PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689787

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689787

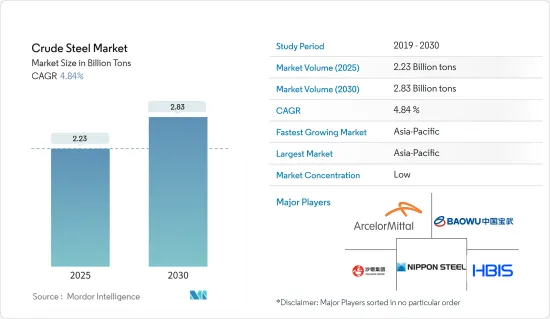

Crude Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Crude Steel Market size is estimated at 2.23 billion tons in 2025, and is expected to reach 2.83 billion tons by 2030, at a CAGR of 4.84% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. Owing to the pandemic, the global sales of all vehicles in 2020 declined. Still, the market recovered in 2021, thereby enhancing crude steel consumption in manufacturing different automotive parts. In 2021, the demand for oil steel increased due to increased demand in various industries such as construction, tools and machinery, energy, transportation, and others.

Key Highlights

- Over the medium term, increasing demand from the building and construction industry and recovering automotive production due to rapid electric vehicle growth are likely to drive the market's growth.

- On the flip side, the depletion of natural resources due to the production of steel and the availability of substitutes are expected to hinder the market's growth.

- The growing trend of a circular economy, where steel is touted to make a significant contribution through its recovery, reuse, remanufacturing, and recycling, is likely to act as an opportunity for the market studied.

- Asia-Pacific is expected to dominate the market, with the most significant consumption from countries such as China and India.

Crude Steel Market Trends

Increasing Demand from the Building and Construction Industry

- Steel and its alloys are among the most common metals used worldwide in the construction industry. Steel is also used on roofs and as cladding for exterior walls. Products such as roofing, purlins, internal walls, ceilings, cladding, and insulating panels for exterior walls are made of steel.

- According to the United Nations (UN), around 50% of the global population resides in urban cities, which is projected to touch 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for commercial, residential, and institutional construction activities.

- China's construction industry is the largest in the world. According to the National Bureau of Statistics of China, the construction industry's business activity index (BASI) rose from 55.9 in November 2023 to 56.9 in December 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- Similarly, in Germany, revenue in housing construction reached EUR 57.95 billion (USD 62.40 billion) in 2023. However, the revenue registered was low when compared to EUR 61 billion (USD 65.69 billion) in 2022.

- According to the Federal Statistical Office (a federal authority of Germany), the number of building permits for residential and non-residential buildings in Germany has reached 110.7 for residential and 26 thousand for non-residential buildings, respectively.

- Furthermore, as per Eurostat (a directorate-general of the European Commission), it is anticipated that the construction revenue in Italy will reach around USD 57.68 billion by the year 2025.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- India is expected to witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it may witness the construction of 60 million new homes. The availability rate of affordable housing is expected to rise by around 70% in 2024. Under the PM Awas Yojana (Gramin), the government aims to build 29.5 million houses for beneficiaries, with 2.95 crore houses built by December 2024.

- Therefore, such industry trends are expected to simultaneously drive the demand for steel in the building and construction industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific has experienced favorable growth in the crude steel industry, with countries like China and India holding significant consumption shares.

- China is the largest producer of crude steel globally. However, according to the National Bureau of Statistics of China, the crude steel production in the country reached 67.44 million metric tons in December 2023 and registered low production when compared to 76.1 million metric tons in November 2023. This decline in steel production was due to policy changes in China that reduced steel output to tackle problems related to pollution levels.

- The expansion of the automotive segment in China is anticipated to benefit the demand for crude steel. The Chinese automotive manufacturing industry is the largest in the world. According to OICA, in 2023, automotive production in the country reached 30.16 million units, which increased by about 11.6%, compared to 27.02 million vehicles produced in 2022.

- Moreover, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, further expected to raise the market demand for crude steel.

- As per the reports by the Society of Indian Automobile Manufacturers, India produced 25,931,867 vehicles from April 2022 to March 2023 and registered growth when compared with 23,040,066 units from April 2021 to March 2022. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are expected to boost the automotive industry.

- According to the IATA (International Air Transport Association) report, India is poised to become the third-largest global aviation market by the end of the forecast period. The country is projected to have a demand for 2,100 aircraft over the next two decades, accounting for over USD 290 billion in sales. Due to these factors, the demand for crude steel from the aerospace industry is expected to rise in the future.

- Furthermore, crude steel is closely tied to the construction industry as a fundamental material essential for building infrastructure and residential and commercial structures, with its demand influenced by factors such as urbanization, economic growth, and technological advancements in construction practices.

- Steel is crucial in transforming solar energy into electrical power. It serves as the foundation for solar thermal systems, pumps, containers, and heat transfer devices. Additionally, a steel column is the primary element of a tidal generator in tidal power systems.

- South Korea aims to produce 70% of its electricity using renewable sources by 2038, a significant increase from the current figure of less than 40% in 2023, as outlined in the nation's 11th Basic Electricity Plan.

- Therefore, all the factors mentioned above are likely to significantly impact the demand in the market studied in the years to come.

Crude Steel Industry Overview

The market studied is fragmented, with moderately high competition among the market players to increase their shares. Some of the key companies in the market (not in any particular order) include China BaoWu Steel Group Corporation Limited, ArcelorMittal, Nippon Steel Corporation, HBIS Group, and Shagang Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Building and Construction Industry

- 4.1.2 Recovering Automotive Production

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Depleting Natural Resources and Availability of Substitutes

- 4.2.2 Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Composition

- 5.1.1 Killed Steel

- 5.1.2 Semi-killed Steel

- 5.2 Manufacturing Process

- 5.2.1 Basic Oxygen Furnace (BOF)

- 5.2.2 Electric Arc Furnace (EAF)

- 5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Transportation

- 5.3.3 Tools and Machinery

- 5.3.4 Energy

- 5.3.5 Consumer Goods

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 China Ansteel Group Corporation Limited

- 6.4.3 China BaoWu Steel Group Corporation Limited

- 6.4.4 China Steel Corporation (CSC)

- 6.4.5 Fangda Special Steel Technology Co. Ltd

- 6.4.6 HBIS Group

- 6.4.7 Hyundai Steel

- 6.4.8 JFE Steel Corporation

- 6.4.9 JSW

- 6.4.10 Nippon Steel Corporation

- 6.4.11 NLMK (Novelipetsk Steel)

- 6.4.12 Nucor Corporation

- 6.4.13 POSCO

- 6.4.14 Rizhao Steel Holding Group Co. Ltd

- 6.4.15 Steel Authority of India Limited (SAIL)

- 6.4.16 ShaGang Group Inc.

- 6.4.17 Tata Steel Limited

- 6.4.18 United States Steel Corporation

- 6.4.19 Techint Group

- 6.4.20 Hunan Valin Iron And Steel Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends of Circular Economy