PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438471

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438471

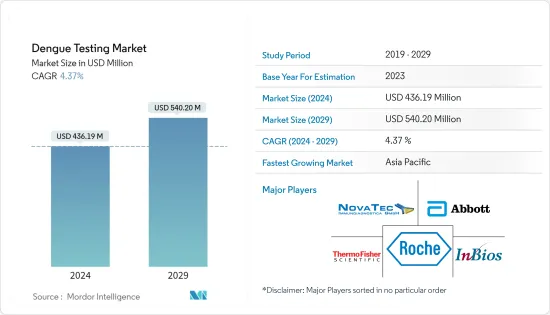

Dengue Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Dengue Testing Market size is estimated at USD 436.19 million in 2024, and is expected to reach USD 540.20 million by 2029, growing at a CAGR of 4.37% during the forecast period (2024-2029).

The COVID-19 pandemic substantially impacted the dengue testing market. Dengue viruses and SARS-CoV-2 cause similar symptoms in the early stages of infection. Thus, as a result, a significant proportion of the population underwent dengue testing, boosting the market's growth. For instance, as per an article published in IDR in June of the base year, it was observed that the clinical and biochemical characteristics of dengue infection and COVID-19 were identical in two infected patients in Singapore. The two individuals were diagnosed with dengue fever through a positive dengue serological test and were treated for it. However, their symptoms worsened, and a subsequent test revealed that they were COVID-19 positive.

Furthermore, several regions worldwide reported growing dengue cases amid the COVID-19 pandemic. For instance, an article published in July of the base year stated that dengue showed an increasing trend in the number of cases in the country, requiring urgent public policies to curb it. This resulted in an increased demand for testing procedures. Hence, COVID-19 significantly impacted the market's growth during the pandemic.

Certain factors contributing to the market's growth are the increasing incidences of dengue cases and the growth in the number of awareness campaigns to educate about the ills of dengue.

The overall incidence of dengue and the explosive outbreaks of the disease increased dramatically over the last several years. For instance, according to the statistics published by the European CDC, 1,371,248 dengue cases and 849 deaths were reported this year worldwide. In addition, as per the same source, the majority of cases were reported by Brazil (1,114,758), followed by Peru (45,816), Vietnam (25,694), Indonesia (22,331), and Colombia (21,576). Additionally, as per the data published by the WHO and PAHO, as of 1st June this year, there were 1,238,528 dengue cases reported in America, with 544,125 confirmed cases and 426 deaths. Thus, the rising burden of dengue cases across countries is expected to increase the demand for dengue testing, which is anticipated to propel the market's growth over the forecast period.

Similarly, government and healthcare professionals' initiatives to limit dengue spread are expected to boost the market's growth over the forecast period. For instance, in May this year, DoH-CHD ramped up its dengue fever campaign in Soccsksargen after the Regional Epidemiology and Surveillance Unit (RESU) recorded 854 dengue cases in the Philippines from January 1 to April 30 this year.

Moreover, the rising focus of companies on adopting various business strategies, such as acquisition, partnerships, and product launches for dengue testing, is expected to fuel the market's growth. For instance, in September of the base year, the Central Drugs Standard Control Organization (CDSCO) approved Cosara Diagnostics to manufacture and distribute SARAGENE Dengue Test Kit. The test kit is a real-time polymerase chain reaction technology-based in vitro diagnostic test that uses Co-Diagnostics' patented CoPrimers technology. In March of the base year, Roche and GenMark diagnostics entered a definitive merger agreement for Roche to fully acquire GenMark for USD 24.05 per share in an all-cash transaction.

However, the unavailability of effective diagnostic tools and the high price of existing test kits will likely restrain the market's growth over the forecast period.

Dengue Testing Market Trends

The ELISA-based Tests Segment is Anticipated to Hold a Significant Share of the Market

The ELISA-based tests segment is anticipated to hold a significant market share owing to factors such as the increasing incidence of dengue cases and the growing adoption of ELISA-based dengue testing.

Enzyme-linked immunosorbent assay (ELISA) is one of the most common and widely accepted methods for diagnosing dengue. The test measures the presence of anti-DENV IgM or IgG antibodies in the patient's serum. The early and timely diagnosis and management of dengue can reduce the risk of morbidity and mortality rates from severe forms of dengue disease and decrease the risk of wider outbreaks.

ELISA, the standard method, can detect NS1 antigens and differentiate between the four dengue virus serotypes. Thus, the use of ELISA for dengue testing is expected to increase over the forecast period. For instance, in February, the Health Department in India issued directions to private labs and hospitals to get only ELISA confirmatory tests done at government labs, due to which private labs were asked to send samples for the ELISA test if patients test positive for dengue through other initial tests.

Furthermore, a research study published in November of the base year showed that ANS1-based DENV IgG ELISA conferred enhanced diagnostic specificity for anti-DENV serological tests and may be particularly useful for serological analyses in endemic regions for DENV and ZIKV transmission. Thus, using ELISA-based tests for dengue is expected to increase over the years and boost the market's growth.

Moreover, technological advancements in ELISA platforms, such as complete test kits offered by several major players, contribute to the market's growth. For instance, Panbio Dengue IGG Indirect ELISA, a test kit provided by Abbott, is used to detect IgG antibodies to dengue antigen serotypes (1, 2, 3, and 4) in serum as an aid to the clinical laboratory diagnosis of patients with clinical symptoms and past exposure consistent with dengue fever.

Thus, considering all the factors mentioned above, the segment is expected to witness steady growth over the forecast period.

Asia-Pacific is the Fastest Growing Region in the Dengue Testing Market

Asia-Pacific is expected to be the fastest-growing region in the dengue testing market over the forecast period.

The increasing prevalence of disease infections within the region contributes to the market's growth. For instance, as per the data published by the ECDC, approximately 313 cases in Indonesia, 816 cases in Sri Lanka, 1,286 cases in Timor-Leste, and 2,440 cases in Vietnam were reported. Additionally, as per NCVBDC, the number of dengue cases in India increased from 44,585 cases to 193,245 in the base year. A large number of dengue cases in the region, necessitating the requirement of testing, is expected to boost the growth of the dengue testing market.

According to WHO data, 17,497 dengue cases were reported in Malaysia in the Western Pacific region. The registered number reflected a 57.6% increase compared to the same period in the base year. The increasing number of dengue cases in the area will likely propel the growth of the dengue testing market over the forecast period.

Furthermore, an article published about the diagnostic challenges in detecting dengue in COVID-19-affected people showed a correlation between COVID-19 and the dengue virus infection, as the patients were reactive to both tests, indicating a cross-reactivity. This indicated a public health concern in detecting COVID-19 infection in dengue-endemic countries.

Similarly, a study published in April of the base year that compared the accuracy and efficacy of six rapid diagnostic kits available for dengue viral detection in Singapore observed that Standard Q had the highest degree of sensitivity and specificity in detecting dengue virus infection. The kit could be used for efficient dengue disease surveillance. The rise in the necessity of such diagnostic kits, owing to the high sensitivity, is likely to add to the market's growth over the forecast period.

Moreover, such outbreaks across various regions in Asia-Pacific led several companies to develop dengue diagnostic test kits, contributing to the market's growth over the forecast period. For instance, in November of the base year, Achiko initiated the development of a dengue fever diagnostic test by applying its DNA aptamer technology platform.

The initiatives taken by the government to spread dengue awareness among the population are expected to fuel the market's growth. For instance, in May this year, the National Dengue Control Unit of Sri Lanka organized a mosquito control program from 18 May to 24 May in risky and high-risk areas in 20 districts to control the spread of dengue.

Thus, the market is expected to project growth over the forecast period due to the abovementioned factors.

Dengue Testing Industry Overview

The dengue testing market is consolidated, with many companies contributing significantly to the market's growth. Some of the major players in the market are Abbott Laboratories, NovaTec Immundiagnostica GmbH, Euroimmun AG (PerkinElmer), F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., and InBios International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase Incidences of Dengue Cases

- 4.2.2 Increasing Awareness Campaigns to Educate About the Ills of Dengue

- 4.3 Market Restraints

- 4.3.1 Unavailability of Effective Diagnostic Tools

- 4.3.2 High Price of Existing Test Kits

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Product Type

- 5.1.1 ELISA-based Tests

- 5.1.2 RT-PCR based Tests

- 5.1.3 Dengue IgG/IgM Rapid Test

- 5.1.4 Other Tests

- 5.2 End User

- 5.2.1 Hospitals

- 5.2.2 Diagnostic Centers

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 India

- 5.3.1.2 Philippines

- 5.3.1.3 Indonesia

- 5.3.1.4 Malaysia

- 5.3.1.5 Vietnam

- 5.3.1.6 Thailand

- 5.3.1.7 Sri Lanka

- 5.3.1.8 Rest of Asia-Pacific

- 5.3.2 Americas

- 5.3.2.1 Brazil

- 5.3.2.2 Mexico

- 5.3.2.3 Nicaragua

- 5.3.2.4 Colombia

- 5.3.2.5 Honduras

- 5.3.2.6 Rest of Americas

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Abnova Corporation

- 6.1.3 PerkinElmer Inc (Euroimmun AG)

- 6.1.4 Certest Biotec SL

- 6.1.5 Diasorin

- 6.1.6 F. Hoffmann-La Roche Ltd

- 6.1.7 InBios International Inc.

- 6.1.8 NovaTec Immundiagnostica GmbH

- 6.1.9 OriGene Technologies

- 6.1.10 Thermo Fisher Scientific Inc.

- 6.1.11 Immundiagnostik AG

- 6.1.12 Quest Diagnostics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS