PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435822

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435822

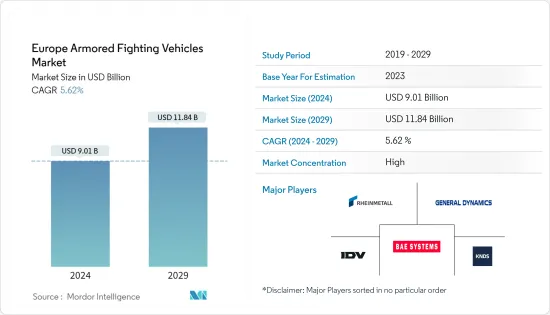

Europe Armored Fighting Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Armored Fighting Vehicles Market size is estimated at USD 9.01 billion in 2024, and is expected to reach USD 11.84 billion by 2029, growing at a CAGR of 5.62% during the forecast period (2024-2029).

Due to the COVID-19 pandemic, industries were badly affected in Europe, and many countries in the region were on the verge of a recession that would exceed the economic depression that followed the 2008 financial crisis. Since the ramifications of such a situation for the defense sector could be catastrophic, the governments of the nations in the region mitigated the impact on the defense sector at an early phase. The market showcased strong recovery post covid due to increased procurement of armored vehicles and growing defense expenditure.

The Russia-Ukraine conflict has altered the European defense landscape. With NATO countries supplying large caches of weapons and other defense equipment to Ukraine, the demand has witnessed a new high due to the continuation of the war and the use of sophisticated weaponry on both sides.Thus, to defend political and defense interests, EU and NATO member states acted collaboratively and aggressively. A progressive and strategic increase in the European defense budget and the launch of infantry support projects are expected to create demand for sophisticated new-generation ammunition with advanced capabilities, thereby driving the market in focus during the forecast period.

Europe Armored Fighting Vehicles Market Trends

Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period

The main battle tank (MBT) segment dominates the market, and it is expected to continue its domination during the forecast period. The segment is propelled by the increasing procurements of tanks by various countries, like Hungary, Russia, Poland, France, and Germany. Countries in the region, like France and Germany, are collaborating to produce the next generation of MBTs. Moreover, the ongoing war between Russia and Ukraine is one of the driving factors for procuring more combat vehicles. The demand is expected to be generated from countries, like the United Kingdom, Italy, Finland, France, Germany, Croatia, Poland, Sweden, and Turkey, in the coming years. For instance, In March 2022, Germany started testing their first action-ready models of Leopard 2 A7V two years ago. In February 2022, the first 30-unit group of the most advanced main battle tanks developed in this country joined the military ranks. All these factors are expected to help the market's growth in the region during the forecast period.

Russia is the Largest Market for Armored Fighting Vehicles in Europe

Russia has the largest fleet of armored fighting vehicles in Europe. Russia is Europe's top defense spender, with a defense budget of USD 65.9 billion in 2021. The continuous conflict with Ukraine and cross-border disputes with NATO nations increased the demand for defense equipment, weapons, and associated ammunition. As Russia maintains its military occupation of Ukraine, the Russian military may face major weaponry shortages by the end of the year. Recent sanctions against Russia and successful counter-offensives by Ukrainian troops have resulted in rapid declines in its stockpiles of artillery shells and armored vehicles.Russia is aggressively developing the BMPT armored vehicle, which is meant to carry a variety of missiles, light cannons, and machine guns capable of engaging a variety of targets, including enemy tanks and ground personnel.The presence of manufacturers, such as Kurganmashzavod and KAMAZ, which are actively spending in the research and development of existing product lines is also driving the market.

Europe Armored Fighting Vehicles Industry Overview

The Europe armored fighting vehicles market is moderately fragmented in nature with a presence of several players holding significant shares in the market. The prominent players in the market are BAE Systems PLC, Rheinmetall AG, General Dynamics Corporation, KNDS N.V., and Iveco Defence Vehicles. The majority of armored fighting vehicles' fleet is present in nearly 3-4 countries; therefore, a need arises to equip the other European countries with advanced fighting vehicles. Many countries are using the older generation fleet. Collaborations for the development of new fighting vehicles are anticipated to propel the growth of the market in these countries. For instance, Germany's Krauss-Maffei Wegmann GmbH and France's Nexter Systems have collaborated to produce next-generation battle tanks that would replace the Leopard 2 Tanks of Germany. Such partnerships may help boost the growth of the players' revenues.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Armored Personal Carrier (APC)

- 5.1.2 Infantry Fighting Vehicle (IFV)

- 5.1.3 Main Battle Tank (MBT)

- 5.1.4 Other Types

- 5.2 Country

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Russia

- 5.2.5 Spain

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems

- 6.2.2 Oshkosh Corporation Inc.

- 6.2.3 Rheinmetall AG

- 6.2.4 General Dynamics Corporation

- 6.2.5 Patria

- 6.2.6 KNDS N.V.

- 6.2.7 Military Industrial Company

- 6.2.8 Supacat Limited (SC Group)

- 6.2.9 ARQUUS Defense

- 6.2.10 Iveco Defence Vehicles

7 MARKET OPPORTUNITIES AND FUTURE TRENDS