PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437503

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437503

Europe Air Traffic Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

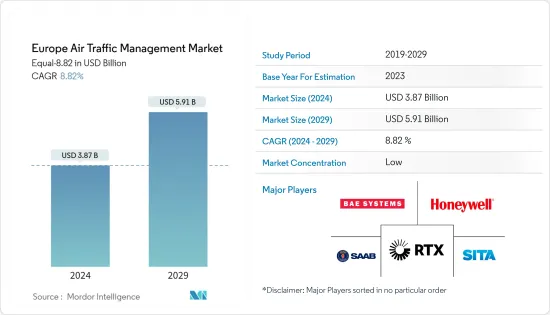

The Europe Air Traffic Management Market size is estimated at USD 3.87 billion in 2024, and is expected to reach USD 5.91 billion by 2029, growing at a CAGR of 8.82% during the forecast period (2024-2029).

Growth in demand for air travel within the European region and the increasing number of aircraft acquisitions by various airline companies in the region will bolster the growth in the market during the coming years. The European Organization for the Safety of Air Navigation, EUROCONTROL develops, coordinates and plans for the collective implementation of short-, medium- and long-term pan-European air traffic management strategies and their associated action plans.

Rising aerial connectivity will lead to growth in the number of new routes and increase in flight movements within the region thereby driving growth in the market. Moreover, new airport constructions as well as expansions will also lead to an increase in the acquisition of more advanced air traffic management systems going forward. On the other hand, operational challenges along with various unprecedented factors will lead to hampering the market in the long run.

Europe Air Traffic Management Market Trends

Air Traffic Flow Management Segment Will Showcase Remarkable Growth During the Forecast Period

The air traffic flow management segment is anticipated to show significant growth in the Europe air traffic management market. Increasing demand in air travel coupled with growing number of commercial aviation operations are the major factors which shall bolster the need for greater and advanced air traffic management services thereby driving the growth of the market during the forecast period.

The aviation industry in Europe in recent years has witnessed noteworthy growth in terms of aviation operations as well as an increase in the number of air passenger traffic. Furthermore, the growth in aviation operations has led to increase in various airline companies within the region adding newer destinations to its operating routes which eventually will lead to growth in the number of commercial aviation acquisitions in the coming years. For instance, in September 2023, British Airways announced that they have finalized a deal to acquire six new Boeing 787-10. Moreover, the company have also converted the optional 10 Airbus A320neo orders into firm orders in the beginning of 2023.

Furthermore, the growing air traffic at various airports, in recent years, has led to the creation of bottlenecks which has stimulated growth in airport expansion/construction projects. For instance, in June 2023, Kaunas airport which is situated in Lithuania has announced international bids for two major expansion projects, namely, the passenger terminal and the northern apron of the airport. Moreover, the expansion project will include the dismantling of the eastern and western facades of the airport and the addition of two extensions. The extensions will be made in the baggage reclaim areas which will be accompanied by technical modernization. Thus, the growth in air travel demand within the region coupled with the growing number of airport expansion projects to handle the traffic flow will generate noteworthy market growth during the forecast period.

The United Kingdom Dominates the Market During the Forecast Period

The UK held the highest shares in the market and is expected to continue its domination during the forecast period. Growing demand for air travel coupled with a growth in number of airport construction projects in order to meet the future air traffic management demands will bolster the growth of the market during the forecast period.

In recent years, the UK have witnessed notable growth in its aviation industry. This growth has led to an increase in the demand for effective air traffic management at various airports within the country. As of the current scenario, airports such as London Heathrow Airport, Gatwick Airport, Stansted Airport, Luton Airport, and Southend Airport are considered to be the major airports handling greater number of passengers within the country. The substantial recovery in the aviation industry in the UK has also led to various airports increasing their expansion/construction projects to provide smoother air traffic management for the near future. For instance, in June 2023, Heathrow airport which is situated in London announced that they are in plans to construct a third runway following the rebound of international air traffic. In addition, the project and its associated new west terminal will help to facilitate an additional 260,000 flights annually from the airport.

Thus, growth in number of airport expansion/construction projects as well as substantial recovery of the aviation industry within the country will lead to generating positive market outlook and also lead to significant market growth during the forecast period.

Europe Air Traffic Management Industry Overview

The Europe air traffic management market is fragmented in nature with various players dominating the market. Some of the major players in the Europe air traffic management market are BAE Systems Plc, Honeywell International Inc., RTX Corporation, Saab AB, and SITA. The major players in the market are focusing on the development of sophisticated air traffic management systems and integrating such systems with AI-based technology in order to improve efficiency and enhance the speed to access important data. Furthermore, the key players are also expected to benefit from partnerships with local producers of ATM systems, parts, and components, as well as third-party software manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Domain

- 5.1.1 Air Traffic Control

- 5.1.2 Air Traffic Flow Management

- 5.1.3 Aeronuatical Information Management

- 5.2 Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 Geography

- 5.3.1 Europe

- 5.3.1.1 United Kingdom

- 5.3.1.2 France

- 5.3.1.3 Germany

- 5.3.1.4 Italy

- 5.3.1.5 Spain

- 5.3.1.6 Rest of Europe

- 5.3.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Adacel Technologies Limited

- 6.2.2 ANPC

- 6.2.3 BAE Systems plc

- 6.2.4 Leidos Holdings, Inc.

- 6.2.5 Honeywell International Inc.

- 6.2.6 Indra

- 6.2.7 RTX Corporation

- 6.2.8 Saab AB

- 6.2.9 THALES

- 6.2.10 SITA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS