PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910480

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910480

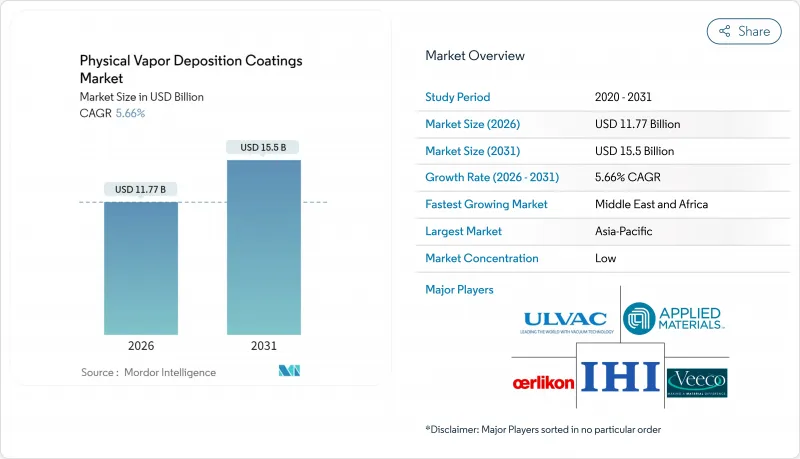

Physical Vapor Deposition Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Physical Vapor Deposition Coatings market size in 2026 is estimated at USD 11.77 billion, growing from 2025 value of USD 11.14 billion with 2031 projections showing USD 15.5 billion, growing at 5.66% CAGR over 2026-2031.

This acceleration reflects demand spikes from sub-7 nm semiconductor nodes and the wider use of minimally invasive medical devices that rely on biocompatible thin films. Regulatory momentum away from hexavalent chromium electroplating, combined with the need to finish 3D-printed parts, positions physical vapor deposition as both a compliance route and a process enabler. The technology's ability to deliver dense, defect-free layers on metals, plastics, glass, and emerging substrates underpins robust capital spending on new coating centers. Competitive intensity rises as titanium target prices increase and equipment manufacturers rush to commercialize high-ionization sputter sources.

Global Physical Vapor Deposition Coatings Market Trends and Insights

Rising Semiconductor Node Transition Below 7 nm

The current ramp toward sub-7 nm logic and memory devices multiplies demand for barrier and seed layers deposited with sub-nanometer precision. Equipment platforms supplied by Applied Materials reported strong uptake for molybdenum-based interconnect stacks that mitigate copper diffusion at extreme aspect ratios. Volume adoption in Taiwan and South Korea anchors regional supply chains for ultra-high-vacuum sputter chambers, advanced titanium and tantalum targets, and in-situ metrology. Each shrink node tightens tolerance bands, pushing tool makers to integrate HiPIMS sources that deliver higher ionization and denser films. Advanced packaging formats, including chiplets and through-silicon vias, further lift spending on conformal physical vapor deposition steps for 3D integration.

Booming Minimally-Invasive Medical Device Production

The accelerating demand for catheter-based implants and orthopedic fixation hardware elevates coating requirements from simple biocompatibility to antimicrobial and osteointegrative functions. Magnetron-sputtered tantalum films of 550 nm thickness achieved critical adhesion loads of 39.184 N, outperforming uncoated titanium constructs in BMC Biotechnology trials. Regulatory approvals under the US FDA (Food and Drug Administration) create durable revenue once process validation is complete, stimulating contract coaters in the United States, Germany, and Ireland to add dedicated medical lines with clean-room isolation. Cost-sensitive device OEMs (original equipment manufacturers) in China and Malaysia are increasingly outsourcing PVD (physical vapor deposition) steps to meet global supply-chain quality audits.

High Cap-ex of Ultra-High-Vacuum Systems

A single 12-inch cluster tool can cost USD 5 million, excluding clean-room build-out and facility utilities. Such capital thresholds deter new entrants in Brazil, Indonesia, and sub-Saharan Africa, consolidating orders among established players that possess depreciation-advantaged assets. Financing is complicated by five- to seven-year payback horizons and the risk of process obsolescence as node geometry evolves. Government incentive programs in India and Vietnam partially offset cap-ex, yet bank covenants still require volume guarantees from blue-chip customers.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Shift Away from Hex-Chrome Electroplating

- 3D-Printing Parts Requiring Conformal PVD Finishes

- Competition from CVD / ALD for High-Aspect Features

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HiPIMS recorded the highest 6.92% forecast CAGR, driven by ionization levels exceeding 70%, which yield dense coatings with superior adhesion for cutting tools. Sputter Deposition remains the bedrock, with a 42.35% market share in 2025, favored for its scalability from microelectronics to architectural glass. Thermal and e-beam evaporation occupy niche markets in optical coating, while Arc Vapor Deposition continues to be used in wear-resistant decorative trims, despite challenges from macro-particles. The physical vapor deposition coatings market size for HiPIMS is projected to climb steadily as automotive OEMs standardize on nitride recipes that extend tool life in press shops.

Equipment builders incorporate multi-cathode configurations that allow for on-the-fly target changes, reducing recipe switch-over by 30%. Ion Implantation and Ion Plating gain visibility in medical implants where surface modification and coating deposition converge. Process-type diversification aligns with an application-driven roadmap: semiconductor fabs demand ultra-clean environments, tool manufacturers prize high-energy ion bombardment, and furniture producers seek low-temperature decorative chrome.

Plastic substrates, though smaller today, are advancing at a 6.05% CAGR as low-temperature cycles and plasma pre-treatments avoid polymer deformation. The physical vapor deposition coatings market share for Metals stays dominant at 60.78%, reflecting entrenched tooling and engine component volumes. Polycarbonate and ABS trim pieces in premium cars utilize sputtered zirconium nitride to replace electroplated chrome, striking a balance between aesthetics and recyclability.

Metallization of glass for architectural low-E panels sustains steady volumes; specialty glass, such as Corning Eagle XG, sees an uptick in photonics applications. Composite substrates in helicopters and drones represent an emergent niche propelled by defense spending. Substrate diversification pressures coerce coatings to validate adhesion under disparate coefficients of thermal expansion, prompting investments in in-situ plasma activation and base-coat strategies.

The Physical Vapor Deposition Coatings Market Report is Segmented by Process Type (Sputter Deposition, E-Beam Evaporation, Hipims, and More), Substrate (Metals, Glass, and More), Material Type (Metals/Alloys, Ceramics and Oxides, and More), End User (Tools and Components), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region retained a 47.40% share in 2025, driven by semiconductor investments in Taiwan, South Korea, and mainland China. Local equipment subsidies and wafer-fab incentive packages channel capital into next-generation HiPIMS and ionized PVD lines. Automotive hubs in Japan and Thailand add decorative chrome alternatives to meet REACH-style export requirements. India benefits from Ionbond's new Mumbai line, which shortens lead times for domestic cutting-tool manufacturers.

North America records stable growth, driven by clusters in the aerospace and medical device sectors. US turbine-engine OEMs adopt multilayer thermal-barrier coatings that lift firing temperatures past 1,500 °C, while California's chrome ban accelerates the adoption of low-temperature decorative films on plumbing hardware. Canada and Mexico contribute to the automotive industry through components such as automotive tooling and oil-sand extraction, which demand erosion resistance.

Europe advances through regulatory tailwinds that outlaw toxic plating baths. Germany leads in precision tools, Switzerland specializes in watch component coatings, and the Nordics pioneer fuel cell stack layers. Ionbond's Swedish mega-center, opened November 2024, doubles Scandinavian capacity and reduces logistics costs for OEMs exporting to North America. Emerging regions led by Saudi Arabia, the United Arab Emirates and South Africa record the swiftest 5.82% CAGR, reflecting infrastructure expansions that rely on coated drill bits, valves and decorative metal-effect fittings.

- Advanced Energy

- AJA International, Inc.

- Angstrom Engineering Inc.

- Applied Materials, Inc.

- Buhler Leybold Optics,

- Crystallume PVD

- Denton Vacuum

- HEF

- IHI Corporation

- Impact Coatings AB

- KDF Electronic & Vacuum Services Inc.

- KOLZER SRL

- Mitsubishi Materials Corporation

- Mustang Vacuum Systems

- OC Oerlikon Management AG

- PLATIT AG

- Richter Precision Inc.

- Satisloh AG

- Silfex Inc.

- Singulus Technologies AG

- ULVAC

- Veeco Instruments Inc.

- voestalpine eifeler Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising semiconductor node transition below 7 nm

- 4.2.2 Booming minimally-invasive medical device production

- 4.2.3 Regulatory shift away from hex-chrome electroplating

- 4.2.4 3D-printing parts requiring conformal PVD finishes

- 4.2.5 Low-temperature decorative PVD on plastics and composites

- 4.3 Market Restraints

- 4.3.1 High cap-ex of ultra-high-vacuum systems

- 4.3.2 Competition from CVD / ALD for high-aspect features

- 4.3.3 Shortage of skilled vacuum-process engineers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Process Type

- 5.1.1 Sputter Deposition

- 5.1.2 Thermal / e-Beam Evaporation

- 5.1.3 Arc Vapor Deposition

- 5.1.4 Ion Implantation and Ion Plating

- 5.1.5 HiPIMS

- 5.2 By Substrate

- 5.2.1 Metals

- 5.2.2 Plastics

- 5.2.3 Glass

- 5.3 By Material Type

- 5.3.1 Metals(Includes Alloys)

- 5.3.2 Ceramics and Oxides

- 5.3.3 Other Material Types

- 5.4 By End User

- 5.4.1 Tools

- 5.4.2 Components

- 5.4.2.1 Aerospace and Defense

- 5.4.2.2 Automotive

- 5.4.2.3 Electronics and Semiconductors (incl. Optics)

- 5.4.2.4 Power Generation

- 5.4.2.5 Other Components (Solar Products, Medical Equipment, and Others)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Nordic Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Advanced Energy

- 6.4.2 AJA International, Inc.

- 6.4.3 Angstrom Engineering Inc.

- 6.4.4 Applied Materials, Inc.

- 6.4.5 Buhler Leybold Optics,

- 6.4.6 Crystallume PVD

- 6.4.7 Denton Vacuum

- 6.4.8 HEF

- 6.4.9 IHI Corporation

- 6.4.10 Impact Coatings AB

- 6.4.11 KDF Electronic & Vacuum Services Inc.

- 6.4.12 KOLZER SRL

- 6.4.13 Mitsubishi Materials Corporation

- 6.4.14 Mustang Vacuum Systems

- 6.4.15 OC Oerlikon Management AG

- 6.4.16 PLATIT AG

- 6.4.17 Richter Precision Inc.

- 6.4.18 Satisloh AG

- 6.4.19 Silfex Inc.

- 6.4.20 Singulus Technologies AG

- 6.4.21 ULVAC

- 6.4.22 Veeco Instruments Inc.

- 6.4.23 voestalpine eifeler Group

7 Market Opportunities & Future Outlook

- 7.1 White-space and unmet-need assessment