PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445499

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445499

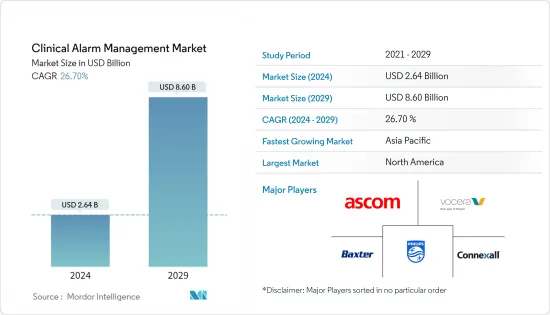

Clinical Alarm Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Clinical Alarm Management Market size is estimated at USD 2.64 billion in 2024, and is expected to reach USD 8.60 billion by 2029, growing at a CAGR of 26.70% during the forecast period (2024-2029).

Clinical alarm management is one of the industries that had a positive impact due to the COVID-19 pandemic owing to the extensive patient pool getting admitted to the hospital due to the infection. Moreover, during the COVID-19 pandemic, nurses were more stressed because of the more significant number of critically ill patients, and during this situation, the clinical alarms were of great use. For instance, according to the study by Elsevier, in October 2022, the alert system, according to nurses, is crucial to their ability to respond quickly. The power of the personnel to respond promptly declines as the number of devices grows along with the frequency of nuisance alerts caused by the increase in patients. False alarms have been a concern during the pandemic, creating unnecessary chaos among healthcare representatives, which increased the focus on properly implementing clinical alarm systems at hospitals and COVID-19 healthcare facilities. Clinical alarm management has demonstrated the ability to enhance health outcomes and reduce chaos during the pandemic which made the hospitals realize the advantage of clinical alarm management systems over manual systems. Hence, the demand for clinical alarm management systems increased, eventually driving the market growth.

The rise in the clinical alarm management market is attributed to the growing prevalence of chronic diseases coupled with longer hospital stays, increasing awareness among healthcare providers in optimizing patient safety using advanced technologies such as mHealth, alarm management systems, and growing investment in healthcare infrastructure by government and private health care providers. For instance, according to AIIMS, for the year 2021-2022 up to September 2021 about 0.83 million (8.3 lakh) people visited OPDs, and 33,830 surgeries were performed. 67,961 people got admission to AIIMS. Such a high number of admissions and surgeries increases the demand for the implementation of clinical alarm management, thereby boosting the market's growth over the forecast period.

Furthermore, the 2022 EU4Health work program has been allocated a budget of more than USD 706.41 million (EUR 835 million) to boost health systems in Europe, including around USD 65.14 million (EUR 77 million) for digital investment, USD 402.76 million (EUR 380.9 million) for crisis preparedness, USD 95.16 million (EUR 90 million) for health promotion and disease prevention, and USD 133.75 million (EUR 126.5 million) for health systems and health workforce. Investments in healthcare IT and digital healthcare are anticipated to boost market growth over the forecast period. Thus, the abovementioned factors such as an increase in chronic disease and investment in healthcare IT are impacting the market growth of the clinical alarm management market. However, high investment in clinical alarm systems and lack of product standardization, and false alarms are the factors expected to restrain the market growth.

Clinical Alarm Management Market Trends

Long term care Segment is Expected to Witness High Growth Over the Forecast Period

Long-term care facilities are healthcare centers that provide various services, including medical and personal care, to people who cannot live independently and geriatric patients. People frequently need long-term care for a severe, continuing health ailment or disability. The necessity for long-term care can arise suddenly, such as after a heart attack or stroke. Clinical alarm management services and solutions play an important role at long-term care centers as the patients at these centers are either critically ill or aged patients who require continuous monitoring and management of their health and wellness. Hence, the use of clinical alarms is increasing in long-term facilities. Furthermore, the growing prevalence of chronic diseases coupled with the increasing geriatric population globally are the major factors driving the respective segment in the market studied. For instance, according to 2022 statistics published by American Heart Association, the prevalence rate of heart failure in the United States was 6 million, 1.8% of the total population, in 2021. Thus, the high burden of heart failure cases in the country is expected to increase the demand for clinical alarm management to alert healthcare professionals and physicians which is further expected to boost the market's growth over the forecast period.

The older population is often susceptible to osteoarthritis, chronic obstructive pulmonary disease, depression, and dementia. This indicates the rising demand for devices required for the monitoring, assisting, and management of patients. For instance, according to World Population Aging Highlight United Nations 2022, in 2022, there were 771 million people aged 65 years or over globally. The older population is projected to reach 994 million by 2030. Thus, the increasing geriatric population is expected to increase hospital admission, which in turn is expected to drive market growth.

Thus, owing to the factors above the usage of clinical alarm management solutions and services is expected to grow significantly during the forecast period.

North America is Expected to Dominate the Clinical Alarm Management Market Over the Forecast Period

North America region is anticipated to have a significant market share owing to increased hospital stays due to chronic disease, and rising healthcare expenditure. For instance, as per the Centers for Medicare and Medicaid Services, national health spending was projected to grow at an average annual rate of 5.4% from 2019-2028 and reach USD 6.2 trillion by 2028. As national health expenditure is projected to grow 1.1% points faster than the average yearly GDP over 2019-2028, the health share of the economy is projected to rise by 19.7% in 2028. Thus, the increasing healthcare spending is anticipated to create opportunities for clinical alarm management, thereby propelling market growth.

Additionally, according to the National Health Expenditure Trend 2021 report from the Canadian Institute of Health Information, Canadian health expenditure increased to USD 308.1 billion in 2021 compared to USD 301.5 billion in 2020. Hence, with the increasing healthcare cost and information technology, the adoption of clinical alarm management is expected to increase in the region. Also, according to the OECD, in June 2022, Mexico's health spending as a share of GDP was 6.2% in 2020; this is expected to impact the market's growth positively.

The companies are actively involved in new product launch developments and collaborations to expand their footprint in the United States. For instance, in August 2022, AirStrip released an FDA-cleared alarm communication solution. The alarm communication platform is built on the core AirStrip ONE solution bundle to enable healthcare providers to focus on patient safety, reduce alarm fatigue, and notify mobile clinicians when critical, actionable alarm conditions occur for their patients and require attention.

Thus, owing to the abovementioned factors, the studied market in the North American region is expected to project growth over the forecast period.

Clinical Alarm Management Industry Overview

The clinical alarm management market is moderate due to the presence of companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold significant market shares and are well known including Baxter International Inc., Koninklijke Philips N.V., Ascom Holding AG, Capsule Technologies, Inc. and Vocera Communications among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Chronic Diseases and Long Hospital Stays

- 4.2.2 Rising Healthcare Expenditure and Technological Advancements in Clinical Alarm Management

- 4.3 Market Restraints

- 4.3.1 High Investment for Clinical Alarm Systems

- 4.3.2 Lack of Product Standardization and False Alarms

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Product

- 5.1.1.1 EMR Integration Systems

- 5.1.1.2 Nurse Calling Systems

- 5.1.1.3 Physiological Monitors

- 5.1.1.4 Others

- 5.1.2 Services

- 5.1.1 Product

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Long-term Care Centers

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Baxter International Inc.

- 6.1.2 Koninklijke Philips N.V.

- 6.1.3 Ascom Holding AG

- 6.1.4 Medtronic PLC

- 6.1.5 Stryker (Vocera Communications)

- 6.1.6 GE Healthcare

- 6.1.7 Masimo

- 6.1.8 TigerConnect (Critical Alert System)

- 6.1.9 Spok Inc.

- 6.1.10 West Com Nurse Call Systems, Inc.

- 6.1.11 Nihon Kohden Corporation

- 6.1.12 Amplion Clinical Communications, Inc.

- 6.1.13 Connexall USA, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS