Catalyzes Retrofit Wave

- Corporate ESG Green Bonds Unlock Capital for Smart Lighting

- Photobiological Safety Compliance Delays Product Launches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LEDs held an 80.3% slice of the horticulture lighting market in 2024 on the strength of efficiency gains that cut power bills by up to 60%. The sub-50 W category is on course for an 18.6% CAGR as vertical farms deploy dense, low-heat modules to reach lower canopies. High-power 50-300 W devices continue to dominate greenhouse retrofits, while >300 W engines serve large campus operations requiring high photon flux densities. Fluorescent lamps began a steep phase-out after the February 2025 mercury ban, and plasma systems now sit in specialist niches. Samsung's stated intent to exit LEDs by 2030 signals that scale alone is insufficient without application-specific expertise.

As LEDs shift from disruptive novelty to essential infrastructure, competitive focus moves to spectral flexibility and software hooks. ams OSRAM's Q3 2024 results revealed seasonal sales spikes aligned with crop calendars rather than technology adoption curves. Suppliers are therefore synchronizing product launches with planting windows, reflecting a maturing horticulture lighting market. Collaborative R&D between fixture makers and seed breeders is also emerging, aiming to co-optimize genetics and light recipes for maximum yield.

Hardware still captured 91.4% of spending in 2024, reflecting the high upfront cost of fixtures and drivers. Yet the software and services slice is rising at a 20.8% CAGR as growers look beyond simple lumen output to algorithmic control. Platforms such as Sollum's Smart LED system link crop physiology databases with dynamic dimming to boost productivity. Philips' GrowWise tie-in with Hoogendoorn's climate computers bundles lighting, HVAC and irrigation within one dashboard.

Recurring software fees create predictable annuity streams for manufacturers and incentivize continuous feature upgrades. Over time, differentiated analytics could eclipse component efficiency as the chief competitive lever in the horticulture lighting market. Early-mover vendors invest in data science talent, turning decades of photobiology studies into commercial algorithms that command premium pricing.

The Horticulture Lighting Market Report is Segmented by Lighting Technology (LED, HID, Fluorescent, and More), Offering (Hardware, and Software and Services), Installation Type (New Installations, and Retrofit Installations), Cultivation (Vegetables and Fruits, Tomatoes and Peppers, and More), Application (Greenhouses, Indoor and Vertical Farms, and More), and Geography). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe led the horticulture lighting market with a 34.7% share in 2024, sustained by stringent energy mandates and century-old greenhouse clusters in the Netherlands and Germany. Trials proving 40% heat input cuts under full-LED regimes strengthen the economic case even before carbon penalties apply. Subsidies for smart-farm tech in Scandinavia further buoy demand.

Asia-Pacific delivers the fastest growth at 15.3% CAGR to 2030, anchored by China, Japan and Singapore's vertical-farm roll-outs. Taiwanese LED makers Everlight and Fucai tailor high-margin horticulture SKUs for local integration, supporting a regional horticulture lighting market size expected to top USD 2.06 billion by 2029. Rapid urbanization and food-import reliance make in-city farms politically attractive.

North America shows steady momentum despite tariff-driven cost volatility. Cannabis legalization in additional U.S. states funnels capital into spectrum-specific fixtures that lift cannabinoid yields. South America and the Middle East are nascent but promising: Gulf states pioneer solar-powered greenhouses that cut water use by 70%, showcasing off-grid models transferable to other arid zones.

- Signify Holding

- ams OSRAM AG

- Fluence Bioengineering (Scotts Miracle-Gro)

- Heliospectra AB

- Hortilux Schreder

- Gavita International BV

- Valoya Oy

- LumiGrow Inc.

- Samsung Electronics Co. Ltd.

- LG Innotek

- Cree LED (SMART Global)

- Current Lighting Solutions

- Everlight Electronics

- Hort Americas LLC

- B-Light Group

- California LightWorks

- Agrolux Nederland BV

- Illumitex Inc.

- Deere and Co. (Infinite Vertical)

- Nanolux Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Precision-tuned LED spectra raising cannabinoid yield in North American cannabis grows

- 4.2.2 Urban food-security programs accelerating vertical-farm lighting demand across Asian megacities

- 4.2.3 EU "Fit-for-55" energy directives incentivising LED retrofits in heated glass greenhouses

- 4.2.4 Surge in off-grid micro-powered CEA* solutions for desert farming in Gulf Cooperation Council Countries

- 4.2.5 Corporate ESG-linked green bonds funding large-scale horticultural greenhouse LED roll-outs

- 4.3 Market Restraints

- 4.3.1 Acute aluminium and rare-earth cost inflation squeezing high-power LED fixture margins

- 4.3.2 Fragmented regional import tariffs complicating fixture price parity for Asia-Pacific growers

- 4.3.3 Photobiological safety compliance costs delaying spectrum-tuning product launches in EU

- 4.3.4 Limited DALI/KNX interoperability curbing smart-lighting adoption in legacy greenhouses

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Lighting Technology

- 5.1.1 LED

- 5.1.1.1 By Chip Power Rating

- 5.1.1.1.1 Les than 50 W

- 5.1.1.1.2 50-300 W

- 5.1.1.1.3 Above 300 W

- 5.1.2 HID

- 5.1.2.1 Metal Halide (MH)

- 5.1.2.2 High-Pressure Sodium (HPS)

- 5.1.3 Fluorescent

- 5.1.4 Plasma and Others

- 5.1.1 LED

- 5.2 By Offering

- 5.2.1 Hardware (Fixtures, Drivers, Controls)

- 5.2.2 Software and Services

- 5.3 By Installation Type

- 5.3.1 New Installations

- 5.3.2 Retrofit Installations

- 5.4 By Cultivation

- 5.4.1 Vegetables and Fruits

- 5.4.2 Leafy Greens and Micro-greens

- 5.4.3 Berries

- 5.4.4 Tomatoes and Peppers

- 5.4.5 Flowers and Ornamentals

- 5.4.6 Cannabis and Specialty Crops

- 5.4.7 Other Crops

- 5.5 By Application

- 5.5.1 Greenhouses

- 5.5.2 Indoor and Vertical Farms

- 5.5.3 Research/Academic Facilities

- 5.5.4 Aquaponics and Container Farms

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Signify Holding

- 6.4.2 ams OSRAM AG

- 6.4.3 Fluence Bioengineering (Scotts Miracle-Gro)

- 6.4.4 Heliospectra AB

- 6.4.5 Hortilux Schreder

- 6.4.6 Gavita International BV

- 6.4.7 Valoya Oy

- 6.4.8 LumiGrow Inc.

- 6.4.9 Samsung Electronics Co. Ltd.

- 6.4.10 LG Innotek

- 6.4.11 Cree LED (SMART Global)

- 6.4.12 Current Lighting Solutions

- 6.4.13 Everlight Electronics

- 6.4.14 Hort Americas LLC

- 6.4.15 B-Light Group

- 6.4.16 California LightWorks

- 6.4.17 Agrolux Nederland BV

- 6.4.18 Illumitex Inc.

- 6.4.19 Deere and Co. (Infinite Vertical)

- 6.4.20 Nanolux Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment