PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690067

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690067

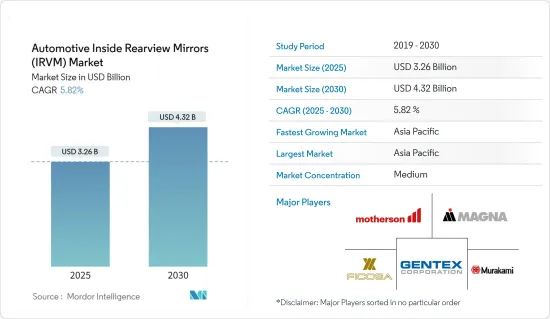

Automotive Inside Rearview Mirrors (IRVM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Inside Rearview Mirrors Market size is estimated at USD 3.26 billion in 2025, and is expected to reach USD 4.32 billion by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

The Automotive inside rearview mirrors was negatively affected by the pandemic, as majority of OEM and auto component suppliers had to close down their production sites with ongoing government lockdown measures. This held the market with low demand from OEMs for IRVM and reduces production volumes from manufacturers. After 2021, market started witnessing a steady demand for the IRVM with rising auto sales across the globe coupled with an improved supply chain network worldwide.

Moreover, over the medium term, growing production of vehicles with integrated ADAS features in wake of rising awareness toward comfort and safety of passengers and government regulations mandating safety features expected to drive demand in the market. For instance, According to Insurance Institute for Highway Safety says 15,000 people are injured annually in back over accidents, with children and elders having been the most victims. Additionally, the National Highway Traffic Safety Administration report says that nearly 840,000 blind-spot accidents occur every year in the United States. This makes its prime utilization for vehicle IRVM to maintain driver comfort and safety.

Cameras and sensors are a vital part of any new vehicle, as they serve many different purposes. They help OEMs to manufacture cars that are safer, more comfortable to drive, and more fuel-efficient. Rear-view cameras and other camera systems for vehicles have generally been seen as useful tools for improving the safety of vehicles on the road. But in some cases, the complex camera and monitor systems that are supposed to increase the driver's visibility become confusing and distracting.

Asia-Pacific region is likely to dominate global automotive rear view mirror market owing to rising production of vehicle in the India, Japan and China. In addition, this is Europe are likely to register second largest market due to the presence of prominent players in the region for instance, Porsche, AUDI, Volkswagen, and BMW. The technological development in these regions is expected to create significant opportunities in automotive mirror market over the forecast period.

Automotive Rear View Mirror Market Trends

Passenger Car Segment Likely to Hold Significant Share in the Market

The Passenger car segment of the market during the forecast period to grow at faster pace owing to rising vehicle production and growing focus of jey OEMs on launching innovative products to attract wide range of consumers in wake of rising vehicle sales across major regions in the world. For instance, In 2021, the global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower than compared in 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive IRVM market to grow in the forecast period.

Owing to the increase in the demand for passenger cars and the growing awareness of electric mobility, major players are looking forward to electrifying their present fleet. For instance,

- In March 2022, Ford Motors announced to include three all-electric passenger vehicles in Europe by the end of 2024 and set a target to sell more than 600,000 electric vehicles annually by 2026 in the Europe region.

- In January 2022, General Motors announced considering investing more than USD 4 billion in two Michigan factories to increase its electric car manufacturing capacity. GM and LG Energy Solution have proposed constructing a USD 2.5 billion battery facility in Lansing.

With rising sales of the passenger car segment, demand for IRVM is witnessing promising growth. Nowadays, all the id-segment and luxury passenger cars are equipped with advanced IRVM which has posed technological dominance over the market. For instance,

- In August 2022, Audi India has introduced its new Q3 which has adopted several new technologies to look at. Audi has added frameless auto dimming IRVM and parking aid plus with rear view camera, which shall improve the driver safety and comfort apart from other added features in complete Q3.

- In August 2022, after witnessing impressive sales on Tata Punch, Tata Group is announced that ist going to launch a Creta segment mid-size SUV named Blackbird next year which shall encompass added features. The car shall be equipped with advance digital instrument console, auto-dimming IRVM, automatic climate control, electrically operated ORVMs and may more other features.

The automotive inside rear-view mirror market is facing tough competition from new camera technologies with are coming in the passenger car segment. Leading automotive OEMs and interior rear-view manufacturers are integrating cameras with conventional mirrors to provide a better view of the drivers. In certain situations, the rear view of the vehicle through a mirror is blocked and causes hindrance to the driver's view.

Thus, camera integration with the rear-view mirror system has been the best solution so far in the automotive industry. Considering these developments and factors with rising passenger car sales, demand for IRVM is expected to witness a high growth rate in the forecast period.

Asia-Pacific Region Anticipated to Grow at Significant Level During the Forecast Period

The Asia-Pacific region accounts for the largest share in the market owing to the availability of low-cost raw materials, cheap labour, and increasing government initiatives toward local manufacturing. In the region, China is one of the largest producers and consumers of electric vehicles as well as increasing demand for passenger car sales in the countries like India, Japan, South Korea, etc., are likely to boost the demand for inside rear-view mirrors in the automotive industry.

China, which is the largest electric vehicle market in the world, has been backed up by generous support from the government. China has extended the incentives related to the purchase of new energy vehicles (NEVs) till 2022. Asia-Pacific region is aggressively supporting the electrical vehicle adoption. For instance,

- In January 2020, Tesla Motors inaugurated a USD 2 billion facility in Shanghai that was assembling nearly 3000 cars per week in March 2020, when all the other global facilities of the electric vehicle giant were shut down due to the COVID-19 pandemic.

- During the end of FY21, Hyundai sold 313, 926 cars globally in March. The sales statistics stood at a drop of 17% compared to previous years. The sales were even less than Q1 2021. Moreover, Hyundai observed that its automotive segment witnessed a sharp rise with almost doubled sales figures for its all-electric cars. This in turn makes the sales figure for its BEV to stood at 11,447 units with a rise of 105%. In addition, the plug-in electric cars increased to 14,693 units to 58% year and year growth.

Governments and administrations in developing and untapped markets are spending a major portion of their wealth on improving transportation and its safety. This will result in the sales growth of vehicles and also calls for additional features to suit the needs of vehicle safety. With IRVM being highly dependent of sales of the vehicles, Asia-pacific has been leading the vehicles sales across the globe making its epicentre for IRVM adoption. Considering these aspects demand for IRVM is expected to witness high growth rate during the forecast period.

Automotive Rear View Mirror Industry Overview

The automotive market is moderately fragmented due to the presence of many local and global players such as Gentex Corporation, Magna International Inc., and Samvardhana Motherson Reflectec amongst others. The market is transforming but the new technologies are right now available mostly in luxury vehicles and in a selected market and near future, it will not replace the conventional mirrors. As the laws are still with conventional mirrors.

Although companies are increasing investment in R&D projects to provide more convenient and safer experience to the car owner without replacing the conventional mirrors. With rising technological dominance and improved IRVM features market has witnessed immense growth. For instance,

- In August 2022, the Mahindra and Mahindra introduced the new Scorpio N petrol variant with the auto dimming IRVM in order to improve user safety and comfort during the rises.

- In July 2022, SemiDrive announced that Chery's OMODA 5 SUV has adopted SemiDrive's X9 series automotive SoC (system-on-a-chip). The X9 series can provide outputs of up to 10 HD screens, such as instrument panels, console control, rearview mirrors, and entertainment for back row passengers, through a single chip. It supports multi-screen sharing and interaction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value in USD Million)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Powertrain Type

- 5.2.1 ICE

- 5.2.2 Electric

- 5.3 By Feature Type

- 5.3.1 Auto-Dimming

- 5.3.2 Prismatic

- 5.3.3 Blind spot indicator

- 5.4 By Sales Channel Type

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Gentex Corporation

- 6.2.2 Samvardhana Motherson Reflectec

- 6.2.3 Magna International, Inc.

- 6.2.4 Ficosa International SA

- 6.2.5 Continental AG

- 6.2.6 Murakami Corporation

- 6.2.7 Tokai Rika Co., Ltd.

- 6.2.8 Mitsuba Corporation

- 6.2.9 SL Corporation

- 6.2.10 Flabeg Automotive Holding GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS