Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689792

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689792

Bio-process Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 169 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

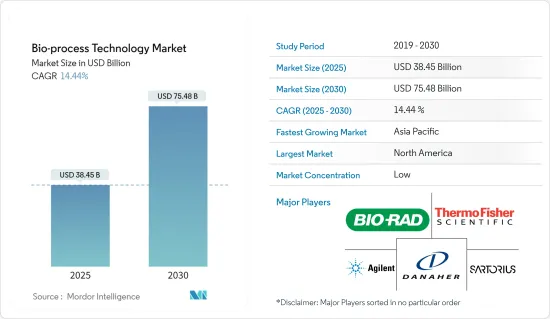

The Bio-process Technology Market size is estimated at USD 38.45 billion in 2025, and is expected to reach USD 75.48 billion by 2030, at a CAGR of 14.44% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic has substantially impacted various markets. The bioprocess technology market faced tremendous disruptions in the initial phase, and its growth was affected. For instance, in August 2022, an article published in the American Pharmaceutical Review stated that the biopharmaceutical manufacturing industry experienced a huge strain on its supply chains. Some of the more significant challenges have occurred in consumable manufacturing goods. Specifically, membrane filters used for sterilization and several other purposes throughout manufacturing bioprocesses were in critically short supply. In addition, single-use systems, separation columns, tubing, raw materials, and components were not readily available. However, this market is expected to gain traction due to the powerful urge to develop vaccines and other biological products. For instance, according to an article published by Poznan University of Economics and Business, biopharma companies undertook new partnerships to discover and deliver vaccines against COVID-19. The pandemic has also enabled the development of several innovative projects related to the COVID-19 vaccine and drug development. Bioprocess technology is highly adopted for vaccine and other biopharmaceutical production.

- The factors driving the growth of the studied market are expansion in the biopharmaceutical industry and increasing investments in research and development by biotechnology and pharmaceutical companies. The biopharmaceutical sector has deepened its roots across the medical and pharmaceutical industries on account of the transformation of pharmaceutical companies toward biotechnology, creating growth opportunities. For instance, an article published in the Biotechnology Report in July 2022 stated that growing technological developments in biopharmaceutical and pharmaceutical sectors like 3D bioprinting, biosensors, and gene editing, as well as the incorporation of cutting-edge artificial intelligence and virtual and augmented reality, are expected to open growth opportunities by increasing and speeding the production through bioprocessing. Thus, the increasing demand for bio-process technology is driving the growth of the market.

- Similarly, in October 2022, Oculis SA and European Biotech Acquisition Corp. reported they had entered into a definitive business combination agreement. This agreement is to accelerate the development of Oculis' differentiated ophthalmology pipeline. This product addresses areas of significant medical need, including diabetic macular edema (DME), dry eye disease (DED), and neuro-retina indications, such as glaucoma, affecting growing patient populations. Such agreements and partnerships between different biopharmaceutical companies for developing innovative products are propelling the growth of the market.

- The increasing research and development are also contributing to the growth of the studied market. For instance, according to the report published by the International Federation of Pharmaceutical Manufacturers & Associations, the annual spending by the biopharmaceutical industry is 8.1 times greater than that of the aerospace and defense industries, 7.2 times more than that of the chemicals industry, and 1.2 times more than that of the software and computer services industry. Of all industrial sectors, the biopharmaceutical industry has consistently invested the most in R&D, even in times of economic turmoil and financial crisis. Similarly, Thermo Fisher Scientific's 2021 annual report reported that the company registered a research and development cost of USD 1,406.00 million in 2021. The R&D expenses grew by 19.05% in 2021. The growing research and development expenses of biopharmaceutical companies are contributing to the development of innovative biopharma products, thereby driving the growth of this market.

- Thus, the bio-process technology market is expected to witness significant growth over the forecast period due to the expansion in the biopharmaceutical industry and increasing investments in research and development by biotechnology and pharmaceutical companies. However, the high cost of instruments and strict regulations may slow down the growth over the studied period.

Bio-Process Technology Market Trends

Recombinant Protein Segment Expected to Witness Significant Growth Over the Forecast Period.

- The industrial synthesis of recombinant proteins that are important for therapeutic and preventative purposes depends on the development of effective bioprocessing techniques.

- Current developments in the various fields of bioprocessing are being used to provide efficient methods for creating recombinant proteins. These include the use of high-throughput devices for effective bioprocess optimization and of disposable systems, continuous upstream processing, continuous chromatography, integrated continuous bioprocessing, quality by design, and process analytical technologies to achieve a quality product with a higher yield.

- The recombinant protein segment is expected to witness significant growth over the forecast period owing to the growing demand for recombinant proteins for therapeutic applications. Moreover, the recombinant therapeutic proteins provide essential therapies for various diseases, such as diabetes, cancer, infectious diseases, hemophilia, and anemia.

- Furthermore, recombinant proteins are valuable tools in understanding protein-protein interactions, and the increasing research and development and technological advancements are also expected to drive the growth of this segment.

- For instance, in October 2022, Larimar Therapeutics Inc. reported issuing a US patent for the protection of CTI-1601. CTI-1601 is a recombinant fusion protein intended to deliver human frataxin to the mitochondria of patients with Friedreich's ataxia who cannot produce enough of this essential protein.

- Similarly, in February 2021, Sanofi and GSK promulgated the initiation of a new randomized, double-blind, multi-center dose-finding Phase 2 study of their adjuvanted recombinant protein-based COVID-19 vaccine with 720 volunteers. Thus, innovation in healthcare solutions and the development of new recombinant protein-based drugs are driving the segment's growth.

- The increasing prevalence of chronic diseases like diabetes also boosts the demand for recombinant proteins. For instance, IDF reported that 537 million people (20-79 years old) had diabetes in 2021. This number is expected to increase by 643 million diabetics worldwide by 2030 and 783 million by 2045. With the increase in the diabetic population, the demand for recombinant proteins in the therapeutics segment is likely to show lucrative growth in the coming years, thereby contributing to the development of this segment.

- Thus, due to the growing demand for recombinant proteins for therapeutic applications and new product launches, the segment is expected to witness significant growth over the forecast period.

North America Expected to Witness Significant Growth Over the Forecast Period.

- North America is expected to witness significant growth over the forecast period owing to government support for promoting bioprocess technologies, rising medical expenditure, and developing healthcare infrastructure. In addition, the region has witnessed major collaborative activities with healthcare giants that are extensively investing in R&D in bioprocess technology development.

- For instance, in March 2022, Stam Biotech raised USD 17 million for its next-generation 3-D printer bioreactor. Similarly, in October 2022, Thermo Fisher Scientific Inc. launched a large-scale cell culture harvesting solution. DynaSpin single-use centrifuge system is a centrifuge that is specifically designed to provide an optimal single-use solution for large-scale cell culture harvesting, to improve and streamline the process by reducing the number of depth filtration cartridges required to complete the harvest process.

- Furthermore, in May 2022, GOOD Meat signed an exclusive multi-year agreement with ABEC Inc. to design, manufacture, install, and commission the largest known bioreactors for avian and mammalian cell culture. Technologies are focused on helping customers in the biopharmaceutical and pharmaceutical industry to improve the human condition and to provide life-changing drugs to market faster and more efficiently. The collaboration between the companies has leveraged their complementary strengths to develop specific workflows, which bridge the gap between analytical and process solutions.

- These major biopharmaceutical companies are expanding and boosting the biopharmaceutical segment in North America. For instance, in October 2021, 3M Health Care and Thermo Fisher Scientific collaborated to meet the growing demand for protein-based therapeutics. Manufacturers need advanced technologies and solutions that support reliable and consistent manufacturing processes. The collaboration between 3M and Thermo Fisher also enabled the manufacturers to capture high titer, high cell-density cultures to improve harvesting and clarification and optimize manufacturing capacity, quality, and efficiency.

- Thus, the technologies, expansions, and investments by these global biopharmaceutical companies are driving the bioprocess technology market in North America.

Bio-Process Technology Industry Overview

The bio-process technology market is fragmented and competitive due to many companies operating globally and regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold market shares and are well known. Some of them are listed below.

- F. Hoffmann-La Roche Ltd

- Sartorius Group

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Elitechgroup SpA (Gonotec Gmbh)

- Advanced Instruments LLC

- Danaher Corporation

- Merck KGaA

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Lonza Group AG

- Sartorius Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 68277

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion in the Biopharmaceutical Industry

- 4.2.2 Increasing Investments in Research and Development by Biotechnology and Pharmaceutical Companies

- 4.3 Market Restraints

- 4.3.1 High Cost of Instruments

- 4.3.2 Strict Regulations

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.1.1 Bioprocess Analyzers

- 5.1.1.2 Osmometers

- 5.1.1.3 Bioreactors

- 5.1.1.4 Incubators

- 5.1.1.5 Other Instruments

- 5.1.2 Consumables and Accessories

- 5.1.2.1 Culture Media

- 5.1.2.2 Reagents

- 5.1.2.3 Other Consumables and Acessories

- 5.1.1 Instruments

- 5.2 By Application

- 5.2.1 Recombinant Proteins

- 5.2.2 Monoclonal Antibodies

- 5.2.3 Antibiotics

- 5.2.4 Other Applications

- 5.3 By End-User

- 5.3.1 Biopharmaceutical Companies

- 5.3.2 Contract Manufacturing Organizations

- 5.3.3 Academic Research Institute

- 5.3.4 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-La Roche Ltd

- 6.1.2 Sartorius Group

- 6.1.3 Thermo Fisher Scientific Inc.

- 6.1.4 Agilent Technologies Inc.

- 6.1.5 ELITechgroup Inc. (Gonotec Gmbh)

- 6.1.6 Advanced Instruments LLC

- 6.1.7 Danaher Corporation

- 6.1.8 Merck KGaA

- 6.1.9 Getinge AB

- 6.1.10 Bio-Rad Laboratories Inc.

- 6.1.11 Lonza Group AG

- 6.1.12 Eppendorf AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.