Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439732

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439732

Aerospace Foams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

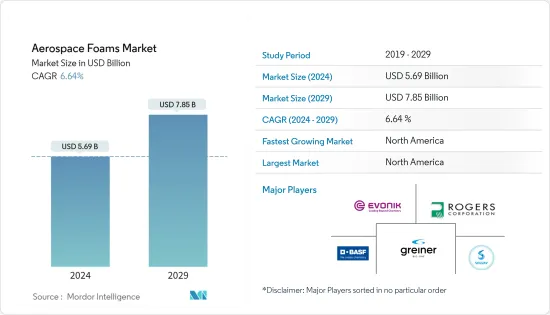

The Aerospace Foams Market size is estimated at USD 5.69 billion in 2024, and is expected to reach USD 7.85 billion by 2029, growing at a CAGR of 6.64% during the forecast period (2024-2029).

Key Highlights

- The market was negatively impacted by COVID-19 in the year 2020. As passenger demand was low because of the pandemic, the corresponding travel restrictions and the economic recession forced airlines to find ways to cut costs. Cost-cutting measures such as the cancellation or postponement of aircraft orders were carried out. However, traveling increased as soon as the restrictions were picked up in the years 2021 and 2022, and this has increased the demand for air freights.

- Over the short term, the major factor driving the market studied is the increasing demand for lightweight and fuel-efficient aircraft. The production of polyurethane (PU) foam is still highly petroleum-dependent, and this acts as a restraint for the market.

- Increasing trends toward bio-based polyurethane foam manufacturing may act as an opportunity for the market during the forecast period. North America is expected to dominate the market over the forecast period.

Aerospace Foams Market Trends

Increasing Demand from Commercial Aviation

- The decreasing fuel price fluctuations and the increasing operational efficiencies have supported the growth of commercial aircraft operations in the past few years. The increasing air travel rates, majorly in emerging economies in Asia-Pacific and South America, along with increasing disposable incomes around the world, have been driving the growth in the aircraft fleet globally.

- The increasing volumes of passengers and the increasing retirements are expected to drive the need for 44,040 new jets, valued at USD 6.8 trillion, over the next two decades. The global commercial fleet is expected to reach 50,660 airplanes by 2038, with all the new airplanes and jets would remaining in service considered.

- Additionally, according to the Boeing Commercial Market Outlook 2022-2041, by 2031, airplanes will grow their commercial fleet with an annual rate of 2.6% and reach 35,400 airplanes in service, and by 2041 this number will reach 47,080, representing an annual rate of 2.8% over the 2019-2041 period.

- Further, new airplane deliveries for commercial fleet from 2022-2041 in Latin America will be 5%, Middle East 7%, North America 23%, Asia 21%, and Europe 21% out of the total deliveries.

- All the aforementioned factors are expected to enhance the demand for aerospace foams during the manufacture of these aircraft in the coming years, thereby boosting the market studied.

North America to Dominate the Market

- North America is the largest market for the aerospace industry across the world. Aerospace manufacturers in North America are expected to expand their operations on account of the rising number of air passengers and increasing military expenditure in the region in recent times.

- The United States is the largest aviation market in North America and has one of the largest fleet sizes in the world; hence, it is one of the largest markets for aerospace foams. According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 in 2037, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow at a rate of 54 aircraft per year due to the existing fleet getting older.

- In the 2022 defense budget, the United States government allowed USD 768.2 billion for national defense programs, which is about a 2% increase from the Biden administration's original budget request, registering a growing usage of aerospace materials in the sector.

- According to the Boeing Commercial Outlook 2022-2041, in North America, 13% of travel by air is done for business purposes, 50% for leisure, and 37% for visiting friends and relatives.

- Further, according to the report, the North American freight fleet is estimated to grow by one-third from 2022-2041. The market demand for commercial services in the region is highest as compared to other regions, with a total value of USD 1,045 billion.

- Globally, Canada ranks first in civil flight simulation, third in civil engine production, and fourth in civil aircraft production. It is the only nationally ranked in the top five of all the key categories. The Canadian aerospace industry exports over 70% of its products to over 190 countries across six continents.

- In Mexico, Volaris is one of the low-cost airlines, which witnessed a 23% growth in passenger influx of domestic travel and 10% in international flights during July 2021 compared to the pre-pandemic situation. Volaris airlines were reported to order three Airbus aircraft and some more to close the year with 98 aircraft.

- Owing to all these factors, the demand for aerospace foams is projected to grow in the region during the forecast period.

Aerospace Foams Industry Overview

The aerospace foams market is partially consolidated among the top-level players. The major companies include (not in any particular order) Greiner Aerospace, BASF SE, Evonik Industries AG, Rogers Corporation, and Solvay.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 67705

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight and Fuel-efficient Aircraft

- 4.1.2 Steady Growth in the Aerospace Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Regarding the Use of PU Foams

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyurethane

- 5.1.2 Polyimide

- 5.1.3 Metal Foams

- 5.1.4 Melamine

- 5.1.5 Polyethylene

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Commercial Aviation

- 5.2.2 Military Aviation

- 5.2.3 Business and General Aviation

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3A Composites

- 6.4.2 Aerofoam Industries, LLC

- 6.4.3 ARMACELL

- 6.4.4 BASF SE

- 6.4.5 Boyd

- 6.4.6 Diab Group

- 6.4.7 DuPont

- 6.4.8 ERG Aerospace Corporation

- 6.4.9 Evonik Industries AG

- 6.4.10 General Plastics Manufacturing Company

- 6.4.11 Grand Rapids Foam Technologies

- 6.4.12 Greiner Aerospace

- 6.4.13 Rogers Corporation

- 6.4.14 Technifab, Inc.

- 6.4.15 UFP Technologies, Inc.

- 6.4.16 Zotefoams plc

- 6.4.17 Recticel NV/SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Trends toward Bio-based PU Foam Manufacturing

- 7.2 Other Opportunities

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.