PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433909

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433909

Global Renal Dialysis Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

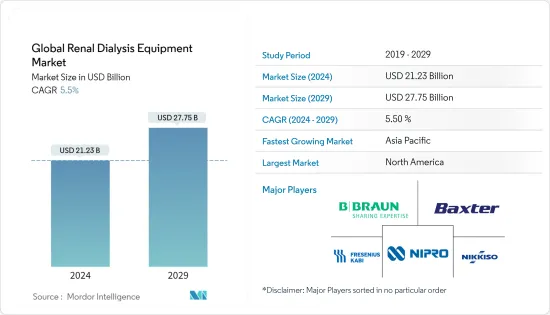

The Global Renal Dialysis Equipment Market size is estimated at USD 21.23 billion in 2024, and is expected to reach USD 27.75 billion by 2029, growing at a CAGR of 5.5% during the forecast period (2024-2029).

The COVID-19 pandemic had an impact on the healthcare sector. People affected by the COVID-19 pandemic were found to develop kidney diseases and other chronic conditions. According to a Johns Hopkins University article on the impact of COVID-19 on kidney diseases updated in March 2022, some people infected with COVID-19 showed signs of kidney damage, and even those with no prior kidney problems were infected. Furthermore, approximately 30% of COVID-19 patients hospitalized in New York and China developed moderate or severe kidney injury. Atypical blood work and high protein levels in the urine were signs of kidney problems in COVID-19 patients, leading to kidney damage and the need for dialysis in some cases. For severe cases, patient recovery took six weeks or more. About 1% of infected patients died from the disease. Thus, COVID-19 had a profound impact on the market studied.

Some factors driving the market growth include the rise in the number of end-stage renal disease patients (ESRD), growing demand for peritoneal dialysis, rise in cost-effective and accurate portable dialysis apparatus, and advanced technologies.

There has been an increase in the incidence of renal diseases, such as kidney diseases, in developed and developing countries. Dialysis is referred to patients with an end-stage renal disorder (ESRD) or chronic kidney disease. According to an article titled 'A Cross-Sectional Assessment of Urinary Tract Infections Among Geriatric Patients: Prevalence, Medication Regimen Complexity, and Factors Associated With Treatment Outcomes' published in the journal of Frontiers in public Health in October 2021, about 7 million outpatient visits, 1 million emergency outpatient visits, and 100,000 hospitalizations were due to urinary tract infections, accounting for about 25% of all infectious diseases in the elderly each year.

As per the article titled 'Epidemiology of chronic kidney disease: an update 2022' published in the journal of Kidney International Supplements in April 2022, chronic kidney disease, a progressive condition, has affected over 10% of the general population worldwide till date, accounting for more than 800 million individuals. The large volume of the population affected by kidney diseases in the world is likely to add to the growth of the renal dialysis equipment market over the forecast period.

The renal dialysis equipment market is expected to show good growth due to the expanding number of dialysis centers, growth in research and development expenditure for developing new dialysis products, and increasing end-stage renal diseases. In November 2021, Fresenius Medical Care showcased new digitalized options that enable patients with end-stage kidney disease to perform dialysis in the comfort of their own homes, including the 5008S hemodialysis (HD) machine and a new automated peritoneal dialysis (APD) machine.

However, factors such as complications and risks associated with dialysis and reimbursement issues may impede the market growth over the forecast period.

Renal Dialysis Equipment Market Trends

Hemodialysis (HD) Equipment Segment is Expected to Exhibit the Fastest Growth Rate over the Forecast Period

Globally, hemodialysis equipment adoption is steadily increasing due to the increasing prevalence of kidney failure patients. It is used to filter wastes and water from the blood. Thus, market players are found focusing on the developments of the new hemodialysis equipment that help in the growth of the overall market.

COVID19 is a very high transmission infectious disease with a variable prognosis in the general population. Patients in hemodialysis therapy are vulnerable to developing an infectious disease. Moreover, risk factors such as age, hypertension, diabetes, cancer, and chronic respiratory and cardiovascular disease are associated with the worst prognosis. For instance, according to an article titled 'COVID-19 Risk Factors and Mortality Outcomes Among Medicare Patients Receiving Long-term Dialysis' published in the journal of Nephrology in November 2021, the conditions of patients with chronic kidney failure associated with COVID-19 were worse. COVID-19 infects the kidneys and may induce acute kidney injury.

Also, another article titled 'Variability in Hemoglobin Levels and the Factors Associated with Mortality in Hemodialysis Patients: A 78-Month Follow-Up Study' published in the International Journal of Environmental Research and Public Health in January 2021 indicated that several risk factors associated with kidney disease, including the hemoglobin variability, played a major role in the severity of the disease. Such associated risk factors are likely to add to the growth of the renal dialysis equipment market.

Some of the factors which are driving the segment growth include the rising prevalence of kidney diseases such as end-stage renal disease (ESRD), along with increasing innovative product launches in the market by market players. According to the National Institute on Diabetes and Digestive and Kidney Diseases (NIDDK), in 2020, ESKD, also known as an end-stage renal disease (ESRD), affects almost 786,000 people in the United States, with 71% requiring dialysis and 29% requiring a kidney transplant. ESKD affects three men for every two women who develop it. However, most of the population remains undiagnosed in the early stages, eventually leading to death worldwide.

Furthermore, technological advancements in healthcare have led to the development of hemodialysis machines with improved ergonomics. For instance, in March 2021, Fresenius Medical Care North America (FMCNA) and DaVita Kidney Care expanded their partnership to provide home dialysis technology, including NxStage home hemodialysis (HHD) machines, dialysis supplies, and a connected health platform. Thus, the above-mentioned factors are expected to drive segment growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market and is Expected to do the Same in the Forecast Period.

The factors driving the market growth in North America include the massive adoption of new technologies in the kidney dialysis division. The large number of people affected by the COVID-19 pandemic also added to the number of people affected by kidney diseases, which added to the market growth. There is also a boom in public healthcare expenditure and increased awareness programs about the availability of advanced treatments.

The novel coronavirus disease 2019 (COVID-19) has a high mortality rate among older adults and individuals suffering from chronic conditions, such as chronic kidney diseases (CKD). According to the Centers for Disease Control and Prevention (CDC) data on chronic kidney disease in the United States 2021 updated in March 2021, about 15% of adults in the United States or around 37 million people suffer from chronic kidney diseases (CKD).

According to an article titled 'CKD Prevalence Among Patients With and Without Type 2 Diabetes: Regional Differences in the United States' published in the journal of Kidney Medicine in January 2022, diabetes mellitus was the leading cause of chronic kidney disease in the United States. The rising number of diabetic patients in the nation also contributed to the increasing number of people affected by chronic kidney disease, thereby adding to the growth of the renal dialysis equipment market.

Some of the market players involved in the United States market include DaVita, Baxter International, Medtronic, and U.S. Renal Care. These players adopted various strategies, such as collaborations, mergers, acquisitions, and product innovations, to maintain their market position. In January 2021, Quanta Dialysis Technologies Ltd, a British medical technology pioneer developing innovative dialysis products and services, received 510(k) clearance from the United States Food and Drug Administration to market its small and simple, high performance hemodialysis system SC+ in the United States.

Thus, the abovementioned factors are expected to drive market growth over the forecast period.

Renal Dialysis Equipment Industry Overview

The renal dialysis equipment market is fragmented and competitive, with several market players. Some market players have used strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions to increase their footprints in this market. Some of the market players include Fresenius Kabi AG, B. Braun Melsungen AG, Baxter International Inc., Nikkiso Co. Ltd, and Nipro Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Peritoneal Dialysis

- 4.2.2 Growth in R&D Expenditure for the Development of New Dialysis Products

- 4.2.3 Increasing Prevalence of Kidney Disease

- 4.3 Market Restraints

- 4.3.1 Complications and Risks Associated with Dialysis

- 4.3.2 Reimbursement Issues

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Hemodialysis (HD) Equipment

- 5.1.2 Peritoneal Dialysis (PD) Equipment

- 5.1.3 Concentrates and Solutions

- 5.1.4 Catheters and Tubings

- 5.1.5 Other Products

- 5.2 By Application

- 5.2.1 Hemodialysis

- 5.2.2 Peritoneal Dialysis

- 5.3 By End User

- 5.3.1 In-Center Dialysis Settings

- 5.3.2 Home Care Settings

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fresenius Kabi AG

- 6.1.2 Baxter International, Inc.

- 6.1.3 Nipro Corporation

- 6.1.4 B. Braun Melsungen AG

- 6.1.5 Nikkiso Co. Ltd

- 6.1.6 Asahi Kasei Corporation

- 6.1.7 Medtronic PLC

- 6.1.8 Rockwell Medical

- 6.1.9 Teleflex Incorporated

- 6.1.10 Medivators Inc

- 6.1.11 Toray Medical Co. Ltd

- 6.1.12 Hemoclean Co. Ltd

- 6.1.13 Medtronic PLC

- 6.1.14 Quanta

- 6.1.15 Outset Medical Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS