PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851211

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851211

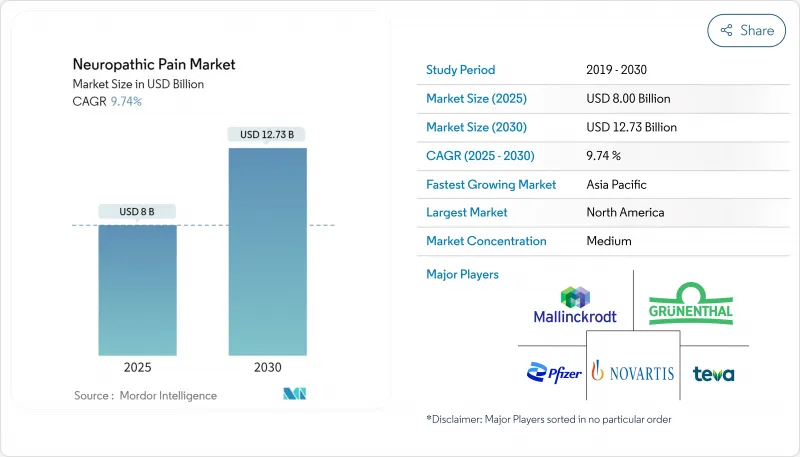

Neuropathic Pain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Neuropathic Pain Market size is estimated at USD 8.00 billion in 2025, and is expected to reach USD 12.73 billion by 2030, at a CAGR of 9.74% during the forecast period (2025-2030).

Escalating prevalence of diabetes, cancer survivorship and viral infections is enlarging the treated population, while regulators, payers and clinicians increasingly favour non-opioid options that lower abuse risk. Evidence from real-world prescription audits shows a steady shift away from centrally acting painkillers toward peripherally selective agents, hinting at a structural rebalancing of Neuropathic Pain market share. Pipeline diversity spanning small-molecule sodium-channel blockers, biologic nerve-growth-factor antagonists and advanced topical formulations underscores commercial confidence in mechanism-based differentiation. An additional observation is that the fastest uptake is occurring in provider settings able to measure functional gains, suggesting that outcome-linked reimbursement is already shaping treatment choices.

Global Neuropathic Pain Market Trends and Insights

Growing Global Prevalence of Diabetes & Obesity Driving Diabetic Peripheral Neuropathy

The escalating global diabetes epidemic is fundamentally reshaping the neuropathic pain landscape, with diabetic peripheral neuropathy (DPN) affecting approximately 50% of diabetic patients. This high prevalence translates to a substantial patient population requiring effective pain management solutions. Recent epidemiological studies reveal that DPN is often underdiagnosed, with 75% of cases remaining undetected until symptoms become severe, creating a significant untapped market opportunity Elafros et al.. The economic burden of DPN extends beyond direct treatment costs, as patients with painful DPN experience reduced productivity and higher healthcare utilization across multiple specialties, driving demand for more effective and tolerable treatment options that can improve functional outcomes while minimizing side effects.

Increasing Cancer Survival Rates Elevating Chemotherapy-Induced Peripheral Neuropathy Burden

As cancer treatment efficacy improves, the population of survivors experiencing chemotherapy-induced peripheral neuropathy (CIPN) continues to expand, creating an urgent need for effective management strategies. CIPN affects 30-40% of patients receiving neurotoxic chemotherapy agents, with symptoms often persisting long after treatment completion Dove Press. The condition significantly impacts quality of life and may necessitate chemotherapy dose reductions, potentially compromising oncological outcomes. Recent advances in understanding CIPN pathophysiology have revealed the role of oxidative stress and neuroinflammation, opening new therapeutic avenues beyond traditional analgesics. Biomarker development for early CIPN detection is gaining momentum, with neurotrophic factors and microRNAs showing promise for identifying high-risk patients Widyadharma. This trend could potentially reduce the addressable market for CIPN treatments, as preventive interventions might decrease the incidence of severe cases requiring pharmaceutical management. Pharmaceutical companies face the strategic challenge of balancing innovation in treatment with the market-constraining effects of improved prevention and early intervention strategies.

Safety Concerns & Abuse Potential Limiting Opioid and Gabapentinoid Utilization

The clinical utility of traditional neuropathic pain treatments is increasingly constrained by mounting safety concerns and regulatory scrutiny. Opioids, despite their analgesic efficacy, face severe prescribing restrictions due to their high abuse potential and the ongoing public health crisis associated with opioid misuse. Gabapentinoids (pregabalin and gabapentin), while effective for many neuropathic pain conditions, are encountering growing regulatory oversight due to emerging evidence of misuse potential and dependence issues. These safety challenges are driving a fundamental market shift toward treatments with improved risk-benefit profiles. The development of peripherally-acting analgesics that do not cross the blood-brain barrier represents a strategic response to these concerns, offering pain relief without central nervous system effects that contribute to abuse potential NIH. This safety-driven market evolution is creating opportunities for novel therapeutic approaches that can maintain efficacy while addressing the limitations of current standard-of-care treatments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Clinical Adoption of Next-Generation Sodium-Channel Blockers & NGF Antagonists

- Accelerating R&D Investments in Non-Opioid Analgesics by Big Pharma & Biotech

- Patent Expirations of Blockbuster Therapies Driving Price Erosion & Generic Entry

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anticonvulsants command the largest market share at 33.50% in 2024, with pregabalin and gabapentin serving as cornerstone therapies due to their established efficacy across multiple neuropathic pain conditions. Their mechanism of action, primarily involving calcium channel modulation and enhanced GABA activity, effectively addresses the hyperexcitability that characterizes neuropathic pain states. Recent comparative analyses reveal that pregabalin demonstrates superior pain reduction and fewer adverse events compared to gabapentin, potentially explaining its growing preference among clinicians Mayoral et al.. Despite their dominance, anticonvulsants face challenges from emerging drug classes with potentially superior safety profiles and more targeted mechanisms. Topical agents represent the fastest-growing segment with a 10.10% CAGR (2025-2030), driven by their favorable risk-benefit profile, particularly for localized neuropathic pain. SNRIs maintain significant market presence due to duloxetine's established efficacy in diabetic peripheral neuropathy, while opioids face declining utilization amid safety concerns and regulatory restrictions. The "Other Classes" segment, including NMDA antagonists and cannabinoids, shows promising growth potential as research advances on novel mechanisms targeting neuropathic pain pathways.

The competitive dynamics within drug classes are evolving as pharmaceutical companies strategically reposition their portfolios toward differentiated mechanisms. Emerging evidence suggests that combination approaches targeting multiple pain pathways simultaneously may offer superior outcomes compared to monotherapy, potentially reshaping treatment algorithms Kumar et al.. This trend is driving increased interest in rational polypharmacy and fixed-dose combinations that can address the complex pathophysiology of neuropathic pain while minimizing individual drug side effects. The recent approval of novel agents like suzetrigine signals a potential paradigm shift toward mechanism-based prescribing rather than the current symptom-based approach, which could fundamentally alter market share distribution across drug classes in the coming years.

Diabetic peripheral neuropathy (DPN) dominates the indication landscape with 32.30% market share in 2024, reflecting its high prevalence among the growing diabetic population worldwide. The condition affects approximately 50% of patients with diabetes duration exceeding 10 years, creating a substantial and expanding patient pool. Treatment approaches for DPN are evolving beyond symptom management to address underlying pathophysiological mechanisms, with increasing focus on disease-modifying therapies that can prevent or slow neuropathy progression. Chemotherapy-induced peripheral neuropathy (CIPN) represents the fastest-growing indication segment with an 11.56% CAGR (2025-2030), driven by improving cancer survival rates and growing recognition of CIPN's impact on quality of life. Postherpetic neuralgia maintains significant market share due to its distinctive pathophysiology and treatment challenges, while trigeminal neuralgia represents a smaller but therapeutically distinct segment with specific treatment algorithms.

The indication landscape is being reshaped by advances in diagnostic capabilities and biomarker development that enable earlier intervention and more precise patient stratification. Recent research has identified potential biomarkers for CIPN, including neurotrophic factors and microRNAs, which could facilitate preventive strategies in high-risk patients Widyadharma. For HIV-associated neuropathy, antiretroviral therapy optimization is increasingly recognized as a critical component of management alongside direct pain interventions. Phantom limb pain is benefiting from innovative approaches, including the FDA-approved Altius Direct Electrical Nerve Stimulation System, which demonstrated significant pain reduction in clinical studies FDA. These advances in indication-specific approaches are driving market segmentation and creating opportunities for targeted therapies that address the unique pathophysiological features of each neuropathic pain condition.

The Neuropathic Pain Market Report Segments the Industry Into by Drug Class (Anticonvulsants, Tricyclic Antidepressants, and More), by Indication (Diabetic Peripheral Neuropathy, Postherpetic Neuralgia and More), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominates the neuropathic pain market with 42.50% share in 2024, driven by high disease prevalence, advanced healthcare infrastructure, and favorable reimbursement policies. The region's leadership position is reinforced by its role as the primary launch market for innovative therapies, exemplified by the recent FDA approval of Journavx (suzetrigine) as the first new analgesic class in over two decades FDA. The implementation of the NOPAIN Act represents a significant policy advancement, creating reimbursement pathways specifically for non-opioid pain management in outpatient settings Vertex Pharmaceuticals. This regulatory tailwind is expected to accelerate market access for novel neuropathic pain therapies, particularly those with demonstrated advantages over existing options. The United States accounts for the largest share within North America, reflecting its substantial patient population and high healthcare expenditure, while Canada and Mexico contribute significantly to regional growth through expanding access programs and improving diagnostic capabilities.

Europe represents the second-largest regional market, characterized by strong healthcare systems and comprehensive reimbursement frameworks that facilitate access to advanced neuropathic pain therapies. The region's market dynamics are shaped by stringent health technology assessment processes that emphasize comparative effectiveness and cost-utility, driving demand for treatments with demonstrable advantages over existing options. The United Kingdom and Germany lead in adoption of innovative therapies, while France, Italy, and Spain maintain substantial market shares due to their large patient populations and established pain management infrastructure. Recent European approvals of novel treatments and devices, including advanced spinal cord stimulation systems, reflect the region's commitment to expanding therapeutic options for neuropathic pain patients Medtronic.

Asia-Pacific represents the fastest-growing regional market with a 12.37% CAGR (2025-2030), driven by increasing disease prevalence, improving healthcare access, and rising healthcare expenditure. China leads regional growth with expanding insurance coverage and significant investments in healthcare infrastructure, while Japan contributes substantial market share through its advanced healthcare system and aging population with high neuropathic pain prevalence. India is emerging as a key growth market due to its large diabetic population and improving diagnostic capabilities, though access challenges persist in rural areas. The region is witnessing increasing adoption of traditional medicine approaches alongside conventional therapies, with recent research highlighting the potential of traditional Chinese medicine in treating neuropathic pain Zhang et al.. South Korea's market is characterized by rapid technology adoption and strong pharmaceutical research capabilities, contributing to regional innovation. The Middle East & Africa and South America regions represent smaller but growing markets, with improving healthcare infrastructure and increasing disease awareness driving expansion from a lower base.

List of Companies Covered in this Report:

- Pfizer

- GlaxoSmithKline

- Eli Lilly and Company

- Johnson & Johnson

- Novartis

- Teva Pharmaceutical Industries

- Grunenthal GmbH

- UCB

- Sanofi

- Biogen

- Astellas Pharma

- Vertex Pharmaceuticals

- Aptinyx Inc.

- Daiichi Sankyo

- Takeda Pharmaceuticals

- Bayer

- Mallinckrodt Pharmaceuticals

- Sun Pharmaceuticals Industries

- Assertio Holdings, Inc.

- Ipsen

- Endo International

- Lexicon Pharmaceuticals, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Global Prevalence of Diabetes & Obesity Driving Diabetic Peripheral Neuropathy

- 4.2.2 Increasing Cancer Survival Rates Elevating Chemotherapy-Induced Peripheral Neuropathy Burden

- 4.2.3 Rapid Clinical Adoption of Next-Generation Sodium-Channel Blockers & NGF Antagonists

- 4.2.4 Accelerating R&D Investments in Non-Opioid Analgesics by Big Pharma & Biotech

- 4.2.5 Expanding Availability of Long-Acting Topical & Transdermal Formulations Worldwide

- 4.2.6 Favorable Global Reimbursement & HTA Outcomes for High-Cost Biologic Analgesics

- 4.3 Market Restraints

- 4.3.1 Safety Concerns & Abuse Potential Limiting Opioid and Gabapentinoid Utilization

- 4.3.2 Patent Expirations of Blockbuster Therapies Driving Price Erosion & Generic Entry

- 4.3.3 Stringent Regulatory Requirements Delaying Approval of Novel Analgesics

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Class

- 5.1.1 Anticonvulsants

- 5.1.2 Serotonin and Norepinephrine Reuptake Inhibitors

- 5.1.3 Tricyclic Antidepressant

- 5.1.4 Opioids

- 5.1.5 Topical Agents

- 5.1.6 Other Classes

- 5.2 By Indication

- 5.2.1 Diabetic Peripheral Neuropathy

- 5.2.2 Postherpetic Neuralgia

- 5.2.3 Chemotherapy-Induced Peripheral Neuropathy

- 5.2.4 Trigeminal Neuralgia

- 5.2.5 HIV-Associated Neuropathy

- 5.2.6 Phantom Limb Pain

- 5.2.7 Others (MS, Spinal Cord Injury)

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Topical

- 5.3.3 Parenteral

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Pfizer Inc.

- 6.4.2 GlaxoSmithKline plc

- 6.4.3 Eli Lilly and Company

- 6.4.4 Johnson & Johnson Services, Inc.

- 6.4.5 Novartis AG

- 6.4.6 Teva Pharmaceutical Industries Ltd.

- 6.4.7 Grunenthal GmbH

- 6.4.8 UCB S.A.

- 6.4.9 Sanofi S.A.

- 6.4.10 Biogen Inc.

- 6.4.11 Astellas Pharma Inc.

- 6.4.12 Vertex Pharmaceuticals Incorporated

- 6.4.13 Aptinyx Inc.

- 6.4.14 Daiichi Sankyo Company, Limited

- 6.4.15 Takeda Pharmaceutical Company Limited

- 6.4.16 Bayer AG

- 6.4.17 Mallinckrodt Pharmaceuticals

- 6.4.18 Sun Pharmaceutical Industries Ltd.

- 6.4.19 Assertio Holdings, Inc.

- 6.4.20 Ipsen S.A.

- 6.4.21 Endo International plc

- 6.4.22 Lexicon Pharmaceuticals, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment