PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405721

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405721

UAV Propulsion Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

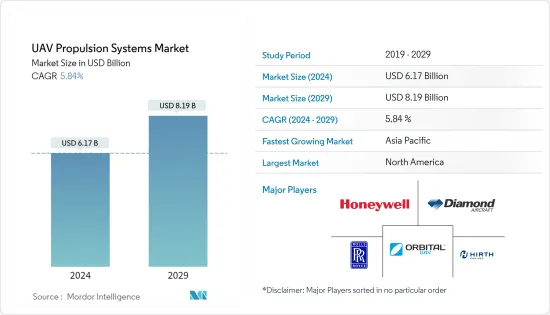

The UAV Propulsion Systems Market size is estimated at USD 6.17 billion in 2024, and is expected to reach USD 8.19 billion by 2029, growing at a CAGR of 5.84% during the forecast period (2024-2029).

Over the years, the usage of drones has penetrated several applications in the commercial sector, such as aerial photography, express shipping and delivery, gathering information or supplying essentials for disaster management, geographical mapping of inaccessible terrain and locations, building safety inspections, precision crop monitoring, unmanned cargo transport, law enforcement and border control surveillance, storm tracking, and forecasting hurricanes and tornadoes. As the customization of commercial UAVs is quite cheap, it paves the way for new functionalities in a wide array of niche spaces. For instance, sophisticated UAVs are being deployed to fertilize crop fields on an automated basis, monitor traffic incidents, and survey hard-to-reach places.

The inherent benefits of integrating an electric-propulsion system to different UAV platforms are also driving the adoption of electric propulsion technologies at a much faster pace than their other counterparts. For instance, an electrical propulsion system provides more flexibility in the installation of machinery as they are compact, and due to the absence of several moving components of the drivetrain, they weigh less and, hence, contribute toward weight savings and endurance enhancement of a particular UAV model. Besides, the emergence of global green emission initiatives has encouraged the adoption of eco-friendly propulsion technologies, such as electric propulsion. UAVs have evolved into increasingly capable platforms deployed for a wide variety of applications. The capability to fight effectively in urban areas against widely dispersed forces while minimizing collateral damage and achieving information superiority has enabled UAVs to play a greater role in critical missions. The endurance of a UAV is influenced by the propulsion technology used and is dependent on the aerodynamic design and amount of fuel carried. To fulfill the energy requirements of a large variety of UAVs, several variants of piston engines and electric motors have been designed by the market players. The potential benefits of a propulsion system are measured by their impact on the costs of the whole UAV. Lightweight, more fuel-efficient engines permit the usage of expensive payloads for a given mission without significantly affecting the size and cost of the UAV. In recent years, the electric propulsion system has gained more popularity among small or mini-UAVs for its apparent advantages: quiet operation, easy and safe to handle and store, precise power management, and control.

UAV Propulsion Systems Market Trends

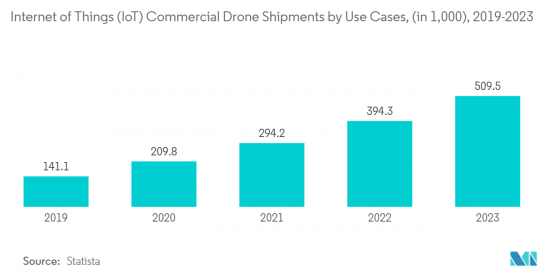

Commercial Segment is Expected to Lead the Market During the Forecast Period

Drone technology is no longer limited to military and homeland uses. UAVs have found a vast number of applications in different commercial industries. There is a rapid rise in the adoption of UAVs for various commercial applications. UAVs are used for close visual inspection of different assets like roof inspection, telco and radio towers inspection, and oil & gas plant inspections. UAVs are utilized for monitoring and management applications such as waste management, road safety, traffic monitoring, highway infrastructure management, natural hazards and disaster relief, and port & waterways. Commercial UAV manufacturers have long been strategizing over the adoption of alternative propulsion technologies for UAVs. With several vendors experimenting with such innovative technologies, the dependence of UAVs on fossil fuels has been reduced significantly. Recently, hydrogen fuel cells have emerged as a viable alternative fuel to replace Li-ion batteries in smaller drones, and their efficiency in terms of weight/power ratios is increasing rapidly. They offer compelling value for UAVs due to improved reliability over small internal combustion engines, enhancing safe and low maintenance operation. UAV systems powered by fuel cells operate longer than their battery counterparts, with the same benefits of low thermal and noise. For instance, in August 2023, the Federal Aviation Administration (FAA) granted approval to the Pelican Spray drone from Pyka for crop protection operations in the US.

Asia-Pacific is Expected to Generate the Highest Demand During the Forecast Period

The Asia-Pacific region is expected to generate the highest demand for UAV propulsion systems during the forecast period. This increasing demand is mainly due to the increasing orders for different UAV configurations for a plethora of military and commercial applications. Investments in drone start-ups are projected to grow in several countries in the region, necessitating the implementation of well-defined regulatory policies. In the Asia-Pacific, several modernization programs are underway to enhance the current capabilities of the commercial and military end-users in the region. For instance, in June 2023, India's Defense Acquisition Council (DAC) announced the procurement of 31 MQ-98 Predator drones manufactured by General Dynamics Atomics Systems Inc. The procurement cost is USD 3 billion, and the acquisition of these drones will improve India's surveillance capabilities beyond its borders.

Additionally, in July 2023, the Indian Armed Forces issued out notice to purchase 97 medium-category and long-endurance 'Made-in-India' drones. Moreover, in October 2022, Garuda Aerospace and Elbit Systems signed an agreement at the Defense Expo for Garuda Aerospace; Elbit Systems signed an agreement to provide Skylark 3 UAS drones to commercial and government agencies. Skylark 3 drones are used to implement large-scale surveying and mapping of government village projects. Such developments are envisioned to drive the growth prospects of the market in focus during the forecast period.

UAV Propulsion Systems Industry Overview

The UAV propulsion systems market is moderately consolidated. The prominent players in the UAV propulsion systems market are Orbital Corporation Limited, Diamond Aircraft Industries GmbH, Hirth Engines GmbH, Rolls-Royce plc, and Honeywell International Inc., amongst others. These companies are majorly into the design, manufacturing, and integration of complete propulsion systems for compatible UAV models. The market is highly competitive, and players are releasing products with cross-compatibility. The continuous R&D of prominent market players, such as MMC, to develop advanced UAV propulsion systems and enhance their current capabilities poses a threat to new market entrants.

Additionally, the use of 3D printing technology in propulsion drives is anticipated to simultaneously generate demand for new system components and designs to cater to the demand for sophisticated electric propulsion systems with reduced size and mass without compromising on relative performance. For instance, in June 2023, Firestorm Labs partnered with Greenjets to build the first-of-its-kind additively manufactured unmanned aerial Vehicle airframe and engine solution. Similarly, in December 2022, Vertiq won a research grant from the U.S. Air Force to develop its Underactuated Propulsion System for use in UAVs. Vertiq's Underactuated Propulsion System was to offer UAVs longer flight time and increased maneuverability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Engine Type

- 5.1.1 Conventional

- 5.1.2 Hybrid

- 5.1.3 Full-electric

- 5.2 Application

- 5.2.1 Civil and Commercial

- 5.2.2 Military

- 5.3 UAV Type

- 5.3.1 Micro UAV

- 5.3.2 Mini UAV

- 5.3.3 Tactical UAV

- 5.3.4 MALE UAV

- 5.3.5 HALE UAV

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Diamond Aircraft Industries GmbH

- 6.2.2 Honeywell International Inc.

- 6.2.3 Rolls-Royce plc

- 6.2.4 Orbital Corporation Limited

- 6.2.5 Hirth Engines GmbH

- 6.2.6 3W International GmbH

- 6.2.7 General Electric Company

- 6.2.8 Pratt & Whitney (RTX Corporation)

- 6.2.9 BRP-Rotax GmbH & Co KG

- 6.2.10 UAV Engines Limited

- 6.2.11 Ballard Power Systems Inc.

- 6.2.12 MMC

- 6.2.13 H3 Dynamics Holdings Pte. Ltd.

- 6.2.14 Intelligent Energy Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS