PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851200

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851200

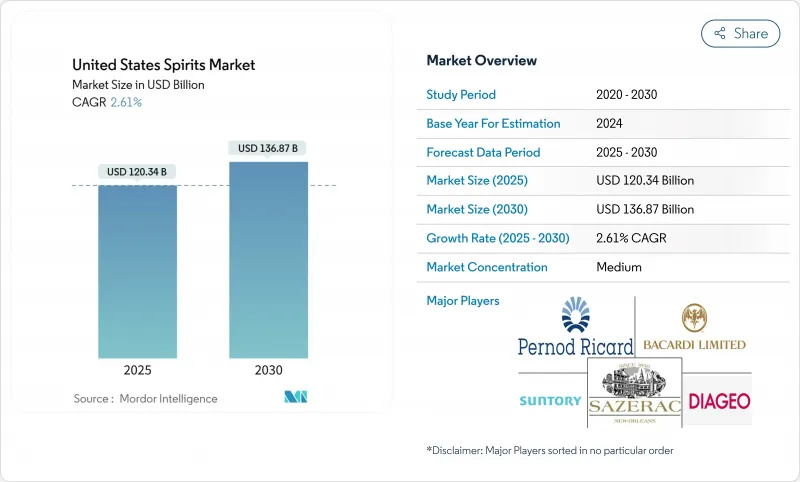

United States Spirits - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US spirits market is expected to grow from USD 120.34 billion in 2025 to USD 136.87 billion in 2030, at a CAGR of 2.61%.

This growth is driven by premiumization trends, recovery in on-premise consumption, and increasing participation from female and younger legal-age consumers, despite flattening volume trends. Major distillers are expanding their super-premium offerings, while craft producers differentiate through regional authenticity. Health-conscious consumers are shifting toward premium products with transparent labeling and sustainable practices, adopting a "drink less but better" approach. While trade tensions and complex regulations moderate growth, the US spirits market maintains stronger value growth compared to beer and wine, demonstrating sustained consumer preference for quality distilled beverages.

United States Spirits Market Trends and Insights

Growing tourism and hospitality sector

The resurgence of the hospitality industry presents significant opportunities for spirits brands to capture new consumers through immersive, experience-based offerings. The robust growth in tourism has intensified demand for authentic local spirits experiences, with distillery visits emerging as a substantial revenue stream for both traditional and craft producers. According to the Distilled Spirits Council, the US spirits industry generates USD 250 billion in economic activity and sustains over 1.7 million jobs, with tourism and hospitality representing an increasingly vital component of this economic impact. This trend is particularly prominent in the South and West regions, where destination distilleries have evolved into cornerstone elements of regional tourism strategies. The strategic integration of spirits with local food culture establishes distinctive regional identities that attract both domestic and international visitors, enabling brands to cultivate deeper consumer loyalty beyond conventional retail distribution channels.

Consumers inclination towards craft spirits

The craft spirits movement continues to reshape market dynamics, with consumers increasingly prioritizing authenticity and provenance over mass production. Despite experiencing its first market decline in 2023, the craft spirits sector still sold 13.5 million cases, maintaining a significant 7.5% value share of the total spirits market, according to the American Craft Spirits Association. This resilience underscores the segment's strong consumer connection, particularly among younger demographics seeking unique drinking experiences. The number of active craft distillers grew by 11.5% to 3,069 in 2023, indicating continued entrepreneurial confidence despite economic headwinds. Craft producers are increasingly leveraging local ingredients and production methods to create distinctive flavor profiles that cannot be replicated by larger competitors, establishing defensible market positions based on authenticity and innovation rather than scale economies.

Stringent government regulations

The United States spirits market faces substantial entry barriers due to intricate regulatory frameworks. Seventeen states and jurisdictions operate under a "Control" model, where government agencies exclusively manage and oversee distilled spirits sales. These control states account for 24.7% of the US population and 23.0% of distilled spirit sales, according to the National Alcohol Beverage Control Association. The three-tier distribution system prevalent in most states strictly prohibits direct-to-consumer sales, compelling producers to establish relationships with wholesalers, which often creates market access challenges for smaller brands. Emerging regulatory requirements, including the TTB's proposed "Alcohol Facts" labeling and mandatory allergen disclosures, introduce additional compliance costs, disproportionately impacting smaller producers. Furthermore, the diverse state-level taxation structures for distilled spirits contribute to a multifaceted and challenging operational landscape.

Other drivers and restraints analyzed in the detailed report include:

- Surge in demand for premium alcoholic products

- Product diffrentiation in terms of raw material and alcohol content

- Rising consumer inclination towards other alcoholic beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whiskies dominate the spirits market with a 34.62% share in 2024, demonstrating market leadership despite significant challenges from international tariffs and production oversupply conditions. The category exhibits remarkable resilience amid a decline in Scotch whisky export value and persistent oversupply issues in American whiskey production. The global whiskey market demonstrates substantial growth potential throughout the forecast period, driven by expanding craft spirits movements and heightened consumer interest in bourbon and rye varieties. The category's continued success stems from effective premium positioning strategies and compelling heritage narratives that strongly resonate with consumers seeking authentic product experiences.

White spirits, led by vodka, gin, and silver tequila, are set to achieve the fastest growth rate, with a projected CAGR of 3.01% through 2030. Their clean flavor profiles, versatility in mixology, and the rise of ready-to-drink formats make them increasingly popular, especially among health-conscious consumers and younger drinkers of legal age. Tequila and mezcal categories show exceptional performance in the US market, while rum and liqueur segments benefit significantly from the ongoing cocktail renaissance. The spirits market landscape continues to fragment, with successful brands distinguishing themselves through innovative production methodologies and authentic heritage storytelling rather than traditional category conventions.

The United States Spirits Market Report Segments the Industry Into Product Type (Brandy and Cognac, Liqueur, Whiskies, Rum, White Spirits, Tequilla and Mezcel, and Other Spirit Types; by End User (Men and Women); by End User (Men and Women); Distribution Channel (On-Trade, and Off-Trade), and Region (Northeast, Midwest, South, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Diageo PLC

- Suntory Holdings Limited

- Bacardi Limited

- Pernod Ricard SA

- Sazerac Company Inc.

- Constellation Brands, Inc.

- Brown-Forman Corporation

- E. & J. Gallo Winery

- Heaven Hill Distilleries, Inc.

- Davide Campari-Milano N.V.

- William Grant & Sons Ltd.

- Remy Cointreau S.A.

- Becle, S.A.B. de C.V. (Proximo Spirits)

- Fifth Generation, Inc.

- MGP Ingredients Inc.

- The Asahi Group Holdings, Ltd.

- Castle & Key Distillery, LLC

- Stoli Group

- Ole Smoky Distillery LLC

- The Boston Beer Company, Inc. (Truly Spirits)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing tourism and hospitality sector

- 4.2.2 Consumers inclination towards craft spirits

- 4.2.3 Surge in demand for premium alcoholic products

- 4.2.4 Product diffrentiation in terms of raw material and alcohol content

- 4.2.5 Sustainability and ethical sourcing

- 4.2.6 Strategic expansion by pubs and bars

- 4.3 Market Restraints

- 4.3.1 Stringent government regulations

- 4.3.2 Rising consumer inclination towards other alcoholic beverages

- 4.3.3 Health issues over excessive consumption

- 4.3.4 Supply chain disruptions

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Brandy and Cognac

- 5.1.2 Liqueur

- 5.1.3 Rum

- 5.1.4 Tequilla and Mezcel

- 5.1.5 Whiskies

- 5.1.6 White Spirits

- 5.1.7 Other Spirit Types

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Specialty/Liquor Stores

- 5.3.2.2 Others Off Trade Channels

- 5.4 By Region

- 5.4.1 Northeast

- 5.4.2 Midwest

- 5.4.3 South

- 5.4.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Diageo PLC

- 6.4.2 Suntory Holdings Limited

- 6.4.3 Bacardi Limited

- 6.4.4 Pernod Ricard SA

- 6.4.5 Sazerac Company Inc.

- 6.4.6 Constellation Brands, Inc.

- 6.4.7 Brown-Forman Corporation

- 6.4.8 E. & J. Gallo Winery

- 6.4.9 Heaven Hill Distilleries, Inc.

- 6.4.10 Davide Campari-Milano N.V.

- 6.4.11 William Grant & Sons Ltd.

- 6.4.12 Remy Cointreau S.A.

- 6.4.13 Becle, S.A.B. de C.V. (Proximo Spirits)

- 6.4.14 Fifth Generation, Inc.

- 6.4.15 MGP Ingredients Inc.

- 6.4.16 The Asahi Group Holdings, Ltd.

- 6.4.17 Castle & Key Distillery, LLC

- 6.4.18 Stoli Group

- 6.4.19 Ole Smoky Distillery LLC

- 6.4.20 The Boston Beer Company, Inc. (Truly Spirits)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK