PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523335

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523335

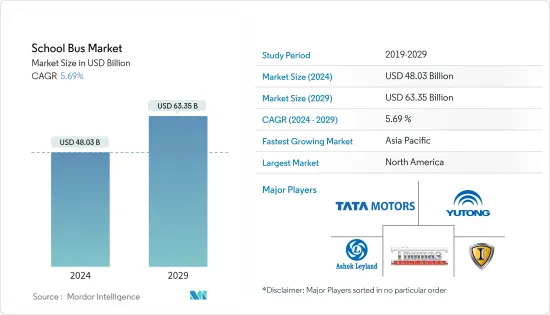

School Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The School Bus Market size is estimated at USD 48.03 billion in 2024, and is expected to reach USD 63.35 billion by 2029, growing at a CAGR of 5.69% during the forecast period (2024-2029).

The school bus market is transforming, driven by multiple factors reshaping student transportation. Growing concerns for student safety are fuelling the demand for technologically advanced buses. Additionally, government initiatives worldwide supporting education infrastructure are propelling growth. In 2023, the regional market share was dominated by North America, followed by Europe, Asia-Pacific, Latin America, and the Middle-East and Africa.

Furthermore, rapid urbanization and population growth are key drivers necessitating innovative solutions for route optimization and congestion reduction. The growing demand for electric school buses, driven by a global shift toward sustainability, presents growth opportunities for the market. There has also been a surge in interest in zero-emission, electric-powered buses. Integrating advanced technologies, including artificial intelligence for route optimization and IoT-enabled maintenance monitoring, presents a significant opportunity for market players to differentiate their offerings.

Moreover, the adoption of fleet management solutions, encompassing real-time tracking, maintenance scheduling, and data analytics, is emerging as a key trend. This allows educational institutions to optimize operations, enhance safety, and reduce overall costs. However, budget constraints in educational institutions, especially in developing regions, pose challenges for market expansion.

Collaboration between school bus manufacturers, technology providers, and educational institutions fosters innovation. These partnerships are essential in addressing the market's diverse needs and providing comprehensive, integrated solutions.

Despite all the challenges, the school bus market is expected to continue its growth trajectory in the coming years.

School Bus Market Trends

Growing Sales of Electric School Buses to Witness Growth in Coming Years

Electromobility is gaining pace across the world due to the government incentives provided to the adoption of electromobility and sales of electric vehicles, rising oil prices, increasing pollution levels, growing environmental consciousness, lower operating costs than ICE mobility, and announcements by various major markets like Europe, China, and India to ban new sales of IC engine vehicles by 2035.

More than 95% of school buses worldwide run on fossil fuels, especially diesel. Numerous studies show that inhaling diesel exhaust causes respiratory diseases, seen widely in children, who are the main commuters. Replacing all the school buses only in the United States with electric buses would avoid an average of 5.3 million tons of greenhouse gas emissions yearly.

Electric buses emit zero emissions, and their annual operating cost is almost half that of diesel buses. In Shenzhen, China, it is expected that the incentives for electric transit buses will also be extended to school buses, thus increasing their adoption. A few states in the United States, such as California and New York, and Quebec in Canada, are also testing and adopting electric buses, which is expected to drive the growth of the market. The state of California in the United States is at the forefront of adopting electric school buses. For instance, in November 2022, the state of California in the United States announced the investment of another USD 1.8 billion in the electrification of school buses. The state has spent USD 1.2 billion on the electrification of school buses so far.

Furthermore, the electrification of school buses in Europe is also rising due to the announcement of the European Commission to ban the sales of IC engine vehicles in Europe from 2035.

In addition, leading players in the school bus market are actively catering to this demand through research, mergers and acquisitions, strategic collaborations, etc, to gain a competitive edge in the electric bus segment. For instance,

In October 2022, BYD signed a deal with Los Olivos Elementary School District to create the first US school district with a 100% zero-emissions bus fleet.

In May 2022, Greenpower Motor Co., based in Vancouver, British Columbia, Canada, unveiled a new Type A battery electric school bus named Nano BEAST (Battery Electric Automotive School Transportation) for the US market.

Thus electric segment of school buses is anticipated to drive the growth of the school bus market.

North America to Play a Key Role in the Development of the School Bus Market

With a well-established and extensive school transportation system, North America boasts many schools and educational institutions that heavily rely on school buses for student transportation. Additionally, the region's population density and geographic factors contribute significantly to the demand for school buses, especially in suburban and rural areas where schools are not easily accessible by foot.

The economic prosperity of North America also plays a pivotal role, allowing substantial investments in education and related infrastructure, including the consistent update and expansion of school bus fleets. The United States and Canada enforce stringent safety regulations for school buses, fostering a market for vehicles with advanced safety features. For instance,

In the United States, the Biden administration has rolled out the 'Clean School Bus' (CSB) program as part of the Bipartisan Infrastructure Law. This initiative aims to replace current school buses running on fossil fuels with newer low- or zero-emission models. The key focus is on promoting buses that are environmentally friendly and contribute to the health of school children.

Furthermore, the Environmental Protection Agency (EPA) also plays a crucial role by implementing the Green House Gases (GHG) phase 3 program, which enforces stricter emission standards. Additionally, North America also provides incentives for propane, also known as liquefied natural gas (LNG), and it is included in the CSB program as a low-emission option.

Moreover, government funding and subsidies further fuel the market, providing financial support for educational institutions to invest in modern and efficient buses. Additionally, North America's early adoption of technological advancements, such as integrating advanced safety features and exploring alternative fuels, increases the overall growth potential of the school bus market. For instance,

In October 2022, Thomas Built Buses, a subsidiary of Daimler Truck North America, announced the delivery of the 200th Proterra Powered Saf -T-Liner C2 Jouley battery-electric school bus to Monroe County Public Schools in Indiana, United States.

The market for school buses in Asia-Pacific and Europe is also expected to grow rapidly due to the growing demand for safe and secure transportation for school-going children, rising disposable incomes of parents in markets like China and India who now can afford school bus services for their children, rising sales of electric school buses in Europe, increasing enrolment of children in schools, and the presence of large bus manufacturers in these markets.

School Bus Industry Overview

The school bus market is moderately consolidated. The market is characterized by the presence of major global and local school bus manufacturers who also cater to other countries. The United States, China, and India players mainly dominate the market. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

Some of the major players dominating the global market are Thomas Built Buses, Yutong Bus Co., Tata Motors Ltd, Ashok Leyland Ltd, and IC Bus. Key players are securing large orders and launching new products to secure their market position and stay ahead of the market curve. For instance, in April 2022, Lion Electric Company, a leading all-electric medium and heavy truck manufacturer, announced that it had received an order for 50 all-electric school buses of the LIONC segment for the province of Quebec. In September 2022, Dwight School London introduced electric bus services in partnership with the global smart bus transport company Zeelo. The initiative is expected to reduce the carbon emissions of Dwight School London by as high as 33% annually.

Additionally, in May 2022, First Student introduced electric school buses in its network with the buses procured from Lion Electric Company. First Student aims to eventually induct 250 electric school buses into its network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth

- 4.2 Market Restraints

- 4.2.1 Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (VALUE IN USD BILLION)

- 5.1 By Propulsion Type

- 5.1.1 Internal Combustion Engine (ICE)

- 5.1.2 Compressed Natural Gas (CNG)/ Liquified Natural Gas (LNG)

- 5.1.3 Electric and Hybrid

- 5.2 By Capacity Design Type

- 5.2.1 Type A

- 5.2.2 Type B

- 5.2.3 Type C

- 5.2.4 Type D

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Thomas Built Buses Inc.

- 6.2.2 Collins Bus Corporation

- 6.2.3 IC Bus (Navistar International Corporation)

- 6.2.4 Blue Bird Corporation

- 6.2.5 Lion Electric Company

- 6.2.6 Yutong Buses Co. Ltd

- 6.2.7 Anhui Ankai Automobile

- 6.2.8 JCBL Limited

- 6.2.9 Tata Motors

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of AI and IoT enabled Technologies in Buses Presents Growth Opportunities for Future

8 MARKET SIZE AND FORECAST IN VOLUME

9 REGULATORY STANDARDS FOR SAFETY OF SCHOOL BUSES BY GOVERNMENTS IN DIFFERENT REGIONS