PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689979

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689979

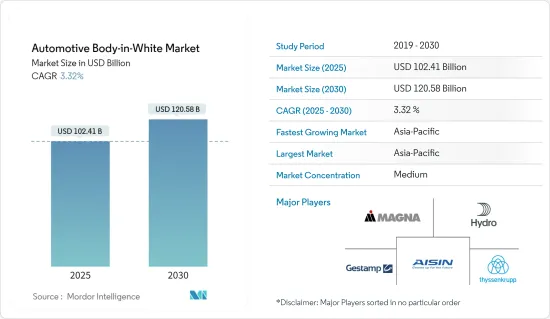

Automotive Body-in-White - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Body-in-White Market size is estimated at USD 102.41 billion in 2025, and is expected to reach USD 120.58 billion by 2030, at a CAGR of 3.32% during the forecast period (2025-2030).

Over the long term, stringent environmental regulations and emission norms, along with the rising adoption of lightweight materials in vehicles to achieve fuel efficiency, are expected to propel the market demand during the forecast period.

The development of solid-state laser sources in the past decade has offered new welding solutions for BIW assembly. In particular, improved electrical efficiency (cost reductions) and the capability to combine optic fibers and long working distances (tool flexibility) offer new possibilities.

For instance, in April 2023, Comau revealed that it had provided a highly intelligent welding solution for Hycan Automotive Technology Co., Ltd.'s frame line. It guarantees multi-model production of new energy cars, high JPH (Jobs per Hour), and a tangible decrease in production losses. It is used at the Hycan Hangzhou production facility. It can transition between four distinct platforms at random, is completely compatible with existing production platforms, and is mass-producing pure electric A06 automobile and SUV Z03 at 60 JPH cycle efficiency. The solution is built on a modified version of Comau's Opengate frame technology, which allows for flexible high-precision body-in-white construction and virtual commissioning.

Moreover, ongoing R&D on new alloys and efficient manufacturing techniques and increasing investments in automation and robots in the production process are likely to offer new opportunities for players in the market. Apart from this, the body in white is an integral structure for all automobiles. Hence, the development of the automobile sector will also add to the growth of the global body-in-white market.

For instance, in June 2023, NDR Auto Component Limited emphasized the importance of metal components and cosmetic components (trim cover) in the seat. The company's R&D team is now working on numerous product portfolios in these areas. Its metal components team is working on the creation of passenger vehicle seat frames, passenger car body-in-white (B-I-W) parts, and two-wheeler components.

Additionally, the government initiatives adopted in countries like India and China, promoting manufacturing and contributing to the growth of this market.

Automotive Body-in-White Market Trends

Growing Demand for Light-weight Vehicles to Drive the Composites Material

The body-in-white market is seeing advancements in lightweight material developments such as Composites, alloy, and fiber-reinforced plastics (FRP), which are enabling the production of the body in white for lighter vehicles. The other influencing factors for lightweight materials technology are customer-driven requirements like styling, aesthetic appearance, reduced NVH (noise, vibration, harshness) aspects, and comfort.

The primary driving force behind the rising demand for fuel-efficient vehicles is the implementation of stringent emission and safety regulations. Accordingly, to comply with stricter emissions and fuel economy standards, while some automobile manufacturers are focusing on reducing the overall weight of the car and enhancing fuel efficiency, others are entering into collaborations, partnerships, etc., to stabilize their position in the market.

For instance, in September 2022, Atlis Motor Vehicles, which is developing an electric work vehicle as well as the batteries and motors that will power it, struck a cooperation partnership with ArcelorMittal, the world's top producer of automotive steels. ArcelorMittal's S-in motion pickup truck model, as well as cab and box designs, will be used by Atlis to assist in driving the design of the XT, a purpose-built, totally electric pickup truck meant to serve people and fleet owners working in agriculture and construction. ArcelorMittal created S-in-Motion, a series of lightweight steel solutions for manufacturers looking to construct lighter, safer, and more ecologically friendly automobiles. Atlis will use ArcelorMittal's body in white CAD engineering information to cut weight and cost while improving the range of its XT.

In March 2023, Lamborghini unveiled key details about the LB744, marking the company's inaugural high-performance electrified vehicle (HPEV) supercar. This extraordinary automobile represents a pioneering achievement as the world's first high-performance electrified vehicle (HPEV). It features a plug-in hybrid configuration, with a lightweight, high-power lithium-ion battery ingeniously positioned within the transmission tunnel at the center of the chassis. This innovative approach is designed to not only reduce emissions but also enhance performance when compared to its predecessor, the V12. The groundbreaking L545 engine boasts a 6.5-liter capacity, making it Lamborghini's lightest and most potent 12-cylinder engine to date. In total, it weighs a mere 218 kilograms, which is 17 kilograms lighter than the Aventador unit.

In August 2023, Porsche introduced a special edition 911 designed for maximum driving enjoyment on its 60th anniversary. Produced in a limited run of 1,963 cars, the Porsche 911 S/T offers a lightweight design and a pure, undiluted driving experience. For the first time, the 911 GT3 RS's 518 hp, high-revving engine is delivered to the road via a manual transmission and lightweight clutch.

Further, the car sector in the United States will sell around 13.75 million light vehicle units in 2022. This statistic comprises around 2.9 million passenger automobiles and a little under 10.9 million light trucks sold at retail.

Therefore, with manufacturers focusing on adopting innovative technologies and manufacturing processes to stand unique from their competitors, the automotive body-in-white market is expected to accumulate notable growth during the forecast period.

Asia-Pacific Region Likely to Exhibit Fastest Growth During the Forecast Period

The Asia-Pacific region is expected to contribute significantly over the forecast period. Growing automotive production and increasing government focus on designing policies and initiatives encouraging electric vehicles are likely to boost the body-in-white market during the forecast period. The rising prominence of major countries like India and China is anticipated to supplement the development of the market in the Asia-Pacific region.

For instance, in the first half of 2023, retail sales of electric vehicles in India surpassed 700,000 units. According to Vahan statistics, overall sales as of June 2023 were 721,971 units, which is already 73% of India EV Inc.'s record sales in the Year 2022. The government is investing in the development of infrastructure and incentivizing first electric vehicle buyers with subsidies to encourage people to shift from conventional fuel vehicles to green fuel vehicles.

With several key players investing heavily and entering joint ventures with other players to cater to the growing demand, the market is likely to remain highly competitive during the forecast period.

For instance, in July 2022, Thyssenkrupp AG announced an expansion of its automobile body business in China. It spent EUR 8 million (USD 9.4 million) in Kunshan, Jiangsu Province, to establish thyssenkrupp Automotive Equipment (Suzhou) Co., Ltd. This facility is scheduled to begin operations in December 2022. It will be a body-in-white factory that will manufacture dies and equipment for Chinese automakers.

With the aforementioned trends and developments, it is expected that the market in the Asia-Pacific region will grow at a healthy rate during the forecast period.

Automotive Body-in-White Industry Overview

The automotive body-in-white market exhibits a moderate level of consolidation, owing to the presence of both regional and global industry giants. Key players include Magna International Inc., Norsk Hydro ASA, Gestamp Automocion SA, Aisin Seiki, and Thyssenkrupp AG.

These firms boast robust global and regional distribution networks and are strategically engaged in expanding their product offerings within this market. They actively seek collaborations, enter contracts, and forge agreements to fortify their positions.

For instance, in May 2023, Mercedes-Benz, following its technical collaboration with Norsk Hydro ASA (Hydro) in December 2022, unveiled the initial outcomes of its low-carbon technology initiative. This innovative material is expertly cast into advanced structural components designed for body-in-white applications at Mettingen. It finds application in safety-critical elements, such as shock towers, for a range of vehicles, including EQS, EQE, S-Class, E-Class, GLC, and C-Class models. Moreover, the EQE model will feature low-CO2 aluminum longitudinal members.

In November 2022, Comau introduced a versatile Body-In-White (BIW) manufacturing solution for the all-new Alfa Romeo Tonale. This enhanced production setup incorporates 20 lines, enabling the manufacturer to flexibly assemble its mid-size Tonale model in a randomized combination of up to four distinct variants while maintaining optimal throughput.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Lightweight Vehicles to Drive the Automotive Body-in-White Market

- 4.2 Market Restraints

- 4.2.1 High Cost of Materials to Manufacture BIW Structures is Expected to Limit Market Growth.

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value in USD)

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 IC Engines

- 5.2.2 Electric Vehicles

- 5.3 Material Type

- 5.3.1 Aluminum

- 5.3.2 Steel

- 5.3.3 Composites

- 5.3.4 Other Material Types

- 5.4 Material Joining Technique

- 5.4.1 Welding

- 5.4.2 Clinching

- 5.4.3 Laser Brazing

- 5.4.4 Bonding

- 5.4.5 Other Material Joining Techniques

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Magna International Inc.

- 6.2.2 Norsk Hydro ASA

- 6.2.3 Gestamp Automocion SA

- 6.2.4 Aisin Seiki Co. Limited

- 6.2.5 Thyssenkrupp AG

- 6.2.6 ABB Corporation

- 6.2.7 TECOSIM Group

- 6.2.8 Tata Steel Limited

- 6.2.9 Dura Automotive Systems

- 6.2.10 Tower International

- 6.2.11 CIE Automotive

- 6.2.12 Benteler International

- 6.2.13 Kuka AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS