PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690073

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690073

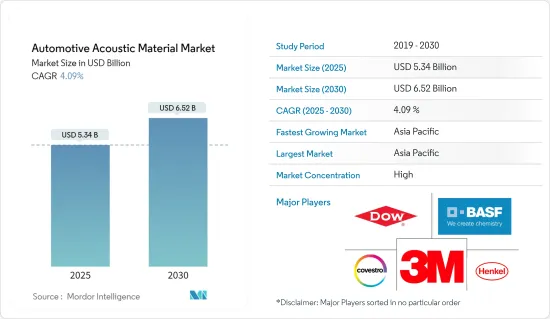

Automotive Acoustic Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Acoustic Material Market size is estimated at USD 5.34 billion in 2025, and is expected to reach USD 6.52 billion by 2030, at a CAGR of 4.09% during the forecast period (2025-2030).

Following early supply and production interruptions as a result of the COVID-19 pandemic, the auto industry is undergoing a demand shock, with an unknown recovery period. Some OEMs have poor liquidity revenues due to a lack of room to minimize fixed expenses. Decreases in power due to a significant period of time of lacking in market capitalization and consolidation and without acquiring fresh investment, some players may risk going out of business.

Vehicle interiors are changing as a result of trends like customization and autonomous driving, in which the driver is increasingly becoming a passenger. Industry players are hard at work developing designs for car interiors that include a number of innovative features.

Car acoustics is slowly gaining popularity as a quality factor in current automobiles, and automakers are expressing a lot of interest in it. Passenger comfort has risen to the top of the priority list when it comes to selling a car. Components must occupy as little space as possible while providing optimal comfort. As a result, continuous progress is being made in this area.

Since they are used in numerous components such as the engine cover, dash insulator, and other components that are regularly vibrated when the car is driving, the aftermarket for automotive acoustic materials is expected to expand. The ever-increasing demand for sports and luxury vehicles and the growing popularity of modified antique cars may open up a large market for automotive acoustic materials.

The slowing economy, combined with taxes on importing acoustic materials and other items, and the COVID-19 pandemic are projected to hinder the market's expansion. On the other hand, price fluctuations in acoustic materials and the increased demand for electric vehicles due to environmental concerns are expected to drive the industry.

Automotive Acoustic Material Market Trends

Growing Demand for Premium Cars

Luxury and comfort have been a significant focus area for manufacturers, as the demand for premium cars has grown. The primary goal is to keep the vehicle's sound within acceptable limits. These noise restrictions need greater attention in the automobile acoustic system. As a result, the market for automotive acoustic materials is expected to grow in the future years.

As automotive acoustic materials provide the interior appearance and minimize noise, vibration, and harshness (NVH) in the cabin, the expansion of the premium cars is likely to fuel the demand for automotive acoustic materials globally.

The advent of automotive acoustic materials that are easy to install and extend to completely fill interior cavities in vehicles is projected to enhance the demand in the automotive acoustic material market. The government's investment in public transportation is expected to boost the demand for vehicle acoustic materials.

The growth in constant R&D spending by manufacturers to enhance noise-absorbing levels is driving the automotive acoustic materials market. Composite materials with the ability to absorb low-frequency sounds are gaining popularity. Furthermore, manufacturers' attention to providing exceptional color finishes for the interior and exterior appearance of cars is expected to contribute to market growth throughout the forecast period.

Many manufacturers are investing in R&D to develop materials with enhanced properties. For instance:

- In November 2021, Autoneum announced a new felt-based technology Flexi-Loft, which due to a unique blend of recycled cotton and functional fibers, reduces product weight and allows for accurate adaptation even to complex shapes. Autoneum is already using Flexi-Loft worldwide as an insulator for various carpets, inner dashes, and other acoustic components based on its Prime-Light technology.

Asia-Pacific Captures the Major Market Share

The Asia-Pacific region has emerged as the largest market for acoustic materials. Asia-Pacific accounted for the largest global vehicle production in 2021. The region is estimated to be the largest market for automotive acoustic materials, by volume and value. The huge vehicle production in the region offers a tremendous growth opportunity for the acoustic materials market.

China is the largest automobile market in the world. However, for the past few years, the country has been witnessing a decline in sales. Overall sales in the world's largest auto market increased by 3.8% year-on-year in December, bringing the total sales for 2021 to 26.28 million, according to figures from the China Association of Automobile Manufacturers (CAAM).

In the past few years, the country has seen various companies expanding their production facilities and opening new facilities. For instance:

- In October 2021, Daimler opened its new 'Daimler R&D Tech Center China' officially in Beijing. With a total investment of CNY 1.1 billion, the R&D tech center has a gross floor area of 55,000 m2. The test building is home to seven testing facilities, including an eDrive lab, a charging lab, a volatile organic compounds (VOC) lab, a chassis lab, a noise, vibration and harshness (NVH) lab, an engine lab, and an environmental lab. The new test building can accommodate more than 300 test vehicles at the same time.

Europe is the second-largest market for passenger cars, particularly for premium cars. The sale of premium cars is projected to show linear growth during the forecast period, thereby increasing the demand for acoustic materials in Europe.

Automotive Acoustic Material Industry Overview

The competition in the market is increasing as the companies are making new strategic partnerships, investing majorly in R&D projects, and launching new products in the market to be ahead of their rivals. For instance:

- In March 2021, Teijin Limited announced that its polyester three-dimensional molded sound-absorbing material had been adopted for Toyota Motor Corporation's fuel cell vehicle (FCV) "Mirai." It will be used as a material to reduce noise when hydrogen and air chemically react in the FC stack, and the generated water is discharged from the FC stack or drain pipe outside the vehicle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyurethane

- 5.1.2 Textile

- 5.1.3 Fiberglass

- 5.1.4 Other Materials

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Application

- 5.3.1 Bonnet Liner

- 5.3.2 Door Trim

- 5.3.3 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Dow Chemicals

- 6.2.2 3M Acoustics

- 6.2.3 BASF SE

- 6.2.4 Covestro

- 6.2.5 Henkel Adhesive Technologies

- 6.2.6 Lyondellbasell

- 6.2.7 Sumitomo Riko

- 6.2.8 Sika

- 6.2.9 Toray Industries

- 6.2.10 Huntsman

- 6.2.11 Freudenberg Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS