PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435825

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435825

Asia-Pacific Border Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

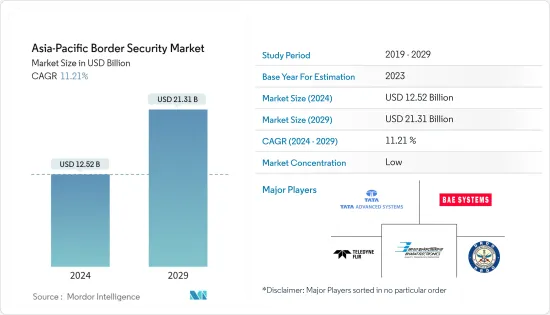

The Asia-Pacific Border Security Market size is estimated at USD 12.52 billion in 2024, and is expected to reach USD 21.31 billion by 2029, growing at a CAGR of 11.21% during the forecast period (2024-2029).

The COVID-19 pandemic had a small effect on the defense industry in Asia and the Pacific. China was the largest defense spender in the region. The country increased its defense budget to USD 257.97 billion in 2020, an increase of 6.6 percent from the previous year despite the COVID-19 pandemic. Despite the pandemic, countries such as India, Japan, South Korea, and others also allocated and spent significant monetary resources on the defense sector.

The need for advanced border security solutions is driven by the region's growing geopolitical divide and rising number of border crossings. During the period of the forecast, the border security market is also expected to grow because the defense budget will spend more on surveillance aircraft, patrol aircraft, ground attack helicopters, transport helicopters, amphibious aircraft, marine vessels, armored patrol vehicles, and submarines for border security.

Furthermore, growing defense expenditure from countries like India and China due to increasing cross-border conflicts, disputes between China and Taiwan, and rising terrorist activities drive market growth. China and India were the world's second and third largest defense spenders, with defense spending of USD 293 billion and USD 76.7 billion, respectively, in 2021.

Also, the upgrades and modernization of the existing border security infrastructure create new market opportunities. The market is witnessing technological innovations, such as integrating various systems, like acoustic sensors, unmanned aerial vehicles, and surve illance towers.

Asia-Pacific Border Security Market Trends

Sea Segment is Estimated to Show Significant Growth During the Forecast Period

The sea segment is projected to show significant growth during the forecast period. The growth is due to growing defense expenditure, rising spending on enhancing naval capabilities, and increasing procurement of advanced border patrol vessels from countries like India and China. Despite having clearly defined boundaries, maritime disputes are common in places where countries compete over inhabited and uninhabited islands. Many Asia-Pacific nations, such as South Korea, India, China, and Japan, have borders surrounded mostly by seas. There are several disputes in the South China Sea among China, Taiwan, Vietnam, the Philippines, Japan, and Malaysia, which have overlapping claims. In the wake of all these issues, all these countries are focusing more on protecting their sea-based borders. For instance, the Indian Navy plans to procure a number of unmanned aerial and underwater platforms in the next few years to enhance its surveillance capability.

In February 2022, Goa Shipyard Ltd. developed the offshore patrol vessel Saksham for the Indian Coast Guard. The ship is fitted with advanced technological navigation and communication equipment, machinery, and sensors. Thus, countries are focusing on developing their sea-based surveillance capabilities, which are expected to drive the growth of the sea segment of the market during the forecast period.

India Will Showcase Remarkable Growth During the Forecast Period

India is expected to showcase remarkable growth during the forecast period. The growth is attributed to increasing defense spending and rising expenditures on procuring advanced border security systems. Widespread geopolitical conflicts, such as the ongoing border infiltration issues between India and Pakistan, illegal human trafficking across the Indo-Bangladesh border, and force multiplication across the Indo-China border, have necessitated the adoption of advanced border security systems to monitor the situation. As evident from the YoY growth in its defense spending and ongoing procurement programs about border security systems, China is investing significantly in upgrading the capabilities of its border patrol units. Even smaller countries, such as Vietnam and the Philippines, are upgrading their border forces for detecting, intercepting, and deterring the highly intricate network of human and arms trafficking. On this note, India is currently working on the Comprehensive Integrated Border Management System (CIBMS), which is expected to become fully functional by 2025-2026 over a 2,000-kilometer stretch on the national borders with Pakistan and Bangladesh to monitor and detect acts of intrusion.

For instance, in November 2022, the Indian government allocated USD 3.6 million to procure drones, surveillance cameras, and other monitoring gadgets for the Border Security Force (BSF) deployed to guard Indian borders along Pakistan and Bangladesh. Such developments are envisioned to drive the market during the forecast period.

Asia-Pacific Border Security Industry Overview

The Asia-Pacific Border Security market is semi-consolidated and features several local players in addition to global technology providers, such as Teledyne FLIR LLC, BAE Systems plc, Tata Advanced Systems Limited, the Defense Research and Development Organization, and Bharat Electronics Limited. To foster the transfer of technology and enable the local manufacturers to gain expertise to design and manufacture advanced security systems, governments of countries in the region are formulating favorable initiatives, such as the Make in India initiative. Local players in Asia-Pacific are particularly threatening the global leaders, as they aim to provide an all-around solution at a fraction of the cost quoted by these global leaders without compromising quality or reliability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Land

- 5.1.2 Air

- 5.1.3 Sea

- 5.2 System

- 5.2.1 C4ISR Systems

- 5.2.2 Radar

- 5.2.3 Perimeter Breach Detection Systems

- 5.2.4 Biometric Systems

- 5.2.5 Other Systems

- 5.3 Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Teledune FLIR LLC

- 6.1.2 BAE Systems plc

- 6.1.3 The Boeing Company

- 6.1.4 China Electronics Technology Group Corporation

- 6.1.5 Defence Research and Development Organization

- 6.1.6 Furuno Electric Co. Ltd.

- 6.1.7 Bharat Electronics Limited

- 6.1.8 Tata Advanced Systems Limited

- 6.1.9 OSI Systems Inc.

- 6.1.10 Blighter Surveillance Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS