PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438563

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438563

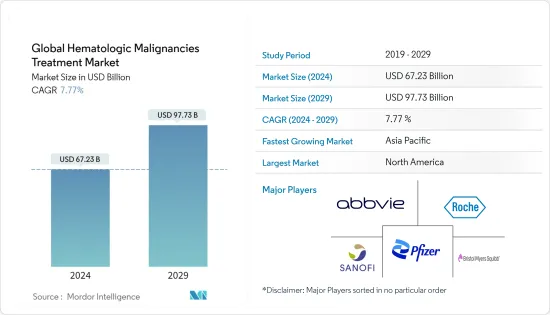

Global Hematologic Malignancies Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Hematologic Malignancies Treatment Market size is estimated at USD 67.23 billion in 2024, and is expected to reach USD 97.73 billion by 2029, growing at a CAGR of 7.77% during the forecast period (2024-2029).

As most elective treatments were deferred due to the outbreak of the COVID-19 pandemic, the hematologic malignancies treatment market was also impacted significantly. However, delayed treatment is not recommended for severe diseases, especially acute leukemia, and thus, necessary guidelines and measures have been put forth recently to allow hematologic malignancies' treatments during the pandemic with all protective measures. According to the research article published in Acta Haematologica, 2020, employing less intensive therapy options, minimizing the exposure between patient and staff, reducing the number of clinical visits, and encouraging telemedicine for follow-up consultations can aid in the effective outcome of treatment of patients with hematologic malignancies. As per the research study carried out by the United Kingdom Coronavirus Cancer Monitoring Project (UKCCMP), 2020, the risk of experiencing severe cases of COVID-19 infection was found to be higher, at about 57%, among patients with blood cancers. Thus, given the aforementioned factors, the COVID-19 pandemic is expected to impact the growth of the studied market.

The major factors attributing to the growth of the hematologic malignancies treatment market are the growing incidence of blood cancer and an increasing emphasis on the development of new treatments, driving the hematologic malignancies treatment market. According to Globocan 2020, the estimated incidence of leukemia was the highest in Asia, with 230,650 cases diagnosed in 2020, followed by 100,020 cases in Europe and 67,784 cases in North America. Thus, the high incidence of leukemia worldwide is expected to drive market growth.

Initiatives by major players such as mergers, acquisitions, product launches, partnerships, and collaborations are expected to boost the market growth. For instance, in May 2021, Tokyo-based Chugai Pharmaceutical Co. Ltd announced the launch of an anticancer agent/antimicrotubule binding anti-CD79b monoclonal antibody called Polivy intravenous infusion 30 mg and 140 mg that can be used for the treatment of relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL).

In February 2021, the United States Food and Drug Administration approved Breyanzi (lisocabtagene maraleucel), a cell-based gene therapy to treat adult patients with certain types of large B-cell lymphoma who have not responded to at least two other types of systemic treatment. Such rising product launches will likely provide growth opportunities to the market studied. However, the high cost of the medication involved in the treatment is the major restraint to the market.

Hematologic Malignancies Treatment Market Trends

Chemotherapy Leads the Segment, and it is Expected to Witness a Healthy Growth Over the Forecast Period

As chemotherapy is the first line of treatment, it is the largest segment in the studied market. Generally, for most types of blood cancers, chemotherapy is the common treatment, and a particular drug or combination of drugs is used depending on the type of cancer. The large patient pool and the increasing incidence of blood cancers are the major drivers for the growth of the studied segment. Also, the growing understanding of the possibility of the disease at the early stage and its subsequent treatment are expected to drive the segment growth.

According to the American Cancer Society, Cytarabine (cytosine arabinoside or ara-C) and anthracycline drugs, such as daunorubicin (daunomycin) or idarubicin, are the most common chemo drugs used in the treatment of acute myeloid leukemia. Cladribine (2-CdA), Fludarabine, Mitoxantrone, Etoposide (VP-16), 6-thioguanine (6-TG), Hydroxyurea, Corticosteroid drugs, such as prednisone or dexamethasone, Methotrexate (MTX), 6-mercaptopurine (6-MP), Azacitidine, and Decitabine are used in chemotherapy of acute myeloid leukemia. Also, the rising product approvals are expected to aid in the growth of the studied market. For instance, in September 2020, the US FDA approved Bristol Myers Squibb's azacytidine (Onureg) 300 mg tablets, CC-486, to continue treating adult patients with acute myeloid leukemia. Similarly, in June 2019, the United States Food and Drug Administration granted approval to Polivy to be used in combination with the chemotherapy drug bendamustine and a rituximab, to treat adult patients with diffuse large B-cell lymphoma (DLBCL) that has progressed or returned after at least two prior therapies. Thus, owing to the aforementioned factors, the studied segment is expected to witness significant growth over the forecast period.

North America Dominates the Market, and it is Expected to do the Same in the Forecast Period

North America is expected to dominate the overall hematologic malignancies treatment market throughout the forecast period. The presence of key players, high prevalence of blood cancer patients, established healthcare infrastructure, and availability of branded drugs are some of the key factors accountable for the large share of the studied market in North America.

According to the Global Cancer Observatory, in 2020, nearly 67,784 cases of leukemia and an estimated 35,318 cases of multiple myeloma were reported in the North American region. According to the Leukemia and Lymphoma Society, in 2021, an estimated combined total of 397,501 people in the United States were living with or in remission from leukemia in the United States. It also stated that around 61,090 people were expected to be diagnosed with leukemia in the United States in 2021. Thus, the increasing number of blood cancer cases in the region is a major driving factor for the growth of the market.

Beneficial government initiatives and an increase in the number of research partnerships are some of the drivers expected to drive market growth. For instance, in December 2020, the Leukemia and Lymphoma Society (LLS) initiated a collaboration to form alliances with leading cancer institutions and foundations to co-fund nearly USD 17 million in research grants to progress the research in finding effective treatment options for patients with leukemia, lymphoma, myeloma, and other blood cancers. In December 2020, Jazz Pharmaceuticals submitted the Biologics License Application (BLA) for its JZP-458 for use as a component of a multiagent chemotherapy regimen in the treatment of patients with acute lymphoblastic leukemia (ALL) or lymphoblastic lymphoma (LBL).

Many companies are undertaking a variety of strategic initiatives like product launches, partnerships, collaborations, mergers, and acquisitions to boost their market share. For instance, in October 2020, AstraZeneca Pharma India announced the launch of Acalabrutinib 100 mg capsules, which are used for the treatment of various types of leukemias (leukemia (CLL) and small lymphocytic lymphoma) under the brand name Calquence. In May 2019, the United States Food and Drug Administration approved AbbVie Inc. and Genentech Inc., jointly developing venetoclax for adult patients with chronic lymphocytic leukemia or small lymphocytic lymphoma. Thus, due to the above-mentioned developments, the market is expected to see robust growth.

Hematologic Malignancies Treatment Industry Overview

The hematologic malignancies treatment market is moderately consolidated and consists of several major players. Some of the companies currently dominating the market include Pfizer Inc., F. Hoffmann-LA Roche Ltd, Sanofi SA, Bristol-Myers Squibb Company, AbbVie Inc., Novartis AG, GlaxoSmithKline PLC, Amgen Inc., Johnson & Johnson, and Takeda Pharmaceutical Co. Ltd. Most of the major players are focusing on expanding their businesses in the developing regions to boost their market shares. They are implementing strategies like mergers and acquisitions and new product developments. For instance, in August 2020, GlaxoSmithKline PLC received US FDA approval for its BLENREP (belantamab mafodotin-blmf), a first-in-class anti-BCMA (B-cell maturation antigen) therapy for the treatment of patients with relapsed or refractory multiple myeloma.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Incidence of Blood Cancer

- 4.2.2 Increasing Awareness about the Possibility of Early Diagnosis

- 4.2.3 Increasing Emphasis on Development of New Treatments

- 4.3 Market Restraints

- 4.3.1 High Cost of Medication

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Disease Condition

- 5.1.1 Leukemia

- 5.1.2 Lymphoma

- 5.1.3 Myeloma

- 5.2 By Therapy

- 5.2.1 Chemotherapy

- 5.2.2 Immunotherapy

- 5.2.3 Targeted Therapy

- 5.2.4 Other Therapies

- 5.3 By End User

- 5.3.1 Hospital Pharmacies

- 5.3.2 Medical Stores

- 5.3.3 E-commerce Platforms

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pfizer Inc.

- 6.1.2 F. Hoffmann-LA Roche Ltd

- 6.1.3 Sanofi SA

- 6.1.4 Bristol-Myers Squibb Company

- 6.1.5 AbbVie Inc.

- 6.1.6 Novartis AG

- 6.1.7 GlaxoSmithKline PLC

- 6.1.8 Amgen Inc.

- 6.1.9 Takeda Pharmaceutical Co. Ltd

- 6.1.10 Johnson & Johnson

- 6.1.11 Incyte Corporation

- 6.1.12 AstraZeneca PLC

- 6.1.13 Celldex Therapeutics Inc.

- 6.1.14 Kite Pharma (Gilead Sciences)

- 6.1.15 Atara Biotherapeutics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IMPACT OF COVID-19 ON THE MARKET