PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642095

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642095

Europe Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

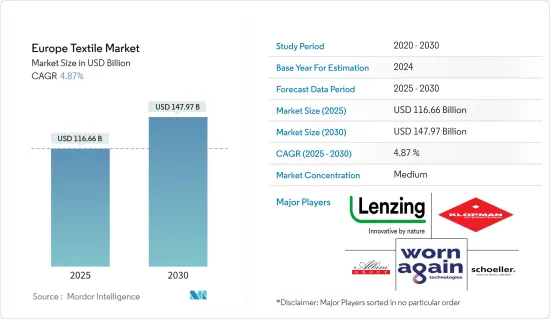

The Europe Textile Market size is estimated at USD 116.66 billion in 2025, and is expected to reach USD 147.97 billion by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

In Europe, the textile industry is a cornerstone of the manufacturing workforce. Consumer behavior has shifted noticeably toward embracing the latest fashion trends, particularly among the younger generation. The introduction of new collections every three weeks has fueled this trend, encouraging consumers to adopt more frequent purchasing habits.

Digital platforms and online marketing strategies have gained prominence in the European fashion market, leading to the emergence of numerous new brands leveraging e-commerce platforms. These digital channels, along with innovations such as virtual reality, have enabled companies to engage with consumers in novel ways. The fashion and apparel sector has experienced significant growth in e-commerce sales, contributing to overall revenue growth in the European textile market.

The rise of online platforms has facilitated increased consumer spending on clothing through digital channels, further fueling sales growth in the textile market in Europe.

Europe Textile Market Trends

Impact of Sustainability and Innovation Driving Market Growth

The European textile market has demonstrated strong growth, with notable increases in market expansion over recent years.

One of the primary drivers of this growth is the rising consumer demand for sustainable and eco-friendly textiles. Increased awareness of environmental issues has spurred interest in textiles made from organic and recycled materials. This trend is supported by advancements in technology and manufacturing processes, which now allow for the production of high-quality, environmentally responsible fabrics. As consumers prioritize sustainability, their preference for eco-friendly products is fueling market growth.

The continual evolution of the textile industry in Europe reflects a broader shift toward sustainability, with innovative practices and materials leading to a more dynamic and expanding market. This positive trend indicates a robust future outlook for the sector, driven by changing consumer values and technological progress.

UK Textile Market Witnessing Growth

The textile market in the United Kingdom has experienced steady growth across various segments. Children's apparel, men's apparel, and women's apparel have all seen increases in market value, reflecting a positive trend in consumer spending.

One of the primary drivers of this growth is the shift toward personalized and high-quality clothing. The increase in disposable incomes and a growing emphasis on fashion and personal style have driven a higher demand for a variety of premium apparel. Furthermore, the growing e-commerce and digital platforms have made it more convenient for consumers to explore and purchase a broad selection of clothing options, supporting market expansion.

Sustainability is another significant factor influencing the market. Consumers are increasingly seeking eco-friendly and ethically produced garments, driving the market toward more sustainable practices. This trend is pushing brands to innovate and adopt environmentally responsible production methods, further fueling market expansion.

Overall, the textile market in the United Kingdom is evolving in response to changing consumer preferences and industry advancements, indicating a robust outlook for continued growth.

Europe Textile Industry Overview

The European textile industry is fragmented, featuring diverse players such as Lenzing AG, Worn Again Technologies, Klopman International, Albini Group, and Schoeller Textil AG. These companies drive innovation in sustainability, technical textiles, and premium fabrics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Rapid Changes in Fashion Trends and the Rise of Fast Fashion Contribute to Increased Textile Consumption and Demand for New Designs

- 4.3.2 Increased Urbanization and Changing Lifestyles Boost Demand for a Variety of Textile Products, From Home Furnishings to Clothing

- 4.4 Market Restraints

- 4.4.1 Elevated Costs of Raw Materials and Manufacturing Processes Can Limit Profitability and Price Competitiveness

- 4.5 Market Opportunities

- 4.5.1 Strategic Collaborations with Designers and Other Industry Players

- 4.5.2 Expanding into Emerging European Markets with Growing Middle-income Populations Can Drive Additional Demand for Textile Products

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

- 4.8 Insights into Latest Technologies Used in the Industry

5 MARKET SEGMENTATION

- 5.1 By Application Type

- 5.1.1 Clothing

- 5.1.2 Industrial/Technical Applications

- 5.1.3 Household Applications

- 5.2 By Material Type

- 5.2.1 Cotton

- 5.2.2 Jute

- 5.2.3 Silk

- 5.2.4 Synthetics

- 5.2.5 Wool

- 5.3 By Process Type

- 5.3.1 Woven

- 5.3.2 Non-woven

- 5.4 By Region

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 Italy

- 5.4.4 Spain

- 5.4.5 United Kingdom

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lenzing AG

- 6.2.2 Worn Again Technologies

- 6.2.3 Klopman International

- 6.2.4 Albini Group

- 6.2.5 Schoeller Textil AG

- 6.2.6 Borges International Group

- 6.2.7 Marzotto Group

- 6.2.8 Gebruder Otto

- 6.2.9 ITV Denkendorf Produktservice GmbH

- 6.2.10 Holland & Sherry *

7 FUTURE MARKET TRENDS

8 DISCLAIMER