PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687322

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687322

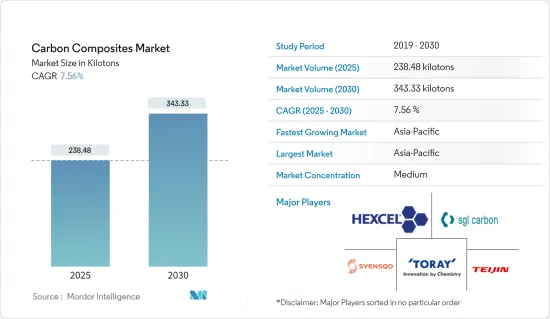

Carbon Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Carbon Composites Market size is estimated at 238.48 kilotons in 2025, and is expected to reach 343.33 kilotons by 2030, at a CAGR of 7.56% during the forecast period (2025-2030).

COVID-19 had a negative impact on the carbon composites sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factors driving the market are increasing demand from the aerospace and defense industry and increasing demand from the wind energy sector.

- However, the high cost of manufacturing in comparison to other composites and the presence of substitutes are hindering the market growth.

- Nevertheless, the growing adoption of carbon composites in 3D printing and increasing demand from fuel cell electric vehicles (FCEVs) will be the market opportunities.

- The Asia-Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Carbon Composites Market Trends

Aerospace and defense applications to dominate the market

- The aerospace and defense sectors dominate the carbon composite market as its primary end-users. Historically, aerospace manufacturing relied on metals like aluminum, steel, and titanium, which made up about 70% of an aircraft's weight. Recently, the use of carbon composites has surged due to their weight reduction, resistance, insulation, and radar absorption properties.

- Carbon composites, made of carbon fibers in a polymer matrix, reduce maintenance costs by resisting rust and corrosion.

- With superior strength-to-weight ratios, these materials lighten aircraft, reducing fuel consumption and allowing longer flights with more passengers.

- Key aerospace applications include clips, cleats, brackets, ribs, struts, stringers, wing leading edges, and specialized parts.

- The aerospace sector is also exploring their use in larger structures like wing torsion boxes and fuselage panels. Carbon composites are used in missile defense, ground defense, and military marine applications.

- Industry leaders like Boeing use various carbon fiber-based composite parts in their aircraft, such as the Boeing 787 Dreamliner, which features composite ceiling rails made using continuous compression molding (CCM) processes.

- The aerospace industry is witnessing a surge in aircraft manufacturing, driven by swift technological advancements and innovations. Boeing's Commercial Outlook for 2023-2042 highlights a rebound in international traffic and domestic air travel, returning to pre-pandemic levels. Owing to these factors, Boeing forecasts global demand for 48,575 new commercial jets by 2042.

- In 2023, Boeing delivered 528 aircraft and secured 1,314 net new orders, a notable increase from 480 deliveries and 774 net new orders in 2022. While Boeing met its revised goal of delivering at least 375 single-aisle planes, it delivered 396 narrowbody 737 jets in 2022, falling short of its initial target of 400 to 450 jets.

- Airbus, on the other hand, reported delivering 735 commercial aircraft to 87 global customers in 2023, marking an 11% increase from the prior year. Airbus's "Commercial Aircraft" division also secured 2,319 gross new orders in the same year. Indicated a strong positive market outlook.

- In 2023, the 31 NATO members collectively spent USD 1,341 billion, constituting 55% of the global military expenditure. The European defense market is projected to grow substantially as NATO members have aimed to increase the defense budget by targeting spending of 2% of the Gross Domestic Product (GDP).

- Hence, due to the aforementioned factors, the aerospace and defense sector is expected to dominate the market studied.

Asia Pacific to dominate the market

- Asia-Pacific accounts for the highest share of the global carbon composites market. Most of the demand for carbon composites comes from applications in aerospace and defense, automotive, sports and leisure, etc.

- Carbon composites have been witnessing tremendous demand in the automotive industry owing to their high strength-to-weight ratios, corrosion resistivity, and workability features. They have been replacing metals in various automotive applications due to their lightweight but tough features, which contribute to lesser fuel consumption.

- According to the International Trade Administration (ITA), China is the world's second-largest civil aerospace market. The Civil Aviation Administration of China (CAAC) estimates that the aviation sector is expected to recover domestic traffic to approximately 85% of pre-pandemic levels.

- In April 2023, Airbus signed a new cooperation agreement with Tianjin FZ Investment Company Ltd. and Aviation Industry Corp of China Ltd. to expand the final assembly capacity of the A320 Family. This expansion includes adding a second assembly line at Airbus's Tianjin facility. The agreement supports Airbus's overall target of producing 75 aircraft per month by 2026 across its global production network.

- According to the latest data released by the China Association of Automobile Manufacturers (CAAM), car production in the country exceeded 30.16 million units in 2023, an 11.6% increase compared to the previous year. A total of 30.09 million passenger cars were sold in the country in 2023, a 12% increase compared to the previous year.

- Moreover, the Chinese government estimates a 20% penetration rate of electric vehicles by 2025. Such significant investments are projected to propel the country's automotive sector and positively impact the market studied.

- All the above-mentioned factors are expected to drive the market for carbon composites in the coming years. Asia-Pacific is expected to dominate the market studied during the forecast period.

Carbon Composites Industry Overview

The global carbon composites market is partially fragmented in nature. The major players (not in any particular order) include Toray Industries Inc., Syensqo, Hexcel Corporation, Teijin Limited, and SGL Carbon SE, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Aerospace and Defense Industry

- 4.1.2 Increasing Demand from the Wind Energy Sector

- 4.2 Restraints

- 4.2.1 High Cost for Manufacturing in Comparison to Other Composites

- 4.2.2 Presence of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Matrix

- 5.1.1 Hybrid

- 5.1.2 Metal

- 5.1.3 Ceramics

- 5.1.4 Carbon

- 5.1.5 Polymer

- 5.1.5.1 Thermosetting

- 5.1.5.2 Thermoplastic

- 5.2 Process

- 5.2.1 Prepeg Layup Process

- 5.2.2 Pultrusion and Winding

- 5.2.3 Wet Lamination and Infusion Process

- 5.2.4 Press and Injection Processes

- 5.2.5 Other Processes

- 5.3 Application

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Wind Turbines

- 5.3.4 Sports and Leisure

- 5.3.5 Civil Engineering

- 5.3.6 Marine Applications

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carbon Composites Inc.

- 6.4.2 China Composites Group Corporation Ltd

- 6.4.3 Epsilon Composite

- 6.4.4 Hexcel Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Carbon Co. Ltd

- 6.4.7 Plasan

- 6.4.8 Rockman

- 6.4.9 SGL Carbon

- 6.4.10 Syensqo

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Carbon Composites in 3D-Printing

- 7.2 Increasing Demand from Fuel Cell Electric Vehicle (FCEV)