PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406017

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406017

Europe Watch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

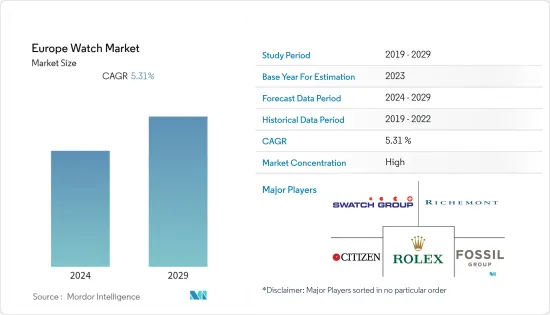

The Europe watch market was valued at USD 26.19 billion for the current year and is projected to register a CAGR of 5.31% over the next five years.

Key Highlights

- One of the key factors propelling the market is the rising propensity of individuals to wear expensive watches as a status symbol. Also, limited edition timepieces with various designs and functions that are being introduced by manufacturers offering an affordable range of looks are attracting customers, thus boosting sales. For instance, in May 2022, Italian titans Bvlgari and Ducati unveiled the Aluminium Ducati Special Edition, limited to 1000 pieces. Additionally, most first-time watch buyers in the area are seen to choose premium models. They typically develop brand loyalty because of this, so they do not mind shelling out more money. Due to the degree of tourist purchases and brand loyalty in nations like the United Kingdom, the market is anticipated to have a substantial prevalence in luxury watches, which is predicted to have a considerable market share.

- Moreover, across countries like Germany, the demand for mid-quartz analog watches is likely to be high, primarily due to shifting consumer focus toward more fashion-oriented watches. Brands like Casio and Timex are continuously investing in R&D for product innovations to blend some of the features of smartwatches with the long-lasting battery life of digital watches while offering the product in attractive designs and affordable prices. Similarly, lower-priced and mid-priced watches are increasingly gaining market traction due to increasing demand for 'value-for-product' watches and accessories among women. In line with this growing demand, manufacturers in the market plan their launches accordingly to meet customers' needs at the most affordable price. For instance, in February 2022, Oppo announced launching the Watch Free to Europe, a smartwatch introduced in China last September. It claims this is the most affordable watch, including several smart features like an optical heart rate sensor that supports 24-hour monitoring. Oppo claims that it has also included a SpO2 sensor for blood oxygen monitoring, along with more than 100 sports modes and 40 watch faces. Such developments in the region are expected to boost the market's growth at a faster pace during the forecast period.

Europe Watch Market Trends

Blending Adventure Sports With Smarter Wearables

- The affluent society across developed countries, specifically in the European Union, is anticipated to have higher average incomes, making them capable enough to pursue recreational and outdoor activities. This is also linked with convenience culture, where the rise of 'empowered consumers' are seeking out more choices within activities along with changing work patterns that facilitate them to use desired time flexibly. The seeking of low-risk activities among the older population is prominent. People between the age group of 40 and 70 cater to two-thirds of the European outdoor activity participation. On the other hand, this segment is also prone to health ailments, and smart wearable that portrays heart rate, and distances covered, among others, have a higher rate of scalability among such consumers.

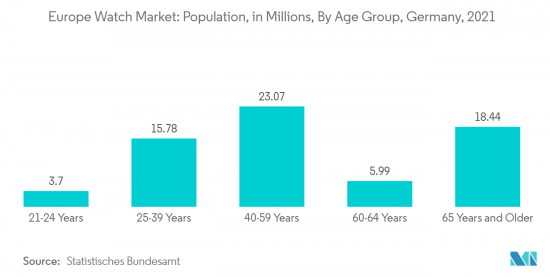

- Moreover, the population between the age group of 40-70 years old is the largest in many countries of the region. For instance, according to Statistisches Bundesamt, 40-59-year-olds make up the largest age group in Germany, at 23 million people. The most recent figures from 2021 confirm that the next-largest age group was 65 years and older, at 18.44 million. This depicts the need for smartwatches that can display heart rate, blood pressure, electrocardiogram (ECG), skin temperature, and SpO2 sensors that can measure blood oxygen levels among the aged population while they perform any rigorous activities.

- The smart wearable markets in Europe will also be driven by the millennial segment, as a change in their living standard will also upgrade the level of commitment that novel technology offers to streamline their daily activities. Apart from them, sports enthusiasts, athletes, and gym goers also make a major customer base that the market can target. Most of the millennials who participate in outdoor sports and vigorous physical activities often spend significant amounts on their timepieces as they are specifically made for such activities. Hence, players in the market are also focused on launching products in line with the consumer's needs. For instance, in April 2023, Huawei launched its HUAWEI WATCH Ultimate, which it claimed is designed for admirers of extreme sports in Italy. The company claimed it to be the first smartwatch made with quality materials and a luxury design. Such developments and the above-mentioned factors are expected to create enough opportunities for the manufacturers to tap into.

Digital (Smart) Watches to Witness the Fastest Growth

- One of the latest trends expected to gain traction in the smart watch segment is the increasing integration of haptics technology, a standard feature used for alerts and notification purposes. Furthermore, the haptic technology used in these smart watches also eliminates the need to carry a smartphone every time, as they alert the user if there are text messages, e-mails, or calls. This is one of the major reasons for the rise in smartwatches, which is eventually driving the market's growth.

- Also, top European watch manufacturers in this segment are investing in the development of new and updated versions of products. They are launching products with smart features to attract the consumer base and remain competitive in the market. For instance, in September 2022, the Chinese tech company Huawei announced that the Watch D would soon be available in the European market. According to the business, the Huawei wristwatch has integrated blood pressure, electrocardiogram (ECG), heart rate, skin temperature, and SpO2 sensors that can measure blood oxygen levels.

- Apart from these developments, manufacturers are attracting consumers with more innovative features that determine smartwatches as better products than analog watches. Custom-made high hardness with improved durability, large displays with clear vision even in daylight, and scratch resistance are some features companies are stressing incorporating into their products. Moreover, the government policies' direct and indirect support for technologically driven firms is, in turn, boosting this market segment studied.

- For instance, in February 2022, in response to the success of the first work program, the European Innovation Council (EIC) introduced its second work program. Compared to the previous program's budget of USD 1.6 billion, this new program has an enhanced budget of USD 1.8 billion. This program aims to find, create, and implement disruptive breakthroughs and cutting-edge technologies. Thus, the initiatives by the regional government are expected to boost the overall revenue of the watch market in the region.

Europe Watch Industry Overview

The European watch market is moderately fragmented, with various players trying to grab the major market share. Major players in the market are focused on social media platforms and online distribution channels for their product's online marketing and branding to attract more customers. Also, players operating in the region focus on leveraging the opportunities posed by innovation in the market to expand their product portfolio so that they can cater to the requirements of various product segments, especially within the integrated analog and smartwatch segments. Players like Citizen Watch, Seiko Holdings Corporation, Rolex SA, Compagnie Financire Richemont SA, The Swatch Group Ltd, and Fossil Group Inc. dominate the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Blending Adventure Sports With Smarter Wearables

- 4.1.2 The Preference for Luxury Time

- 4.2 Market Restraints

- 4.2.1 Increased Prevalence of Counterfeit Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Analogue Watch

- 5.1.2 Digital Watch

- 5.2 End Users

- 5.2.1 Women

- 5.2.2 Men

- 5.2.3 Unisex

- 5.3 Distribution Channel

- 5.3.1 Offline Retail Stores

- 5.3.2 Online Retail Stores

- 5.4 Country

- 5.4.1 Spain

- 5.4.2 United Kingdom

- 5.4.3 Germany

- 5.4.4 France

- 5.4.5 Italy

- 5.4.6 Russia

- 5.4.7 Switzerland

- 5.4.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Seiko Holdings Corporation

- 6.3.2 Casio Computer Co. Ltd

- 6.3.3 Timex Group

- 6.3.4 Rolex SA

- 6.3.5 Compagnie Financire Richemont SA

- 6.3.6 Citizen Watch Co. Ltd

- 6.3.7 Fossil Group Inc.

- 6.3.8 The Swatch Group Ltd

- 6.3.9 Google LLC (Fitbit Inc.)

- 6.3.10 Uhrenfabrik Junghans GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS