PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687932

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687932

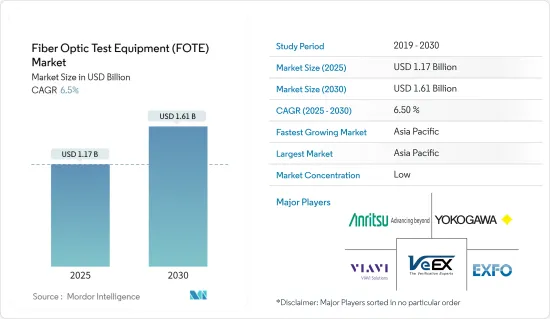

Fiber Optic Test Equipment (FOTE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Fiber Optic Test Equipment Market size is estimated at USD 1.17 billion in 2025, and is expected to reach USD 1.61 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Fiber optic test equipment detects signal loss or changes through a fiber optic cable. When a signal is delivered across optical fibers, signal loss is unavoidable. As a result of the coupling of output and input signals, there may be some transmission losses. Fiber Optic Test Equipment (FOTE) is extremely useful for characterizing and measuring the physical properties of light, which is a critical feature of fiber optic networks.

Key Highlights

- With growing online transactions and virtual meetings, companies need 5G and optic fiber cable to stay competitive. These cables are cost-effective, convenient, and easy solutions for many industrial applications, such as lighting and decorations, data transmission, surgeries, and mechanical inspections. The growing work-from-home or hybrid work model drives the demand for FTTH across the United States and Europe, further driving the studied market.

- Fiber optic cables of high quality and quantity are required to build 5G base stations. The development of UDN, or ultra-dense networks, has sparked a surge in demand for fiber optic cables. The total number of fiber optic cables required for the 5G transition is more than double that of the 4G infrastructure. Other changes will necessitate a large number of Fiber optic lines.

- Moreover, Fiber optic cables are primarily employed in medicine, biomedical research, and microscopy. Optical communication is essential in endoscopy, as it is in non-invasive surgery. A small bright light is utilized in this procedure to light up the operation area inside the human body, allowing the number and size of incisions to be reduced. Fiber optic cable is also utilized as an imaging tool, a light guide, and a laser for surgical assistance.

- The fiber optic test equipment market is predicted to increase in response to the growing number of fiber cable networks. To deliver successful services, the increased need for real-time operations necessitates continual testing of bandwidth and insertion loss. As a result of this need, the fiber optic test equipment market is predicted to grow significantly.

- Various data center vendors are consistently investing in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is expected to reach USD 4.6 billion in 2025. India's higher cost efficiency in both development and operation is its most significant advantage compared to more mature markets. Currently, India's data centers are primarily located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the demand for fiber optic test equipment in India.

Fiber Optic Test Equipment (FOTE) Market Trends

Telecommunications to Witness Significant Growth

- Fiber optic connections have transformed the telecommunications sector. It has also established a strong presence in the data networking field. Optical communications through fiber optic cable have enabled telecommunications lines to be established over considerably greater distances. With the significantly lower transmission and medium loss levels, fiber optical communications have enabled far higher data speeds to be accommodated. As a result of these advantages, Fiber optic communications systems are widely used for applications ranging from significant telecommunications infrastructure to Ethernet systems, broadband distribution, and general data networking.

- Growing demand for connectivity and internet access among the rising metropolitan cities positively drives the market's growth. The growing need for higher internet speed and better connectivity eventually requires strong and efficient fiber optic test equipment, which optical technology fulfills, thereby positively driving the market's growth.

- The market for fiber optic test equipment is also driven by the emergency of 5G connectivity and the rapid expansion of fiber optic networks. For instance, According to Ericsson, rapid growth is expected over the coming years, with the number of 5G subscriptions forecast to reach almost 4.7 billion by 2028

- Additionally, fiber-to-the-home deployments are becoming more common as providers seek to deliver high-speed internet directly to homes and businesses. Fiber test equipment is essential for ensuring the quality and reliability of these last-mile connections.

Asia Pacific to Register Major Growth

- China is anticipated to remain among the major markets for fiber optic test equipment in the Asia Pacific region, owing to the presence of a large ecosystem for optical fiber cables. For instance, the country has a diversified base of fiber optical cable manufacturers. Furthermore, the government is also witnessing a notable growth in digital infrastructure investment, creating opportunities in the market studied as optical fiber cables form the core of digital infrastructure.

- China's technological outreach also incorporates its international infrastructure mega-project, the Belt and Road Initiative (BRI), which aims to reorient the global economy toward Beijing through infrastructure deals with over 60 countries. BRI's most consequential component is expected to be the Digital Silk Road (DSR). China builds the Digital Silk Road from Pakistan to Africa and Europe. Directed by companies like Huawei, the DSR seeks to connect the global economy through evolving technologies transforming global networks, such as fiber-optic cables and 5G-supported communications.

- Japan holds significant growth potential for the fiber optic test equipment market as the country houses an established ecosystem for fiber optic networks. Furthermore, the growing demand for increased network bandwidth is also driving the Japanese optical fiber cable market with the proliferation of digital technologies that shift the bandwidth requirements. For instance, according to the recent government policy promoting digitization, the government aims to expand the high-speed fiber-optic networks to about 99.9% of households by 2028.

- Furthermore, the government aims to expand the coverage of next-generation 5G wireless networks to 99% of the population by 2030 and complete seabed cables surrounding Japan by the end of fiscal year 2025. Hence, such trends will drive ample opportunities in the market studied during the forecast period.

Fiber Optic Test Equipment (FOTE) Market Overview

The fiber optics test equipment market is fragmented due to the high competitive rivalry among the market players. Also, these companies are extensively investing in offering customers a wide range of technologies for application-specific field measurement, monitoring, and maintenance. Moreover, companies such as EXFO Inc., Anritsu Corporation, VIAVI Solutions Inc., VeEX Inc.Yokogawa Electric Corporation continuously invest in strategic partnerships, acquisitions, and product development to gain more market share. Some of the recent actions by the companies are listed below.

- In March 2024, VIAVI Solutions entered into an agreement on terms of a cash tender for Spirent, subject to the unanimous approval of Spirent's Board. The tender is known as the 'Acquisition'. Spirent is implementing this strategy to expand its products into live networks, grow recurring revenue streams, and deliver value-added services and solutions across its product portfolio.

- In February 2024, Korea's Radio Frequency Association (RAPA) and Japan's Anritsu Corp. (Anritsu) signed an MoU on February 22, 2024, at Anritsu's Headquarters. The MoU outlines their collaboration on B5G and 6G, the next generation of communication standards. The MoU outlines RAPA's plan to collaborate with Anritsu in multiple areas to promote the development of B5G / 6G technologies, including setting up a test environment to validate candidate frequency bands for the B5G / B6G technologies, namely FR3 (7GHz to 24GHz) and sub-THz (100GHz and above) and technical cooperation from the PoC stage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of 5G/LTE Networks and Fixed Broadband Subscription

- 5.1.2 Growing Adoption of fiber optic networks for power and utility management, Security, and Communication

- 5.2 Market Restraints

- 5.2.1 High Cost of Testers and Fiber Optic Test Equipment

- 5.2.2 Lack of Awareness and Technical Knowledge

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Optical Light Sources

- 6.1.2 Optical Power and Loss Meters

- 6.1.3 Optical Time Domain Reflectometer

- 6.1.4 Optical Spectrum Analyzers

- 6.1.5 Remote Fiber Test System

- 6.1.6 Other Equipment Types

- 6.2 By End-user Application

- 6.2.1 Telecommunications

- 6.2.2 Data Centers

- 6.2.3 Industries

- 6.2.4 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EXFO Inc.

- 7.1.2 Anritsu Corporation

- 7.1.3 VIAVI Solutions Inc.

- 7.1.4 VeEX Inc.

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 Kingfisher International

- 7.1.7 AFL Global

- 7.1.8 Fluke Networks

- 7.1.9 Pelorus Technologies Pvt. Ltd

- 7.1.10 Deviser Instruments

- 7.1.11 Terahertz Technologies Inc. (Trends Networks)

- 7.1.12 AMS Technologies Ag

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET