PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850183

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850183

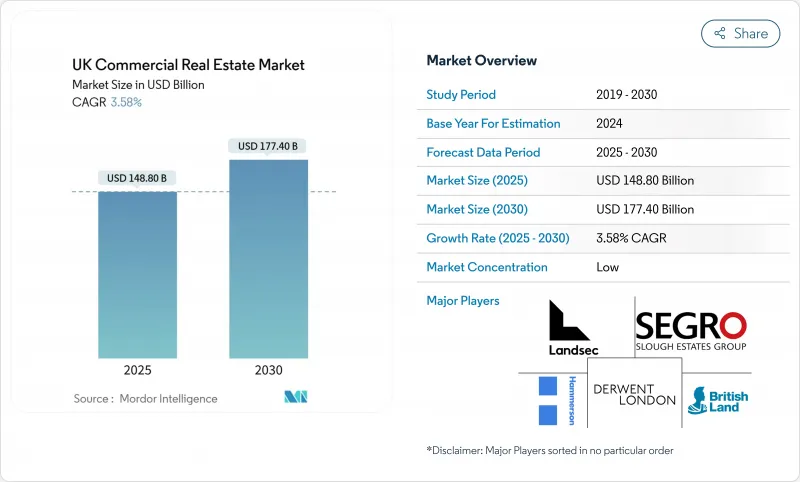

UK Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom commercial real estate market size stands at USD 148.80 billion in 2025 and is forecast to reach USD 177.40 billion by 2030, reflecting a 3.58% CAGR.

Momentum is returning as 2024 investment volumes climbed 20% and base-rate cuts expected in 2025 lower borrowing costs. E-commerce expansion keeps demand for grade-A logistics space 8% above pre-pandemic averages, while corporates drive a sustained "flight-to-quality" toward energy-efficient offices as EPC regulations tighten . Institutional allocations continue to diversify into data-centres and life-sciences facilities following an eight-fold surge in average data-centre capacity uptake since 2019. England remains the capital magnet with 78% United Kingdom commercial real estate market share, yet Scotland leads regional growth at a 4.8% CAGR on stronger inventory and buyer activity . The sales model still dominates at 65% share, but rental-led strategies are expanding at 4.3% as occupiers favor flexibility.

UK Commercial Real Estate Market Trends and Insights

Accelerating E-commerce Warehousing Demand Across the UK

Warehouse leasing reached 27.97 million sq ft in 2024, 23% above the five-year average as on-line retailers and manufacturers compete for edge-of-city plots. Grade-A units comprised 77% of transactions, underscoring a quality-centric market that aligns with occupiers' automation requirements. Near-shoring strategies are now in play for 25% of European corporates, driving UK-based buffer stock locations. Manufacturing tenants already represent 32% of logistics take-up, signalling a diversification away from pure e-commerce fulfilment. Combined with freeport-linked tax holidays, these trends sustain a 4.7% CAGR for logistics within the United Kingdom commercial real estate market

Flight-to-Quality Toward Grade-A, ESG-Certified Offices Nationwide

Prime office rental growth is pacing 2.6% per year to 2030 despite an 8.7% vacancy rate, illustrating a clear bifurcation between compliant and obsolete assets. Buildings meeting EPC-B thresholds command valuation premiums that reach 25% in core sub-markets. Upcoming EPC deadlines-'C' by 2027 and 'B' by 2030-place close to GBP 93 billion of stock at risk of becoming stranded. Corporates favouring green leases help lock-in longer weighted average lease terms, stabilising income for landlords. The premium-driven gap therefore incentivises institutional retrofits across the United Kingdom commercial real estate market.

Construction-Material Inflation & Labour Shortage Post-Brexit

Material costs rose 60% between 2015 and 2022 versus 35% on the continent, while labour costs advanced 30% amid a 330,000-worker shortfall. Iron prices jumped 88% and steel 25%, making new-build feasibilities challenging. Resultant delays cut new commercial orders by 20.8%, constraining the pipeline of grade-A supply. Higher cap-ex tilts capital toward standing assets, uplifting valuations but widening the quality gap. These pressures shave 0.7 percentage points from the forecast CAGR of the United Kingdom commercial real estate market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth of Life-Sciences & Data-Centre Real Estate Enabled by Government Grants

- Rising Institutional Investor Appetite for Build-to-Rent Portfolios amid Severe Housing Shortage

- Persistent Retail Space Rationalisation in Secondary Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The office category retained 45% of the United Kingdom commercial real estate market in 2024 and is poised to compound at 2.6% annually, supported by demand for grade-A, low-carbon space. Prime yield compression to 5.96% in London underlines investor confidence even as hybrid work patterns persist. Secondary stock faces elevated vacancy and capital-expenditure drag from EPC mandates, forcing repositioning or conversion. Meanwhile, the logistics stock, though smaller in share, commands a 4.7% CAGR on sustained e-commerce fulfilment and manufacturing near-shoring. Life-sciences laboratories and data-centre campuses add a high-growth "other" tranche that lifts blended returns across the United Kingdom commercial real estate market.

Tenant behaviour accentuates the divide. Global occupiers embed carbon neutrality clauses within leases, creating rental premia that reward green-certified towers. In contrast, outdated buildings risk functional obsolescence without multimillion-pound retrofits. Logistics remains undersupplied, with demand for 50,000-sq-ft urban warehouses especially acute. Data-centre power availability dominates site selection, pushing developers to partner with utilities on renewable micro-grids. These cross-currents make property-type allocation the principal alpha driver in the United Kingdom commercial real estate market over the decade.

The UK Commercial Real Estate Market is Segmented by Property Type (Offices, Retail, Logistics, Others (industrial Real Estate, Hospitality Real Estate)), by Business Model (Sales and Rental), by End-User (Individuals / Households, Corporates & SMEs, Others) and by Region (England, Wales, Scotland, Northern Ireland). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Land Securities Group PLC

- Segro PLC

- British Land Company PLC

- Derwent London PLC

- Hammerson PLC

- Capital & Counties Properties PLC

- Shaftesbury Capital PLC

- Tritax Big Box REIT PLC

- Unite Group PLC

- Canary Wharf Group Investment Holdings PLC

- Grosvenor Group Limited

- L&G Real Assets (Legal & General)

- Aviva Investors Real Assets

- Brookfield Asset Management (UK Portfolio)

- Get Living PLC

- Grainger PLC

- Watkin Jones PLC

- St. Modwen Logistics (Blackstone)

- Urban Logistics REIT PLC

- Wayhome

- AskPorter

- Landbay

- Thirdfort

- RentProfile

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Accelerating E-commerce Warehousing Demand Across the UK

- 4.9.2 Flight-to-Quality Toward Grade-A, ESG-Certified Offices Nationwide

- 4.9.3 Rapid Growth of Life-Sciences & Data-Centre Real Estate Enabled by Government Grants

- 4.9.4 Rising Institutional Investor Appetite for Build-to-Rent Portfolios amid Severe Housing Shortage

- 4.9.5 Freeports & Broad Tax-Incentive Zones Catalysing Industrial Real Estate Investment

- 4.10 Market Restraints

- 4.10.1 Construction-Material Inflation & Labour Shortage Post-Brexit

- 4.10.2 Persistent Retail Space Rationalisation in Secondary Cities

- 4.10.3 Tightening LTV Ratios amid Volatile Gilt Yields

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porters Five Forces Analysis

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers/Occupiers

- 4.12.3 Bargaining Power of Suppliers (Developers/GCs)

- 4.12.4 Threat of Substitutes (WFH, Flexible Office)

5 Market Size & Growth Forecasts (Value, GBP billion)

- 5.1 By Property Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Logistics

- 5.1.4 Others (industrial real estate, hospitality real estate, etc.)

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Region

- 5.4.1 England

- 5.4.2 Wales

- 5.4.3 Scotland

- 5.4.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Capital Raising)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Land Securities Group PLC

- 6.4.2 Segro PLC

- 6.4.3 British Land Company PLC

- 6.4.4 Derwent London PLC

- 6.4.5 Hammerson PLC

- 6.4.6 Capital & Counties Properties PLC

- 6.4.7 Shaftesbury Capital PLC

- 6.4.8 Tritax Big Box REIT PLC

- 6.4.9 Unite Group PLC

- 6.4.10 Canary Wharf Group Investment Holdings PLC

- 6.4.11 Grosvenor Group Limited

- 6.4.12 L&G Real Assets (Legal & General)

- 6.4.13 Aviva Investors Real Assets

- 6.4.14 Brookfield Asset Management (UK Portfolio)

- 6.4.15 Get Living PLC

- 6.4.16 Grainger PLC

- 6.4.17 Watkin Jones PLC

- 6.4.18 St. Modwen Logistics (Blackstone)

- 6.4.19 Urban Logistics REIT PLC

- 6.4.20 Wayhome

- 6.4.21 AskPorter

- 6.4.22 Landbay

- 6.4.23 Thirdfort

- 6.4.24 RentProfile

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment (Net-Zero Retrofit, Senior Living, Modular Logistics)